Mining profits are under pressure while ETF money swings wildly.

A proposed 10% credit-card cap adds a fresh twist to Bitcoin’s outlook.

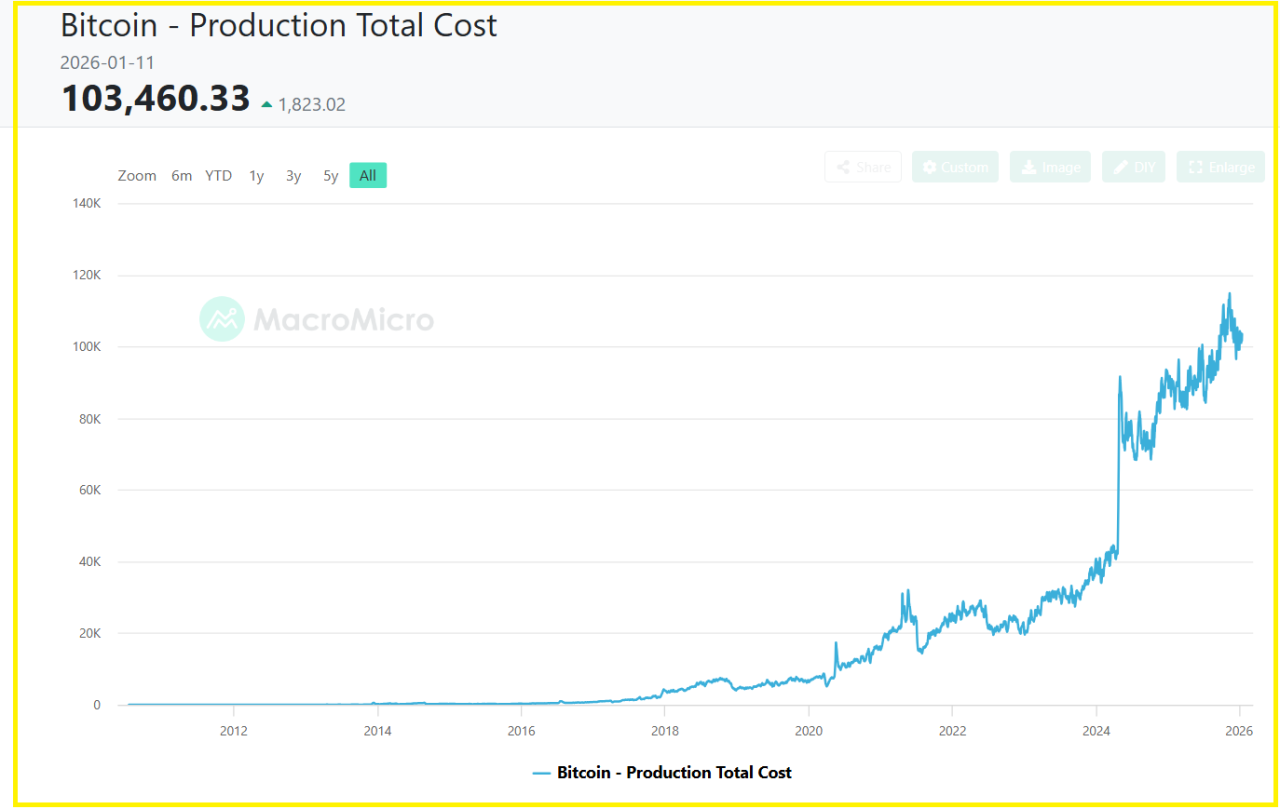

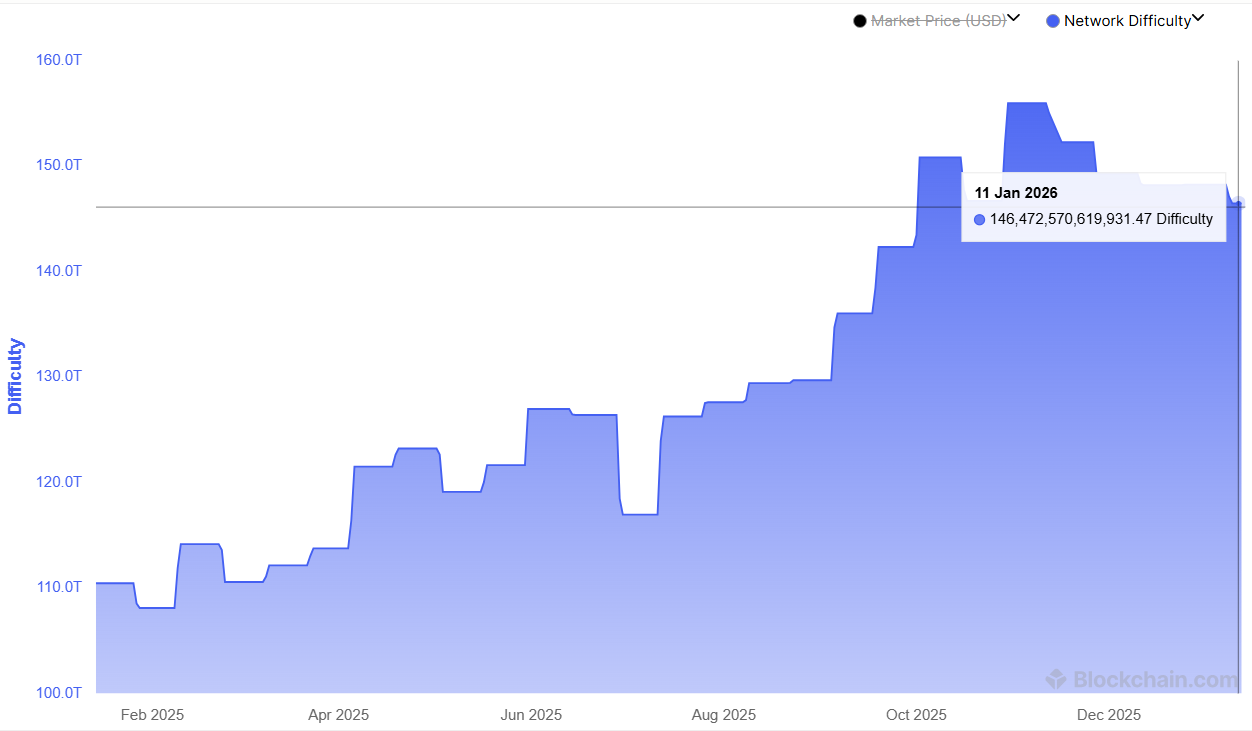

Bitcoin is trading around 95076.81 which slipped under an estimated $103,460 miner breakeven level this week, just as mining revenue fell below $35 per petahash per day and network difficulty eased to about 146.4T.

At the same time, Bitcoin ETFs posted huge daily inflows and outflows, adding to the market’s sharp mood swings.

RELATED: Why Bitcoin Miners Are Selling Now – Record Hashrate And Rising Costs

How Miner Profits Are Getting Squeezed

Bitcoin mining works on a simple math problem: the price of Bitcoin has to stay above the cost of producing it.

Right now, that breakeven level sits around $103,460 for many miners.

When the market trades below that point, some operations struggle to pay for electricity and hardware.

At the same time, mining revenue has fallen. Hash price, which measures how much a miner earns for each unit of computing power, has dropped below $40 per petahash per day.

Network difficulty has also slipped to about 146.4T, which shows how hard it is to mine new coins.

Together, these numbers mean miners earn less each day, even as their fixed costs stay high.

Can Trump’s Credit Card Plan Lift Bitcoin?

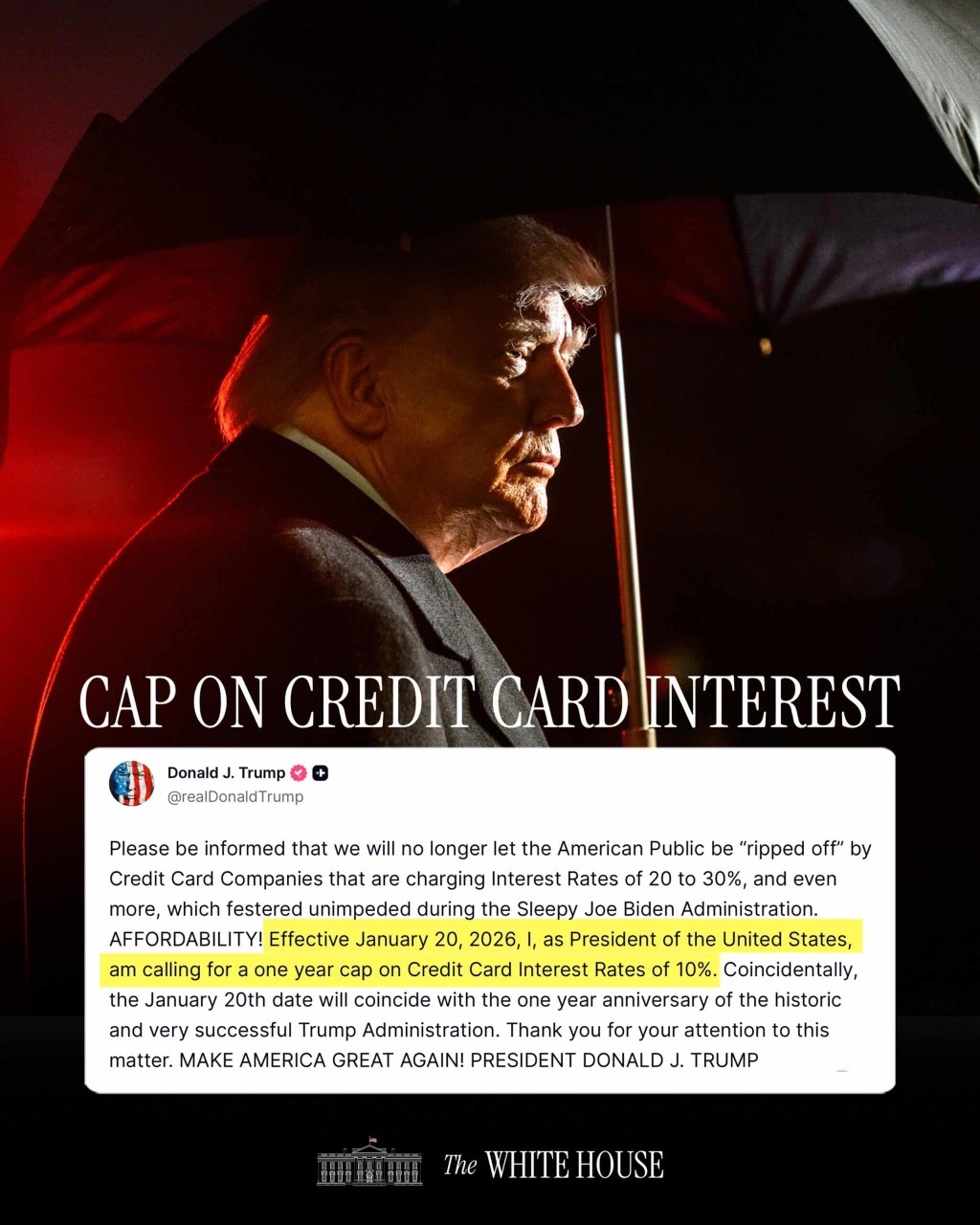

Donald Trump’s proposal to cap credit-card interest at 10% has sparked debate far beyond traditional finance.

If banks earn less from interest, they may tighten lending or shift where they put their money.

Consumers might also change how they borrow and spend.

Some analysts think this could push a portion of money toward risk assets like stocks or crypto, including Bitcoin.

Others say the link is weak and depends on how the policy actually plays out.

For now, the idea adds another layer of uncertainty to an already tense market.

RECOMMENDED: $21M Liquidations Hit Crypto Markets Following Subpoena

ETF Flows Are Now a Major Price Force

Bitcoin ETFs have become one of the biggest short-term forces in the market.

On some days, they pull in hundreds of millions of dollars. On others, they see heavy withdrawals.

When ETFs buy, they can soak up coins that miners and traders want to sell. When they sell, they can add fresh pressure.

With miners already under strain, these ETF moves are now crucial more than ever.

Conclusion

Bitcoin slipping below mining costs shows that real pressure is building inside the system.

Miners are feeling the squeeze, ETFs are moving large amounts of money, and political headlines are adding more uncertainty.

Trump’s credit-card plan could also change how people and banks move their money.

All of this puts Bitcoin at a turning point, where weaker mining profits collide with powerful financial forces that can shift the market fast.

Before you invest in Bitcoin, we will be outlining some key crypto assets to consider for 2026 in our next Premium crypto alert in the next few days.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here