The week ahead promises to be pivotal for both Bitcoin (BTC) and Gold (XAU/USD) as we face economic uncertainty and evolving market dynamics.

Gold has recently benefited from its traditional safe-haven appeal amidst rising concerns over US debt sustainability, while Bitcoin, after hitting a new all-time high, experienced a pullback triggered by geopolitical trade tensions.

So, what should we expect from these two assets in the coming week?

Gold (XAU/USD): Bullish Tilt Amid Geopolitical Concerns

Gold has demonstrated significant strength, rallying on the back of investor unease regarding US fiscal stability.

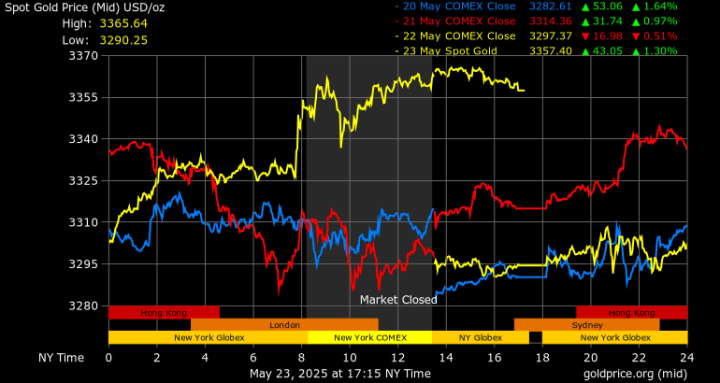

This safe-haven demand propelled the precious metal to a fresh two-week high near $3,350 earlier in the week, though it saw a modest retreat as the US Dollar found some support.

Technically, Gold’s outlook appears bullish in the near term. It has re-entered its ascending regression channel and, importantly, closed the last three trading days above its 20-day Simple Moving Average (SMA).

Furthermore, the Relative Strength Index (RSI) on the daily chart is climbing towards 60, indicating that selling pressure may be subsiding.

Looking ahead, key resistance levels for Gold are pegged at $3,370, which is the mid-point of its current ascending channel. Beyond that, traders will be watching $3,430 (a notable static level) and the all-time high of $3,500.

On the downside, initial support is anticipated in the $3,290-$3,300 zone, a confluence of the Fibonacci 23.6% retracement of its five-month uptrend, a psychological round number, and the 20-day SMA. Further supports lie at $3,250 (the lower limit of the ascending channel) and $3,200 (the 50-day SMA).

Bitcoin (BTC): Eyeing a Rebound After Tariff Shock

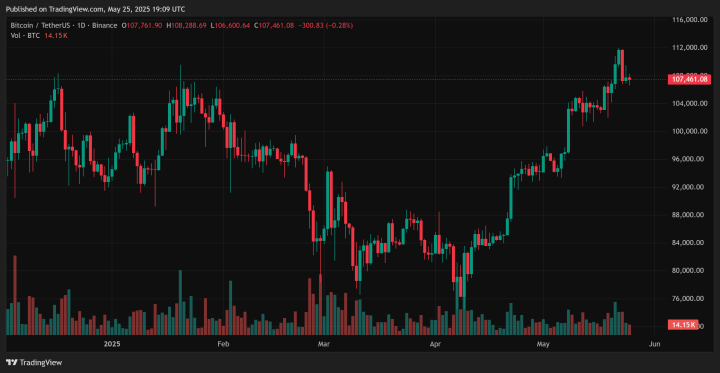

Bitcoin investors experienced a rollercoaster week. The cryptocurrency surged to a new all-time high of $112,000, only to see a sharp 5% correction down to around $106,800.

This decline was largely attributed to renewed market jitters following US tariff announcements, sparking concerns of potential retests of the $104,000 and $102,000 support levels, with $110,000 currently acting as a strong resistance.

Despite this volatility, several bullish signals remain for Bitcoin. Notably, a “Golden Cross” has formed on its price chart, where the 50-day SMA has crossed above the 200-day SMA. Historically, this pattern, while often preceded by a brief pullback (which may have already occurred with the recent dip), is a strong indicator of a continued bullish trend.

Bitcoin is also maintaining its structure within an ascending channel and appeared to rebound from its lower trendline following the tariff-induced sell-off.

The upcoming weekly close will be crucial. A close significantly above the $104,000 support level, or ideally above $108,000, would signal robust underlying demand and could pave the way for another explosive rally.

Many analysts believe the initial “Golden Cross dump” might be complete. Zooming out, the strong correlation between Bitcoin’s price and the Global M2 money supply continues to suggest a positive long-term trajectory, with some forecasts pointing towards a potential rally to $150,000 within the second quarter.

Conclusion

For the week ahead, Gold exhibits a bullish technical posture, largely driven by macroeconomic anxieties.

Bitcoin, while navigating short-term headwinds from geopolitical events, shows strong underlying bullish indicators, suggesting a potential for recovery and further significant gains. Investors will be closely watching key technical levels and global economic headlines.

Gain Instant Access to the World’s First Blockchain Investing Research Service — Actionable Crypto Alerts, Built on 15+ Years of Market Experience

Discover market-moving insights and exclusive crypto forecasts powered by InvestingHaven’s proprietary 15-indicator methodology. Join smart investors using our premium alerts to stay ahead of the curve—before the big moves happen.

This is how we are guiding our premium members (log in required):