Bitcoin plunged to a 16-month low, triggered mass liquidations, and rebounded fast, exposing fragile liquidity and excessive leverage across crypto markets.

Bitcoin dropped sharply to $60,008.52 during early trading hours, its lowest level since late 2024, before bouncing back above $65,000 within the same session.

The sudden move erased leveraged positions at scale and rattled traders who expected a calmer market.

Order books thinned quickly, sell orders pushed through weak support levels, and forced liquidations accelerated the fall. The speed of the recovery showed demand still exists, but the damage revealed how quickly price can break when leverage builds faster than liquidity.

RELATED: Is Bitcoin Finished? Washington Rejects Bailout As Price Plummets

What Happened During The Flash Crash

Bitcoin’s prices slid through key levels and briefly touched $60,008.52 before buyers stepped in. Within hours, bitcoin traded back in the mid $65,000 range.

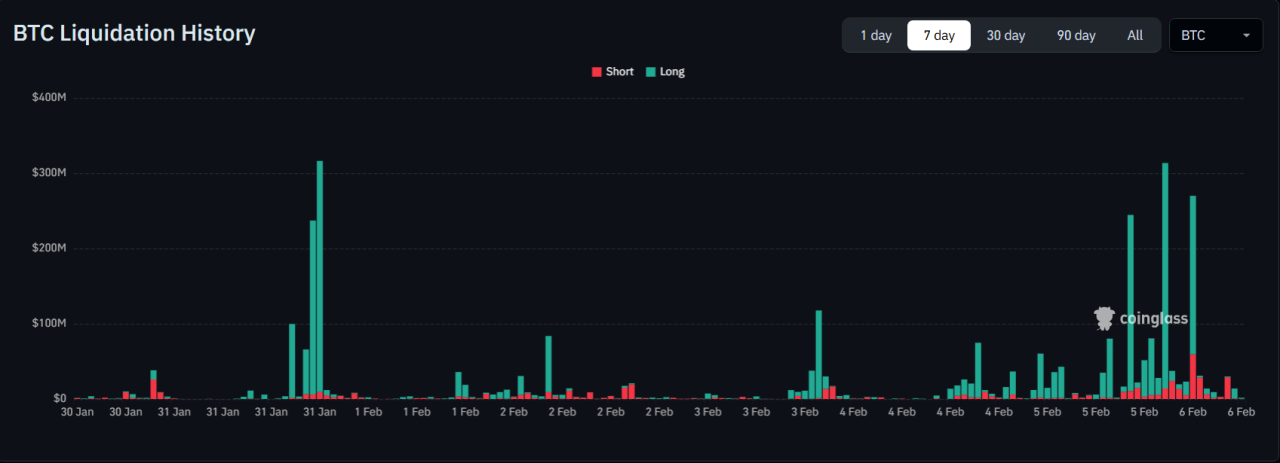

That rebound did little to calm nerves because the damage was already done. Data from derivatives platforms showed forced liquidations ranging from $1.45 billion to as high as $2.6 billion, depending on the time window measured.

Most liquidated positions were long bets placed by traders expecting higher prices.

Open interest dropped sharply as positions closed automatically, as leverage exited the system in a hurry. Spot markets felt the pressure too. Large sell orders ran into shallow order books, causing sharp price gaps.

Bitcoin is now down roughly 30% for the year, and the broader crypto market has lost trillions in value since its peak.

RECOMMENDED: Why Did Bitcoin Crash? – The Secret Trigger Most Traders Missed

Why Bitcoin Fell So Fast

The crash was the result of fragile conditions lining up at the wrong time. Liquidity was thin, meaning there were fewer buy orders waiting at each price level. When selling began, prices fell quickly because there were not enough buyers to absorb it.

At the same time, leverage had built up across futures and perpetual contracts. Many traders held large positions with borrowed funds.

As prices dropped, stop losses triggered automatic selling. Margin calls followed, forcing exchanges to close positions at market prices. Each forced sale pushed prices lower, triggering more liquidations.

Outside crypto, equity markets also weakened, especially technology stocks. That shift reduced risk appetite and pulled capital away from speculative assets. Large bitcoin transfers into exchanges prompted traders to sell more.

These factors turned a normal pullback into a sharp collapse. The market had too many leveraged bets and too little depth to handle stress.

ALSO READ: This Company Spent $2.13B On Bitcoin Despite The Downturn

Who Was Selling And How Markets Reacted

On-chain data showed large bitcoin transfers moving into exchange wallets shortly before and during the crash.

Such moves often signal intent to sell or hedge. At the same time, spot bitcoin ETFs saw heavy trading activity as investors adjusted exposure quickly.

Market makers responded by pulling back liquidity, widening spreads, or stepping aside altogether. That made price moves more extreme.

Retail traders felt the impact through liquidations, especially in perpetual futures where leverage is common. Institutional players also faced pressure as unrealized losses mounted and risk limits tightened.

Exchanges processed massive liquidation volumes in a short period, which strained order books further. This combination of large holders repositioning, ETFs adjusting exposure, and leveraged traders getting wiped out created a fast, self-reinforcing move.

No single group caused the crash. It happened because many reacted at once in a market that could not absorb the flow.

What Comes Next For Bitcoin Prices

Short term direction depends on three signals:

- Leverage: If open interest continues falling, volatility may cool as excess risk clears.

- Exchange flows: Continued large deposits could signal more selling pressure.

- Broader risk sentiment: Especially equity markets and the US dollar.

If these stabilize, bitcoin may consolidate above $60,000. A failure to hold that level could invite another sharp drop. A recovery requires deeper liquidity and lower leverage. Until then, price swings may remain sudden and unforgiving.

YOU MIGHT LIKE: Wall Street Strategist Dumps Bitcoin, Goes All-In on Gold

Conclusion

This flash crash proved how quickly bitcoin can move when leverage overwhelms liquidity. The fast rebound showed buyers remain active, but the drop exposed weak market structure.

For now, stability depends on reduced leverage, steadier capital flows, and calmer global markets. Bitcoin did not break, but the system around it showed clear stress under pressure.

Should You Invest In Bitcoin Now?

Before you invest in Bitcoin, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.