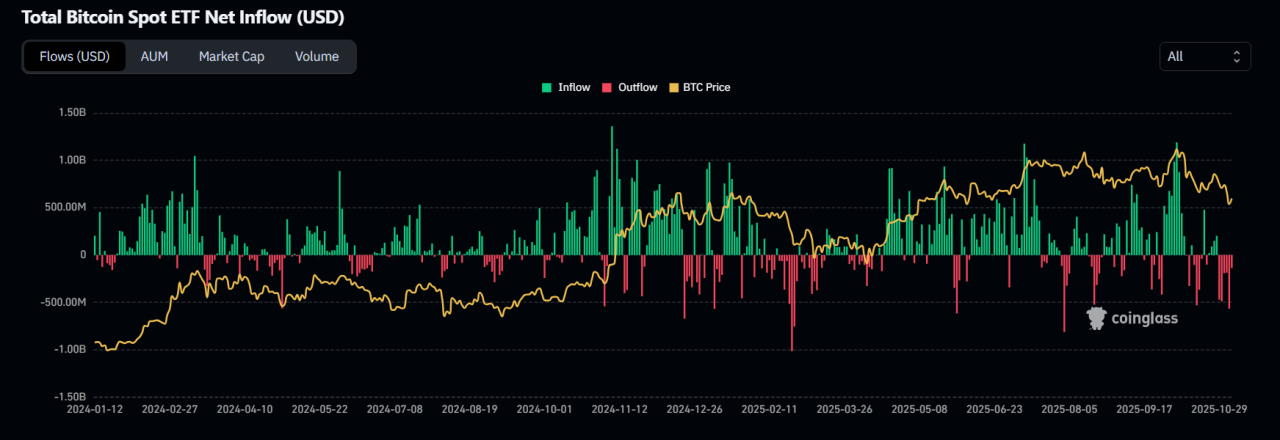

Over $2.0B flowed out of US spot Bitcoin ETFs last week, even as Bitcoin’s price showed signs of recovery. The move highlights short-term caution among investors despite a stable long-term outlook.

US spot Bitcoin ETF outflows surpassed $2.0B over the past week, marking one of the biggest redemption streaks this year.

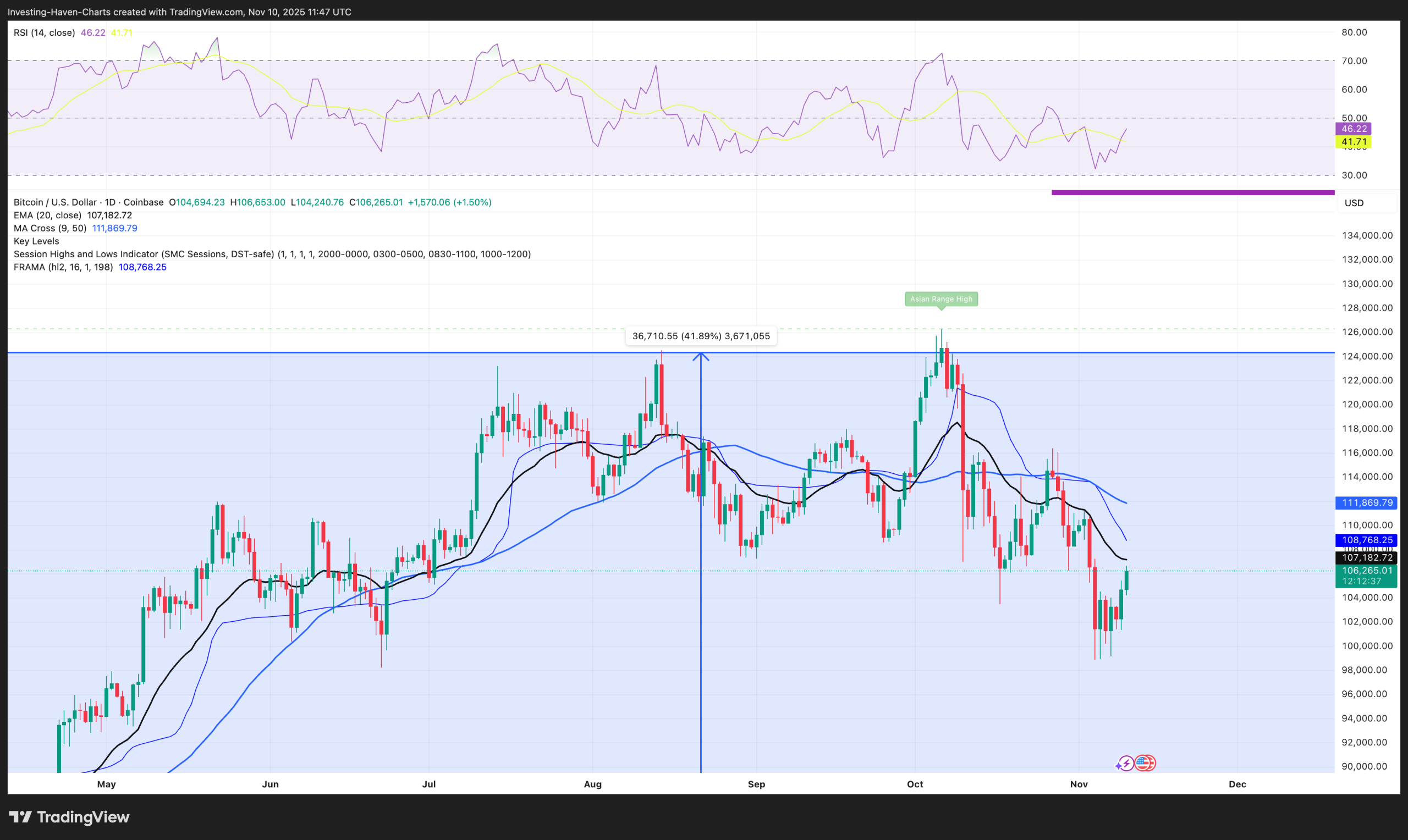

The withdrawals came even as Bitcoin prices steadied above $103,000 after recently slipping under $100K – which is why this crypto news today is being particularly scrutinized by BTC enthusiasts.

This shows that some large investors were still locking in profits and adjusting their positions, even as overall market sentiment improves.

Todays chart tells a different story, Bitcoin is now back up above $106,000.

RECOMMENDED: The ETFization Of Bitcoin: How Flows Reshape Macro Sensitivity

What Happened: Bitcoin ETF Outflows And Timeline

According to data from Farside and other trackers, about $2.0B left US spot Bitcoin ETFs during a five to six-day streak of redemptions.

When combined with Ethereum funds, total crypto ETF outflows reached around $2.6B for the week. Although these numbers seem large, they account for roughly 1–1.5% of total ETF assets, which are estimated to be between $137B and $179B.

This means the withdrawals, while significant, are still small compared to the overall size of the ETF market.

RECOMMENDED: Bitcoin Price Target: Michael Saylor Is Sticking With $150k By Year-End – Here’s Why

Why Investors Were Pulling Back

The outflows appear to be linked to short-term profit-taking and portfolio rebalancing. Many institutional investors have seen strong gains this year and are taking advantage of higher prices to secure returns.

Others are adjusting their exposure as Bitcoin’s volatility increases. A few funds also reported heavier redemptions during days when broader market sentiment weakened, suggesting some traders preferred to sit on cash instead of risk short-term losses.

RECOMMENDED: Why Bitcoin Will Close 2025 Under $125K According To Crypto Investment CEO

What This Crypto News Today Means For The Market

Short-term selling pressure from ETFs can cause extra volatility and price swings, especially during low trading volume periods.

However, a $2.0B outflow is relatively small in the context of the entire Bitcoin ETF market. It does not signal a loss of confidence in Bitcoin, but rather normal adjustments from investors who are managing risk and profits.

RECOMMENDED: 10 Giant Companies That Hold the Most Bitcoin You’ll Be Surprised Who’s on Top

Conclusion

The $2.0B Bitcoin ETFT outflows show that even as Bitcoin’s price improves, institutional investors remain cautious and selective.

While these redemptions may affect short-term market movement, the long-term trend for Bitcoin ETFs remains steady, supported by growing demand for regulated crypto investment products.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here