Corporate treasuries and spot ETFs are removing tradable Bitcoin, tightening available float. Current flows now exceed new issuance, creating a plausible supply squeeze.

Aggressive corporate treasuries, heavy spot ETF inflows, and depleted exchange reserves raise the risk of a Bitcoin supply squeeze. This piece quantifies current flows, shows how corporate and fund demand exceeds new issuance, and flags the data points to watch.

RELATED: Weak Ahead: Bitcoin Vs. ‘Red September’, ETF Flows, And NFP Risk

Demand Surge: Corporates, ETFs And Big Buyers

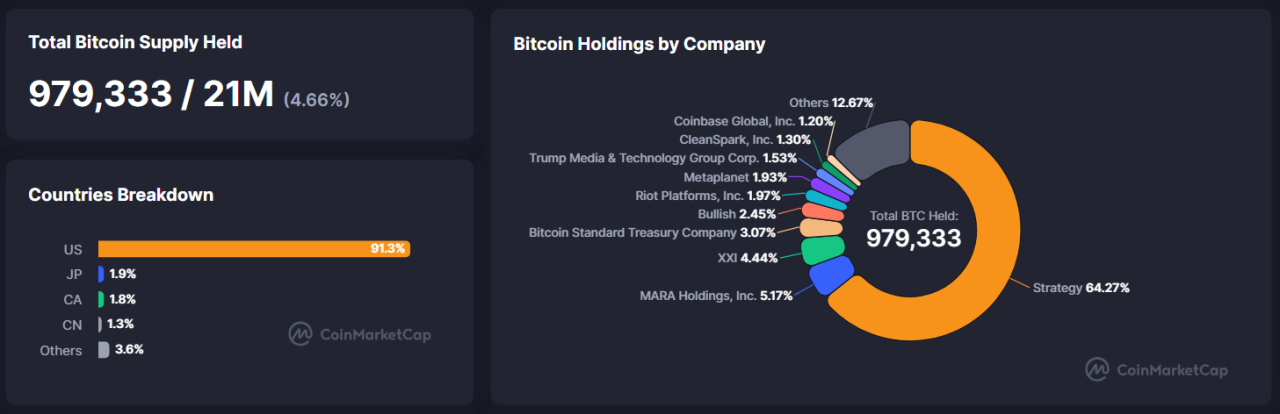

Strategy has accumulated 636,505 BTC, making it the largest corporate holder, and it continued buying through August. Public companies and treasury firms added roughly 134,000 BTC in Q2 2025, a marked rise from prior quarters.

U.S. spot ETFs remove coins from exchanges on large-flow days; for example, IBIT and peers bought about 1,620 BTC on Aug 28.

Those buyers move supply into custody and reduce market depth, which forces larger buyers to pay higher execution premiums.

READ ALSO: Bitcoin Price Prediction: Will BTC Break Above $112K This Week or Slip Back?

Supply Mechanics: Exchanges, Miners And Available Float

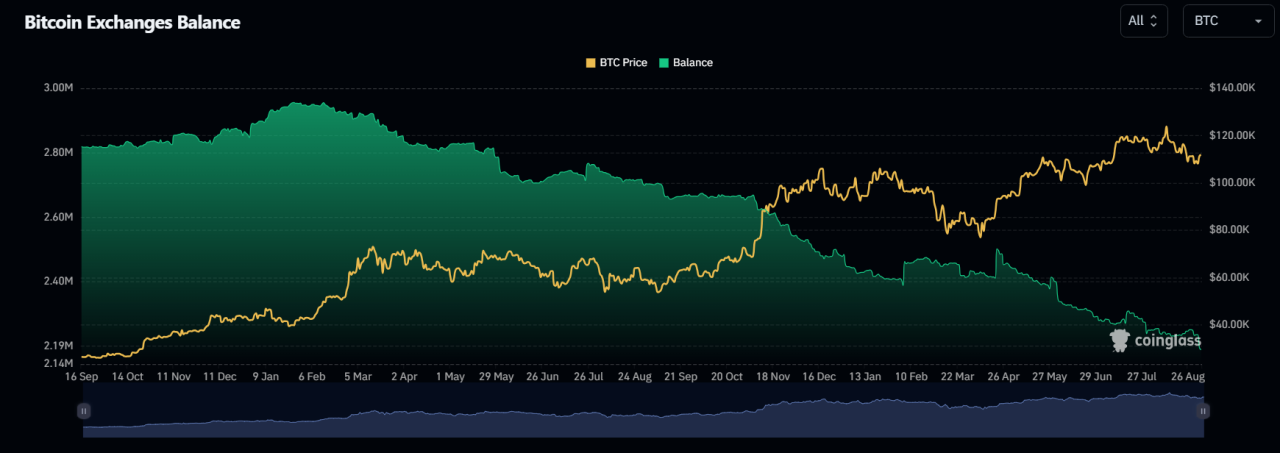

Centralized exchange balances have fallen to roughly 2.7 million BTC, about 14.5% of total supply, shrinking tradable float on major venues. After the April 2024 halving, miners now issue about 450 BTC per day.

River and other trackers estimate companies absorb about 1,755 BTC daily while funds add roughly 1,430 BTC, putting combined institutional demand multiple times above new issuance.

With total supply around 19.9M BTC, those flows materially lower the fraction of coins available for quick trading.

Scenarios And Signals To Watch

- Bull case: Continued ETF stacking and corporate accumulation squeeze exchange liquidity and steepen rallies when volume falls.

- Bear case: Large treasury sales, ETF redemptions, or sudden OTC liquidity would release supply and widen drawdowns.

Immediate signals to watch include weekly ETF net inflows, changes in exchange reserves, disclosed corporate treasury trades, OTC desk inventories, and miner sell schedules closely.

RECOMMENDED: Why Bitcoin Is Down And Whether It’s A Smart Buy

Conclusion

A sustained supply shock is plausible if current demand persists. Keep tabs on exchange reserves, weekly ETF inflows, corporate filings, OTC inventories, and short interest metrics weekly for early confirmation of durable scarcity.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)