Analysts see room for a 50 – 150% Bitcoin rally, but only after a sharp correction clears excess leverage.

Bitcoin currently trades around $90,000 after a volatile start to the year.

Several market models point to upside targets between $135,000 and $225,000.

At the same time, stress indicators highlight liquidation risk that could pull price toward the mid-$40,000s if leverage unwinds quickly.

This mix creates a market that can reward patience and punish haste.

RECOMMENDED: Bitcoin Tumbles Below $90K As U.S. – Should You Buy BTC?

Experts Are Hopeful Despite the Bearish Run

Geoffrey Kendrick, Standard Chartered’s head of digital asset research, recently forecast roughly a 55% upside for the year.

Kendrick’s call centers on sustained inflows and thinner available supply at higher prices; his public note puts a 55% rally in view from today’s price.

Anthony Scaramucci of Skybridge described $125k–$150k as plausible given continued institutional interest and ETF flows.

Strategy’s recent filings and large corporate purchases signal meaningful demand that analysts use to justify higher targets.

These factors create scenarios where price can move quickly upward if new buy pressure meets light sell liquidity.

ALSO READ: Bitcoin Whale Wakes Up: $85M Moved After 13 Years

Why A Violent Correction Could Come First

The main risk comes from leverage and thin liquidity.

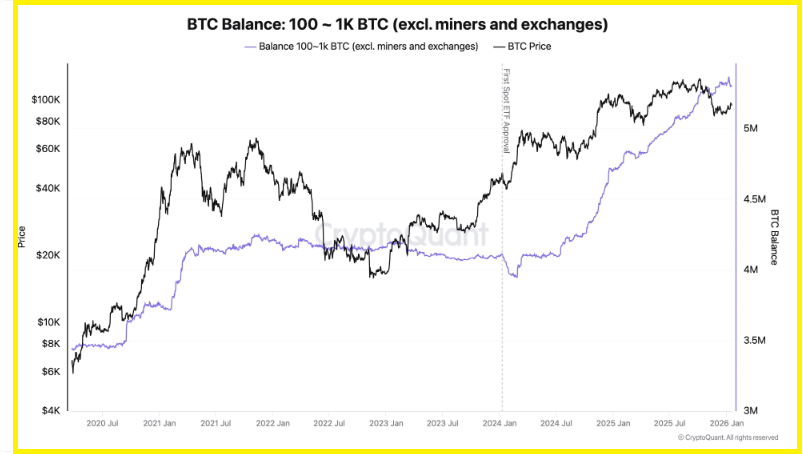

On-chain data from CryptoQuant shows higher exchange inflows and stress among short-term holders, signals that often appear before sharp sell-offs.

If a macro shock hits or large holders rush to exit, liquidations can trigger one another and push prices down quickly.

Some risk models now include a fast drop into the mid-$40,000 range in very extreme cases.

That risk explains why several analysts expect a hard pullback before any lasting move higher.

What Investors And Traders Should Do

This is a high-volatility setup, not a straight bet on price going up.

Position sizes should allow room for deep swings without forcing exits via panic selling.

Clear stop rules are important for short-term trades, while staggered entries can reduce timing risk.

Active traders should track leverage levels and exchange flows.

Longer-term holders may prefer adding after sharp pullbacks rather than chasing rallies.

As always, manage and understand your risk.

Whilst the potential for upside is there, nothing is guaranteed. Therefore you should only risk what you can afford to lose.

YOU MIGHT LIKE: Trump Tariffs Spark Overnight Crypto Bloodbath – $100B Wiped

Conclusion

Bitcoin still offers strong upside potential, but the road higher may turn rough first.

Clear risk rules matter just as much as bullish price targets when markets move this fast.

Should You Invest $1,000 In Bitcoin Now?

Before you invest in Bitcoin, you’re going to want to red our latest members premium crypto alert, which will be published in just a few days.

We will reveal some key crypto assets to consider for 2026 with explosive potential.