KEY TAKEAWAYS

- Bitcoin is stabilizing around $100k-$105k, forming a potential base after October’s correction and early November volatility.

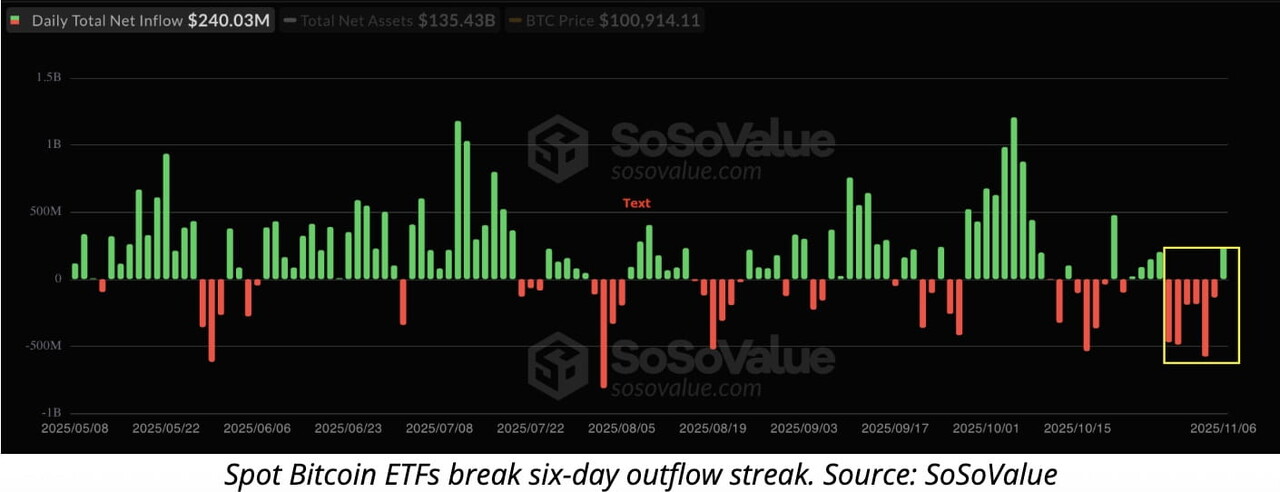

- ETF inflows are returning, showing that institutional demand remains strong despite recent market swings.

- The November 13 U.S. CPI report will likely decide Bitcoin’s next big move ; softer inflation could trigger another rally.

Bitcoin started November with big swings. ETF inflows are returning, inflation data is coming, and $100k is the level everyone is watching.

Bitcoin kicked off November with heavy volatility after rallying hard in October. Prices briefly dropped below $100k before recovering, and the market now feels tense but alive. The next big trigger will be the U.S. inflation report on November 13.

If data softens and ETF inflows keep improving, Bitcoin could reclaim momentum fast. But if inflation surprises, we could see another shakeout before the next move higher. Let’s look at a brief Bitcoin November outlook.

RECOMMENDED: Bitcoin Price Forecast: Can It Hit $150,000 in 2025?

Bitcoin November Outlook: Price Action, ETFs & Liquidity

After hitting record highs in October, Bitcoin saw a sharp correction, falling from $126k to around $100k. That pullback scared off weak hands, but long-term investors never left.

The first week of November brought renewed confidence, with U.S. spot Bitcoin ETFs recording $240 million in inflows, their first positive day in nearly a week.

This rebound shows institutions are still in the game. While derivatives traders continue to add leverage, this also means liquidations can trigger fast price spikes in either direction.

For now, Bitcoin is building a solid base between $100k and $110k. If ETF inflows accelerate again, that base could quickly turn into a springboard toward new highs.

RECOMMENDED: Why Bitcoin Will Close 2025 Under $125K According To Crypto Investment CEO

Macro & On-Chain Catalysts To Watch

Keep your eyes on the U.S. CPI data on November 13; this is the make-or-break event for Bitcoin this month. If inflation cools, expect renewed buying pressure and a quick jump in ETF inflows as traders price in easier financial conditions.

In that case, I’d look to add exposure around the $100k–$105k range before momentum builds. But if CPI surprises on the high side, stay patient and avoid chasing short-term pumps.

On-chain signals look strong: exchange reserves remain low, stablecoin inflows are rising, and large wallets are accumulating. These are all early signs of a market preparing for its next leg higher.

ALSO READ: Bitcoin’s New Place In The Global Financial System.

Technical Levels & Simple Trade Plan

Bitcoin is holding steady between $100k and $105k, a zone that looks like a strong launchpad. As long as this support holds, the next leg higher could come fast. In fact, our Bitcoin price prediction of $180k–$200k in 2025 might materialize.

Generally, you want to treat dips near $100k as strategic entry points, not exit signals. Resistance sits between $114k and $126k meaning a breakout above that range could trigger a sharp move toward $130k+.

For now, stay patient, buy steady, and avoid emotional trades.

YOU MIGHT LIKE: Bitcoin Price Target: Michael Saylor Is Sticking With $150k By Year-End – Here’s Why

Conclusion

Bitcoin’s November outlook is bright, as long as inflation stays friendly and ETF inflows continue to rise. Expect range trading around $100k before a strong December move. Use this calm period to accumulate, not hesitate.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.