Bitcoin is up nearly 30% in 2025, largely due to ETF inflows, corporate adoption, and U.S. regulatory clarity. Momentum continues.

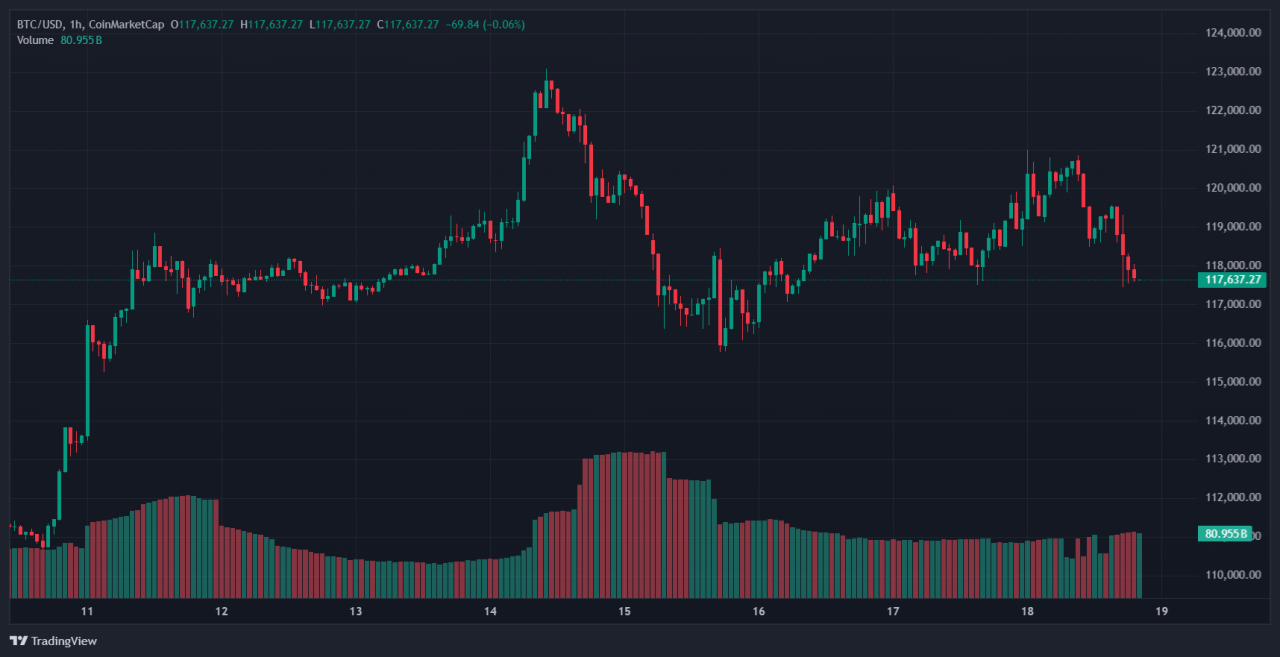

Bitcoin’s 2025 story is one of surging momentum. After hitting an all‑time high above $123,000 in mid‑July, BTC is now up approximately 27 – 30 % year‑to‑date, trading near $118K – $123K.

This strong showing stems from a blend of robust institutional and corporate interest, plus clean regulatory developments in the U.S.

Market Pulse & Demand Dynamics

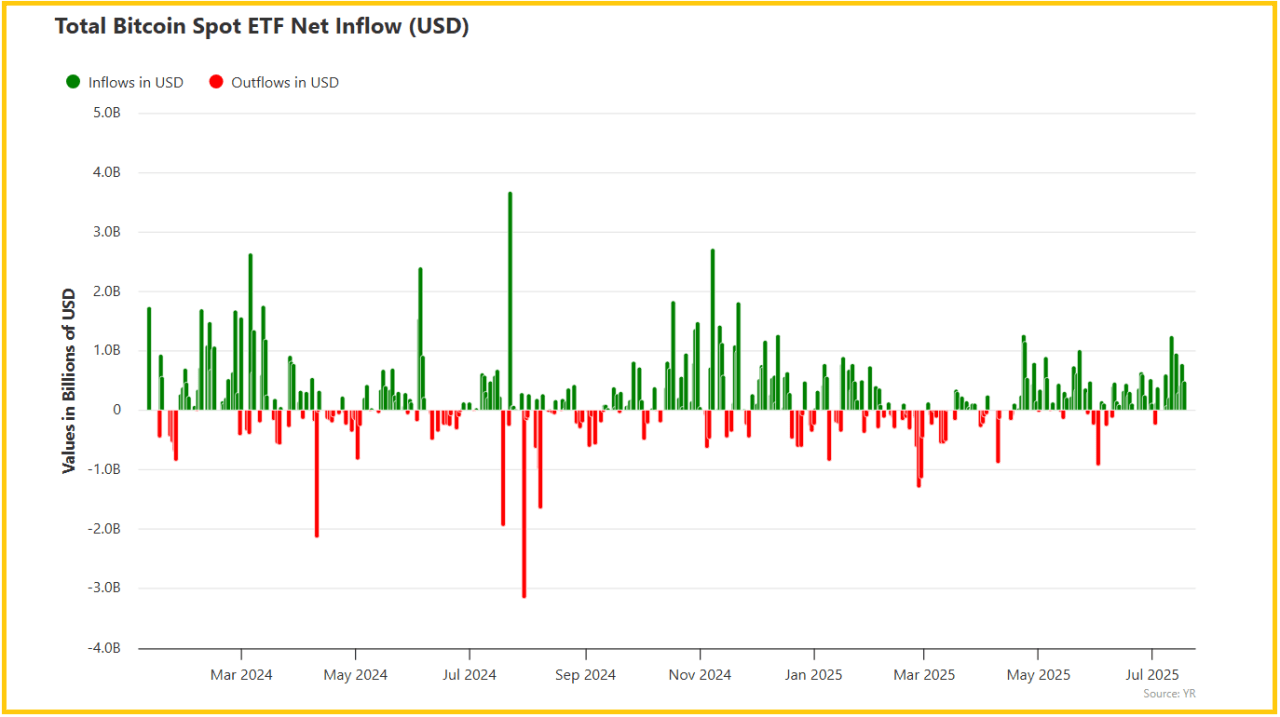

The catalyst behind Bitcoin’s lift has been massive inflows into spot Bitcoin ETFs; about $14.8 B YTD, slightly overtaking year‑ago levels. Mid‑July saw consecutive billion‑dollar‑plus days, lifting ETF assets to a record $158 B.

Still, fewer than 5 % of those holdings are by long‑term institutional allocators like pension funds, with retail and hedge funds maintaining the bulk.

Corporate treasuries are further propelling demand. MicroStrategy alone added over 4,200 BTC (~$470 M) in early July, underscoring growing corporate confidence.

Based on on‑chain data, exchange reserves are at multi‑year lows, while realized market cap has surged from around $812 B to $955 B. This points to seasoned, long‑term accumulation – not short‑term speculation.

Policy, Structure & Risk Signals

A wave of U.S. legislation, including the GENIUS Act, CLARITY Act, and an anti‑CBDC bill, has added regulatory clarity, fueling crypto optimism.

Additionally, President Trump’s executive actions announced a strategic Bitcoin reserve, strengthening BTC’s status in national financial strategy.

That said, the market isn’t without risk: volatility remains, with about $1 B in shorts liquidated in a recent squeeze. Profit‑taking by hedge funds and macro shifts, such as interest‑rate moves, continue to pose short‑term uncertainties.

Forecast & Strategic Trajectory

Looking ahead, consensus price estimates target the $150K – $200K range by the end of 2025. Galaxy Digital projects $185K, Standard Chartered sees a potential $200K, while JP Morgan and Bloomberg Intel estimate $145K – $135K respectively.

More aggressive forecasts from Galaxy and institutional forecasters hint at even higher targets in the years beyond.

Conclusion

Bitcoin’s mid‑year performance in 2025 confirms its evolution into mainstream finance. With around 30 % gains, record ETF flows, corporate accumulation, and supportive policy, the stage is set for continued upside; while volatility and macro risks persist.

If institutional tailwinds hold, BTC is well-positioned to cross six figures again by year‑end.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)