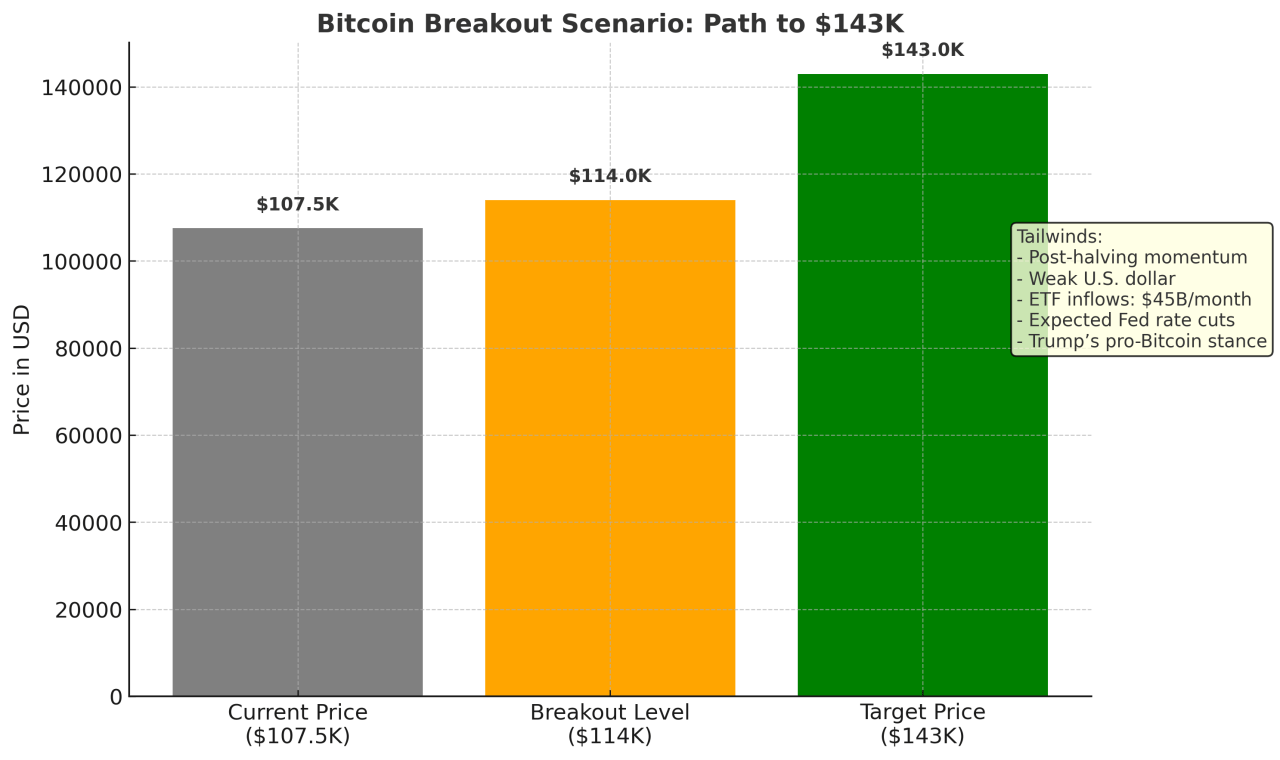

Bitcoin eyes a breakout above $114K, potentially triggering a 25–30% rally fuelled by ETF inflows and macro tailwinds.

Bitcoin is currently trading around $108K, just below its all-time high near $111K, and still pacing toward a record monthly close in June (~$107K). A move above the critical $114K resistance would set the stage for a potential rally into the $136K–$143K zone, depending on the analyst or model cited.

A Surge Above $114K Could Launch a 25% Rally In Bitcoin

Market strategist Ed Campbell (Rosenberg Research) highlights $114K as the key technical breakout level.

He notes that if Bitcoin climbs 6% higher to clear that ceiling, it could trigger a 25% surge to $143K, supported by tailwinds including post-halving momentum, U.S. dollar weakness, robust ETF inflows ($45B/month), expected Fed rate cuts, and pro-Bitcoin policy under a Trump administration.

Meanwhile, the Economic Times echoes this thesis, noting that sustaining above $106K–$107K is crucial to preserving bullish momentum toward the upside target of $143K .

Institutional Inflows & Macro Support For Bitcoin

Institutional capital continues to pour into Bitcoin. A recent Barron’s report says ETF inflows have climbed to $50B, pushing Bitcoin close to its record highs even as traditional markets stagnate.

Simultaneously, Bitwise forecasts a 30% July rally to $136K, citing geopolitical tensions, liquidity from rate-cut expectations, and institutional demand that outpaces miner supply.

Bitcoin Technical Setup: Consolidation Precedes Breakout

Price action shows Bitcoin consolidating below $110K, supported at the $106K–$107K range. Analysts point to a flag pattern and descending channel, suggesting that a clean daily close above $110K–$114K could trigger the next leg toward $135K–$146K, aligned with Fibonacci projections.

Conclusion

The chart and macro backdrop align for a decisive breakout — but the key lies at $114K. If Bitcoin clears that level, we could see a strong rally into the mid-$130Ks to $140Ks.

Until then, support at $106K–$107K will be decisive. Traders should monitor ETF flows

U.S. rate signals, and geopolitical headlines — the breakout window might be closing fast.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)