ETF inflows and lower exchange balances have pushed Bitcoin higher, while leverage cuts and ETF outflows keep the rally uncertain.

Bitcoin’s price has made a strong comeback this month, moving from the low $100,000 range to above $125,000. The rise is backed by renewed institutional interest, lower Bitcoin balances on exchanges, and strong activity in options markets.

Still, sudden sell-offs and weaker leverage positions show that both optimism and caution are shaping the market right now.

RECOMMENDED: Why Bitcoin Will Close 2025 Under $125K According To Crypto Investment CEO

Current Bitcoin Price, Band and Recent Moves

Bitcoin is trading around $113,400 after reaching a record high of $126,223 on October 5. Following that peak, the price dropped to about $107,800 in mid-October, a decline of 17% in just a few days.

This sharp correction cut futures open interest by more than 30% and increased daily volatility.

Since then, Bitcoin has been fluctuating between $107,000 and $126,000 as traders react to shifting volume and momentum. The wide range shows that while buyers remain active, sellers are still quick to take profits, keeping the market tense but lively.

RECOMMENDED: 10 Giant Companies That Hold the Most Bitcoin You’ll Be Surprised Who’s on Top

Bull Case: Institutional Flows, Falling Exchange Reserves and Derivatives Demand

Supporters of the rally point to strong ETF inflows and shrinking exchange reserves as key signs of lasting demand.

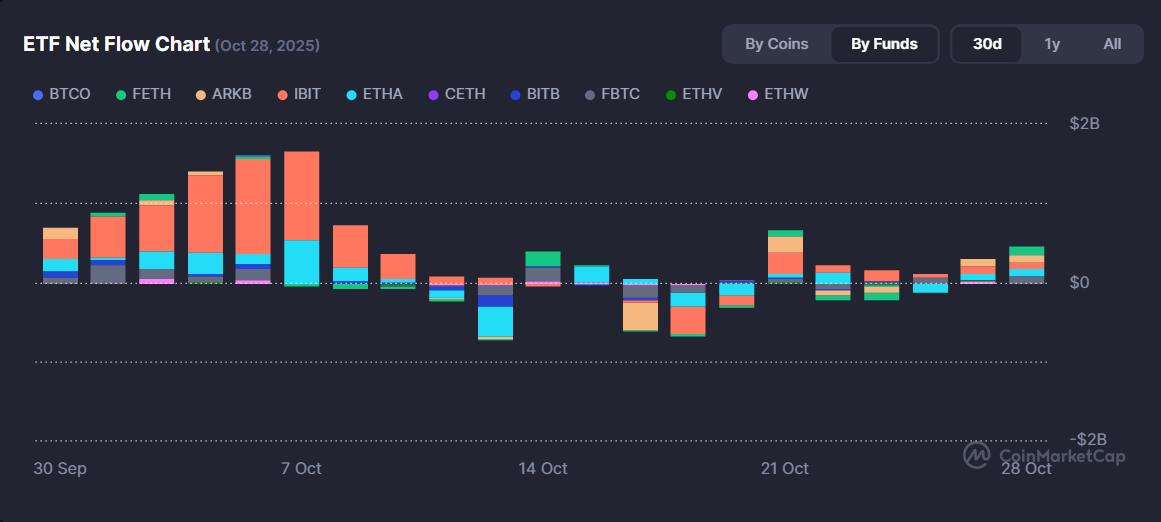

CoinShares data show global crypto ETFs attracted about $5.9 billion in inflows during the week ending October 4, with U.S. spot Bitcoin ETFs adding $3.5 billion. Some funds even recorded more than $1 billion in a single day.

At the same time, the amount of Bitcoin held on exchanges has dropped to its lowest level in years, suggesting investors are moving coins to long-term storage.

Derivatives markets also show a positive tone, with funding rates mostly above neutral and steady options activity, both hinting at healthy buying pressure.

RECOMMENDED: Why Bitcoin Will Close 2025 Under $125K According To Crypto Investment CEO

Bear Case: ETF Outflows, Reduced Open Interest and Macro Triggers

Skeptics note that parts of the rally are still unstable. Occasional ETF outflows and lower open interest after recent liquidations show that leverage remains weak.

The sharp 17% mid-October drop revealed how quickly traders can exit positions when momentum shifts.

Broader market factors, such as a stronger U.S. dollar or fresh inflation data, could also pressure Bitcoin’s price in the short term.

RECOMMENDED: Will Bitcoin Ever Hit $1 Million?

Conclusion

Bitcoin’s latest rally shows real demand but also clear risks. Bulls focus on steady inflows and falling exchange supply, while bears warn of thin leverage and volatile macro conditions. For now, the market sits at a delicate balance between confidence and caution.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here