KEY TAKEAWAYS

- Goldman holds $2.36 billion in crypto exposure, led by Bitcoin and Ethereum.

- The bank reduced BTC and ETH positions in the quarter while adding XRP and Solana.

- Most exposure comes through ETFs, not direct token ownership.

- A real bull run would require sustained ETF inflows and broader institutional follow through.

Goldman now holds about $2.36 billion in crypto exposure, mostly in Bitcoin and Ethereum through ETFs. The allocation adds credibility to crypto with the structure suggesting careful portfolio management.

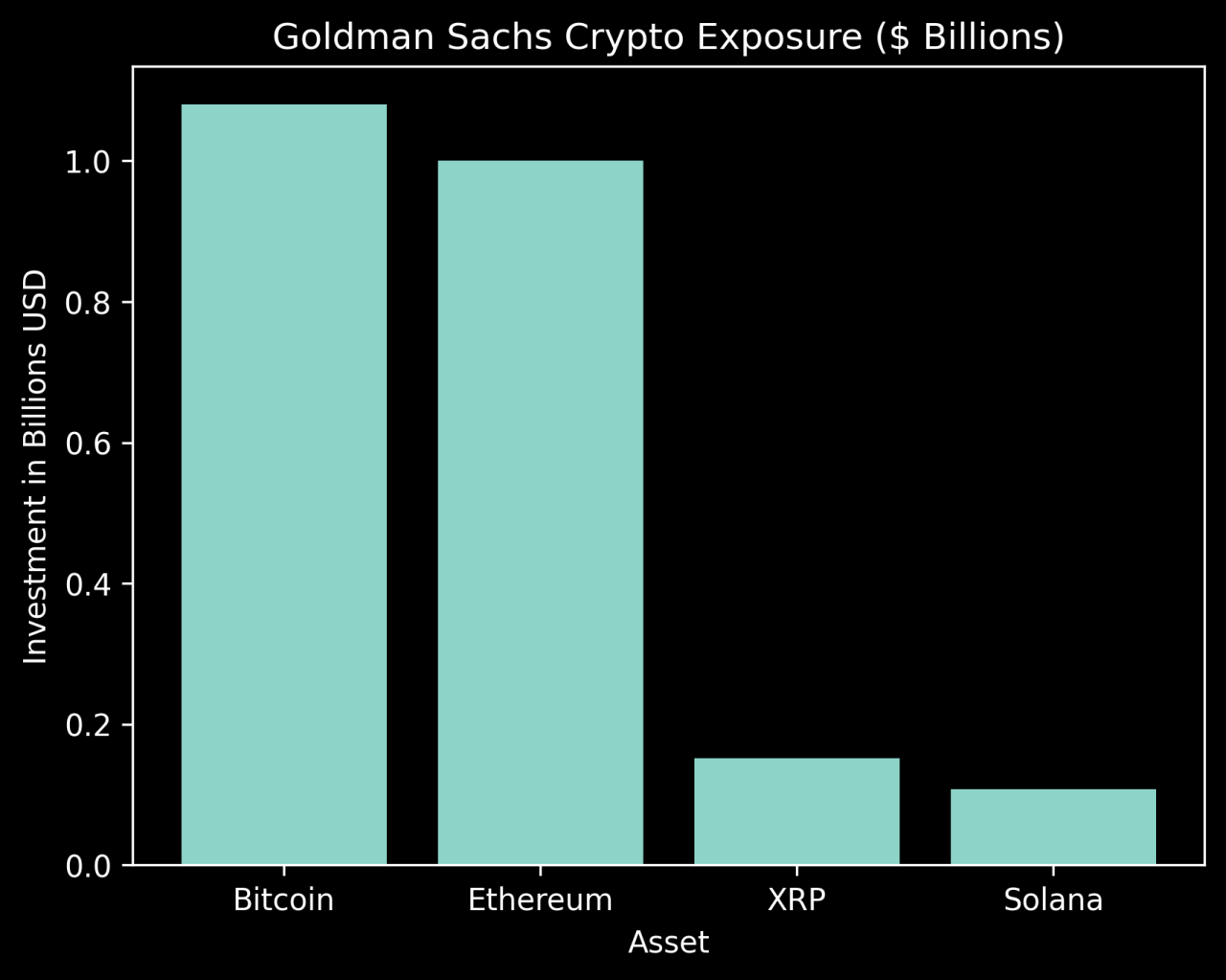

Goldman Sachs has disclosed about $2.36 billion in crypto exposure in its latest regulatory filing. Roughly $1.06–1.10 billion sits in Bitcoin related products, and about $1.0 billion in Ethereum.

The filing also shows around $152 million in XRP and $108 million in Solana. These positions are mostly held through regulated ETFs and trusts rather than direct ownership of tokens.

During the same quarter, Goldman reduced its Bitcoin exposure by about 39% and trimmed Ethereum by about 27%.

ALSO READ: This Company Spent $2.13B On Bitcoin Despite The Downturn

Goldman’s Crypto Holdings Overview

The bank has invested a total of $2.36 billion in crypto exposure. Bitcoin accounts for just over $1 billion of that total, with Ethereum close behind at about $1.0 billion. Smaller but notable allocations include XRP at roughly $152 million and Solana at around $108 million.

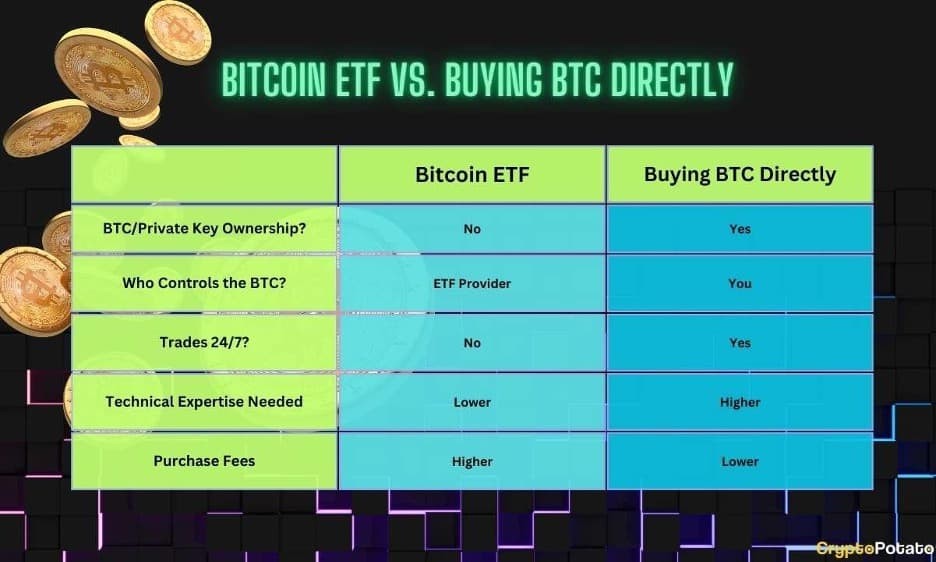

The bank uses exchange traded funds and similar regulated products rather than directly storing coins. That approach reduces custody and compliance risk. It also means the impact on the underlying crypto market flows through ETF channels instead of direct spot buying.

Quarter over quarter, Goldman did not simply increase exposure. It cut its Bitcoin ETF holdings by about 39% and reduced Ethereum exposure by about 27%. At the same time, it added to XRP and Solana products.

This seems like active portfolio management instead of a one way bet on higher prices.

RECOMMENDED: Bitcoin’s Fall From Grace: 5 Secret Signals To Turn Panic Into Profit

Why This Is Important For Crypto Markets

When a global investment bank reports billions in crypto exposure, people pay attention.

Goldman manages vast sums of money and influences how other institutions think. Its presence proves that crypto now sits inside mainstream portfolios.

However, it is important to separate symbolism from impact. ETF exposure does not always create the same market pressure as direct buying. Authorized participants and market makers handle much of the flow behind the scenes, which can smooth out volatility.

The trimming of Bitcoin and Ethereum positions also indicates that Goldman treats crypto like any other asset class. It increases, reduces, and rotates exposure based on risk and return.

While this adds credibility to crypto markets, it does not confirm that institutions are going all in.

YOU MIGHT LIKE: Liquidation Rebooted Bitcoin – Mega Rally Hiding in Plain Sight?

Is A Bull Run On The Way?

While a $2.36 billion allocation from Goldman grabs attention, it does not in itself start a bull market.

A real rally needs sustained capital entering the system. The best signal would be consistent net inflows into spot Bitcoin and Ethereum ETFs over several weeks.

Strong inflows show fresh demand, not just portfolio reshuffling.

Price structure also counts. Higher highs and higher lows on strong volume would confirm buyers are in control.

Rising open interest in options and futures, combined with healthy funding rates, would show conviction rather than short term speculation.

Large Bitcoin withdrawals from exchanges also suggest investors plan to hold, which reduces available supply.

If these signals align with additional institutional disclosures in upcoming filings, momentum could build quickly. But without that follow through, this remains an important development, not the start of a full scale bull run.

What To Watch In The Coming Weeks

Several indicators will show whether this is the start of something bigger:

- Monitor daily spot Bitcoin and Ethereum ETF inflows. Consistent positive flows would support a stronger price trend.

- Review upcoming 13F filings from other major banks and asset managers to see if similar positions appear.

- Track exchange withdrawal data to measure real demand for holding coins off exchange.

- Pay attention to new custody and prime brokerage announcements from large financial institutions. Expanded infrastructure makes larger allocations easier and safer.

These signals will tell us whether Goldman’s move stands alone or marks a broader institutional wave.

ALSO READ: 5 Reasons XRP Could Double Your Money In 2026 After The Drop

Conclusion

Goldman’s $2.36 billion crypto allocation strengthens the case that digital assets have entered mainstream portfolios.

Yet the mix of ETF exposure and active trimming shows a cautious, managed approach.

For a true Wall Street led rally, we need steady inflows, repeated confirmations in filings, and stronger holding behavior across the market. Until then, this remains a powerful signal of legitimacy, not proof of an explosive bull run.

Should You Invest In Bitcoin or Ethereum Now?

Before you invest, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Read our latest alert here: A Harmonic Setup in BTC Indicates a Bottoming Area Is Forming(Feb 8th)

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

Bitcoin Price Prediction

Visualize future value based on annual growth.