Early December pulled Bitcoin back after a strong rally. ETF flows, exchange reserves, and market liquidity will guide what happens next.

Bitcoin is now trading around 90899.24 USD and started December with a quick fall of about 5% after hitting a high of roughly $126,000 in October and sliding about $18,000 in November.

The move felt sharp, but it does not automatically signal trouble. Bitcoin has a history of sudden dips that reset momentum.

Does this mean that Bitcoin is setting up for a run this December? read on to get our take.

RECOMMENDED: Bitcoin Outlook For December: Will It Reclaim $100,000?

What Happened In Early December 2025?

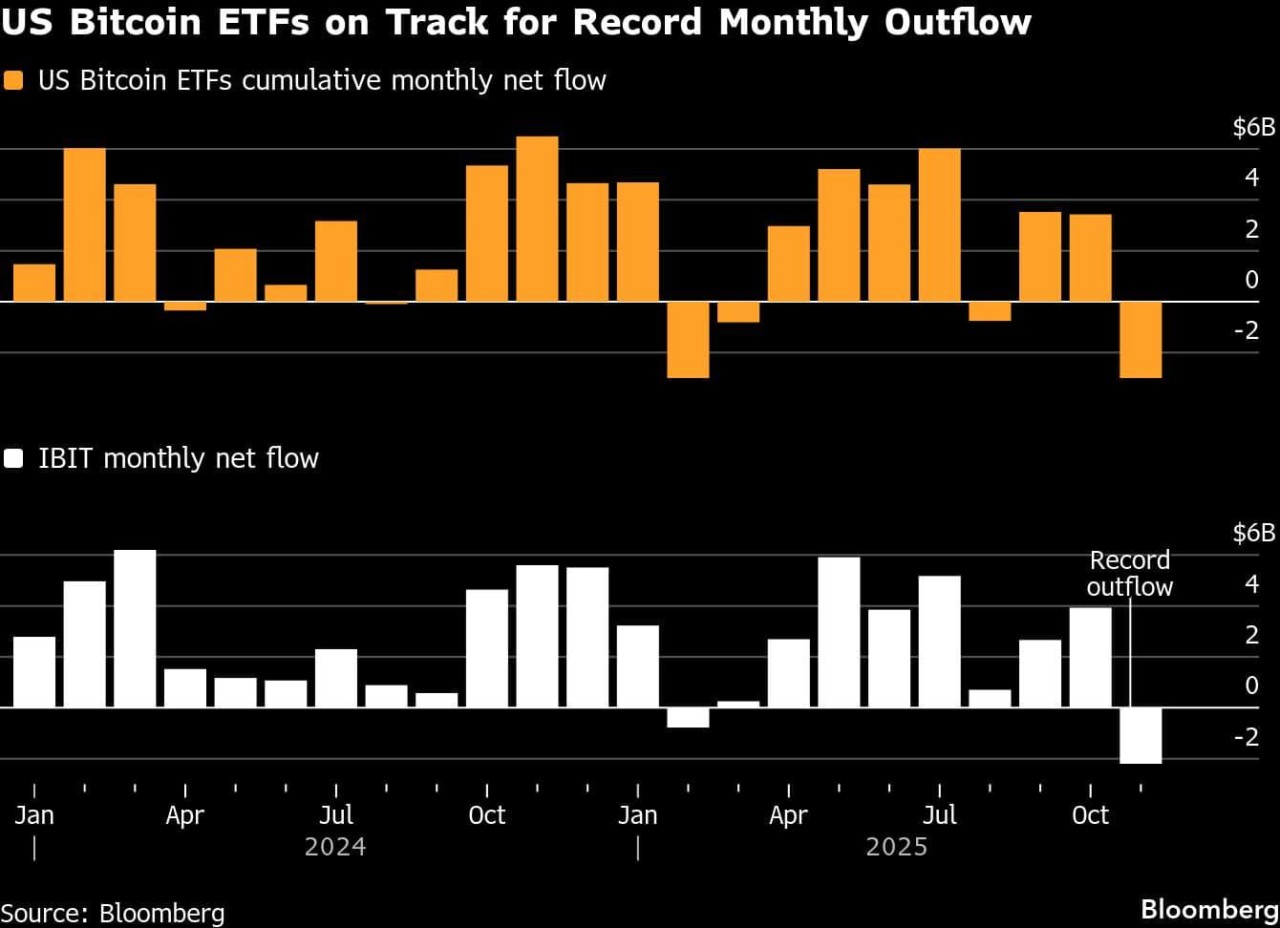

The market came into December after a big surge in October, followed by a cooler November. Spot ETFs saw about $3.4–3.5 billion in outflows toward the end of the month, which added pressure as traders locked in gains.

On Dec 1, Bitcoin dropped into the mid-$80,000s during a fast wave of selling. Thin liquidity made the move feel heavier than it was.

Analysts pointed to margin calls, large sellers, and risk-off moves across traditional markets. These combined forces created a sharp but concentrated pullback rather than a long slide.

Today the monthly candlestick for Bitcoin has turned green, although it’s too early to call if this will be the catalyst for a change in near term price. Both optimism and pessimism exists in the market right now.

The question remains, will we see a big bullish reversal for BTC in December? Investing Haven’s price prediction for Bitcoin is still bullish.

RECOMMENDED: Bitcoin Back Below $100k: Is It Time To Buy?

What History Says About Decembers And Big Reversals

December has produced mixed results for Bitcoin. In some years it added to earlier rallies, with average December gains around +4% in recent periods. In other years it marked the start of broader downtrends, usually when major catalysts hit the market.

Past declines came from clear triggers like leverage unwinds or sudden policy shocks, not the month itself. History shows that Bitcoin often moves in quick waves. A dip can reset the market for another run, but it can also signal that momentum has faded.

ALSO READ: Bitcoin Price Forecast: Can It Hit $150,000 in 2025?

Signals To Watch Now

A few indicators will help show which direction the market chooses:

- ETF flows are the most important, especially if outflows climb above $3 billion again.

- Exchange reserves are key since rising reserves often point to upcoming selling.

- Liquidity also plays a big role, especially around key price areas. If support weakens around $75,000, the market may struggle. If flows stabilize, reserves drop, and liquidity improves, a rebound becomes more likely.

Conclusion

The early December dip could be a healthy reset. ETF flows, reserves, and liquidity will make the answer clear as the month develops.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

- Why This Bounce Matters (30 Crypto Charts) (Nov 23rd)

- What’s Going On With Bitcoin & Alts?(Nov 16th)

- This Is What We Want To See The Next 72 Hours(Nov 9th)

- The Next 2 To 3 Weeks …(Nov 2nd)

- A Successful Test of Bitcoin’s 200 dma? (Oct 26th)

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower