KEY TAKEAWAYS

- JPMorgan lowered its mining cost estimate to $77,000 after recent changes in network difficulty and hashrate.

- Bitcoin trades about $11,000 below that level, putting pressure on higher-cost miners.

- If miners reduce operations, supply tightens, which can support price.

- A sustained rebound requires strong spot demand, especially from ETFs and institutional buyers.

JPMorgan now estimates bitcoin’s average mining cost at $77,000 while price trades around $66,000. This gap puts pressure on miners and sets up a clear supply versus demand battle.

JPMorgan’s latest update puts bitcoin’s estimated production cost at $77,000, down from about $90,000 in earlier models. Bitcoin currently trades around $66,000, leaving many miners operating below breakeven.

When price stays under production cost, weaker miners either sell more bitcoin or shut down machines. This shift in behavior often changes supply in the market. The question now is simple. Will miner stress create a durable bottom, or will it trigger another wave of selling first?

ALSO READ: Michael Saylor Just Pledged To Buy Bitcoin Forever Despite A $12.4 Billion Loss

Bitcoin Mining Cost Falls To $77K

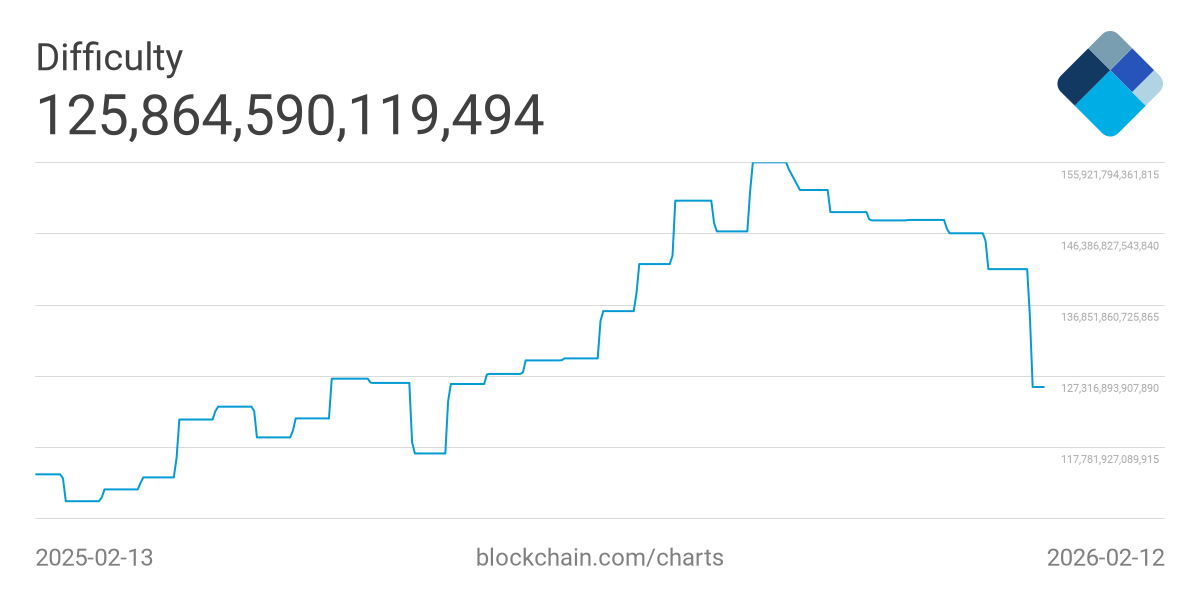

JPMorgan calculates bitcoin’s production cost using energy prices, mining efficiency, and capital expenses. Its updated estimate of $77,000 reflects a recent decline in network difficulty and hashrate.

When difficulty falls, miners need less computational power to earn block rewards. That lowers the short-term cost of producing each bitcoin.

Earlier estimates were closer to $90,000. The drop to $77,000 means that mining conditions have eased slightly. However, bitcoin’s market price remains well below that figure at roughly $66,000. This creates a financial squeeze. Miners with higher electricity costs or heavy debt loads feel that squeeze first.

Production cost does not act as a guaranteed price floor. It acts as a pressure point. When price trades under cost for long, weaker players exit. Stronger operators survive and often gain market share.

RECOMMENDED: Bitcoin’s Fall From Grace: 5 Secret Signals To Turn Panic Into Profit

How Miner Stress Can Move The Market

When miners operate below breakeven, they typically respond in two ways. Some sell more of their bitcoin reserves to cover operating expenses. Others shut down less efficient machines to reduce losses.

Both actions affect supply. Increased selling pushes more bitcoin onto exchanges. Shutdowns reduce hashrate, which can lower difficulty in the next adjustment cycle. Lower difficulty cuts production cost further and reduces forced selling over time.

This process often plays out in stages. First, price drops and miners sell. Then weaker miners exit. Finally, difficulty adjusts downward, easing pressure on remaining operators. If selling slows enough, prices can stabilize and recover.

The timing is critical. If selling accelerates before difficulty adjusts, price can dip further. If difficulty falls quickly and selling slows, the market can find balance faster.

Bitcoin Price, ETFs, And Institutional Demand

Bitcoin trades around $66,000, about $11,000 below JPMorgan’s updated production cost estimate. Recent volatility triggered liquidations in leveraged positions, adding to short-term selling pressure.

At the same time, institutional demand remains a key variable. Spot bitcoin ETFs and large custodial platforms represent the strongest sources of steady buy-side demand. If net inflows into these products increase, they can absorb miner selling.

The math is straightforward. If ETF inflows and institutional purchases exceed the number of coins miners sell daily, price can recover toward the $77,000 range. If inflows slow while miners continue to sell, downside risk remains.

This is more about flow than sentiment. Miner outflows versus institutional inflows will decide the next move.

YOU MIGHT LIKE: Why Did Bitcoin Crash? – The Secret Trigger Most Traders Missed

What Could Happen Next

There are two realistic possibilities:

- In a bullish scenario, hashrate stabilizes, miner selling declines, and ETF inflows strengthen. Price reclaims the $77,000 level and builds support above it. That would signal that supply pressure has eased.

- In a bearish scenario, exchange inflows from miners rise, difficulty does not adjust enough to ease stress, and institutional demand weakens. That combination can push bitcoin lower before a true bottom forms.

The most effective indicators to track are the next difficulty adjustment and its percentage change, daily bitcoin transferred to exchanges by miners, and net ETF flows over rolling 72-hour periods.

These metrics will reveal whether supply pressure is fading or intensifying.

ALSO READ: Dubai Now Lets You Pay Car Insurance With Bitcoin

Conclusion

JPMorgan’s $77,000 production cost estimate offers a practical framework for understanding miner economics. It is not a guaranteed floor, but it defines the stress zone. Bitcoin currently trades below that zone, which forces miners to adapt.

Whether the market rebounds or dips further depends on how quickly miner selling slows and whether institutional demand steps in with enough scale to absorb supply.

Should You Invest In Bitcoin Now?

Before you invest, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Read our latest alert here: A Harmonic Setup in BTC Indicates a Bottoming Area Is Forming(Feb 8th)

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.