Growing use of gold and reserve shifts point to weaker faith in government money.

Crypto traders see Bitcoin fitting this changing mood.

Billionaire hedge-fund manager Ray Dalio said the global money system is under pressure as banks and institutions rethink their exposure to fiat and government debt.

Gold prices climbed strongly last year, and central banks increased gold holdings, signaling a quiet move toward assets that sit outside political control.

RECOMMENDED: Analysts Predicts 50% Bitcoin Surge – But Not Without Warning

Why Banks Are Rethinking Fiat Currencies

Dalio explained that years of rising debt and loose monetary policy weaken confidence in paper money.

Major economies now carry debt levels that make long-term stability harder to maintain.

In response, some central banks have added gold to reserves after years of minimal buying.

Gold gained double digits last year, outperforming several major asset classes.

For Dalio, this shows institutions want assets that cannot be printed or frozen by policy decisions.

He stressed this is a gradual shift, not a sudden breakdown of the financial system.

ALSO READ: Central Banks Are On A Gold-Buying Stampede In 2026

Why Bitcoin Traders Are Excited

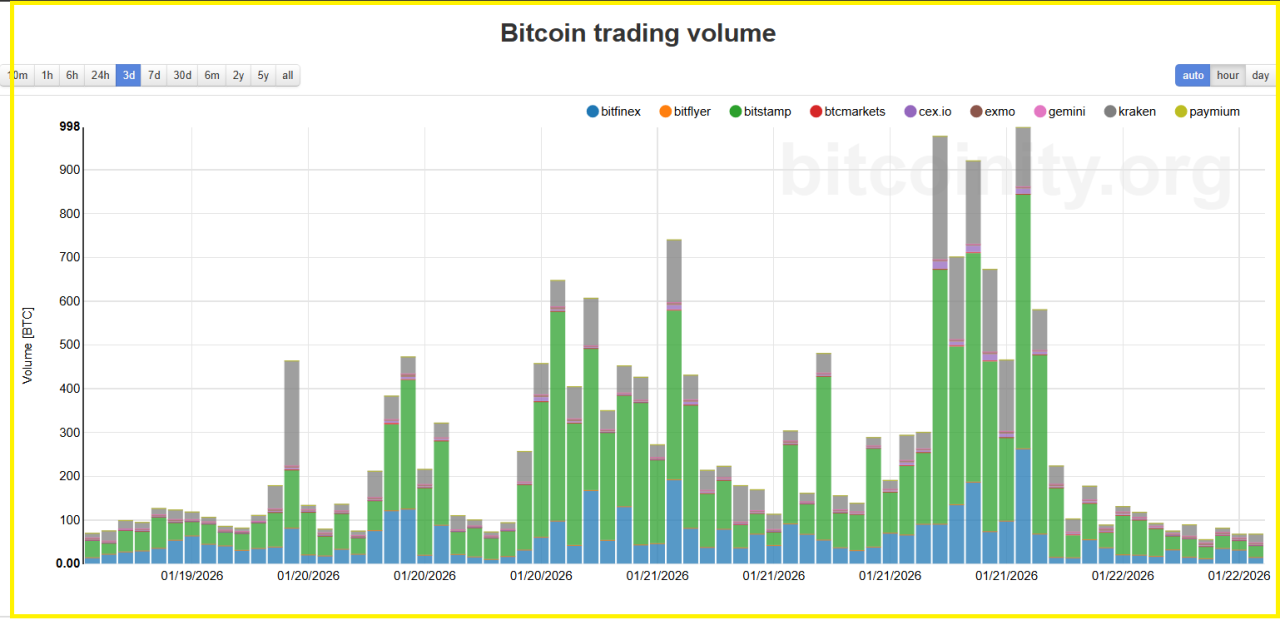

Bitcoin traders reacted quickly to Dalio’s comments.

Many view Bitcoin as digital gold, with a fixed supply of 21 million coins and no central issuer.

Trading volumes spiked on major exchanges after the remarks circulated online on January 21st.

Social platforms filled with posts linking reserve diversification to Bitcoin’s long-term appeal.

Still, Dalio remains cautious. He has said central banks prefer assets they can fully control, which limits Bitcoin’s role at the official level for now.

RECOMMENDED: This Company Spent $2.13B On Bitcoin Despite The Downturn

What This Means For Markets And Investors

The message from Dalio adds weight to a broader trend toward diversification.

Investors increasingly split exposure across gold, commodities, and selective crypto holdings to reduce reliance on sovereign debt.

Any major shift by central banks would likely happen slowly and with clear policy backing.

Until then, prices may swing as markets react to headlines rather than confirmed reserve changes.

Conclusion

Dalio’s warning shows a slow change in how institutions view fiat money.

Bitcoin traders may celebrate the signal, but lasting impact depends on real capital movement, not sentiment alone.

Should You Invest $1,000 in Bitcoin Right Now?

Before you consider Bitcoin, You’ll want to hear this.

In the next few days we will publish our latest premium crypto alert where we will reveal the crypto assets you may want to consider for 2026 with explosive potential.