A landmark executive order now opens retirement accounts to crypto. Bitcoin broke $124,000 likely due to surging institutional inflows, rate-cut expectations, and regulatory clarity.

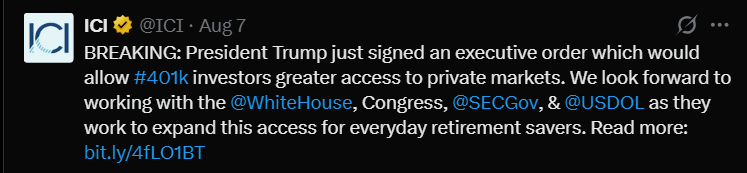

Bitcoin surged past $124,000 this August, reaching a fresh all-time high of $124,480 on August 14, 2025. That spike followed a powerful policy shift on August 7, when the U.S. government issued an executive order allowing 401(k) retirement plans to include cryptocurrency.

That move added legitimacy to crypto and unlocked the possibility of tapping retirement savings as a new and steady source of capital.

RELATED: Why Are Bitcoin (BTC) Prices Up? What’s Happening?

401(k) Access Unleashes Trillions in Potential Capital

The US executive order on crypto instructs federal agencies to revise ERISA rules and create frameworks for plan sponsors to offer alternative assets including crypto.

Defined-contribution plans hold roughly $8.7 trillion; some estimates place total retirement savings at $12 trillion. If even a fraction of that capital is allocated to cryptocurrencies, it would represent a major source of sustained demand across the market.

Analysts view this as the first step toward a reliable, long-term inflow rather than short-lived speculative surges.

RECOMMENDED: Want to Make $1M with Bitcoin? Here’s How in 10 Years

Market Reaction: Price Move and Macro Momentum

Bitcoin’s price in 2025 rose about 33% year-to-date by mid-August. That rally coincided with growing expectations of a September Fed rate cut; markets assigned more than a 90% chance.

Institutional flows into crypto ETFs also gained traction; Bitcoin ETF inflows reached tens of millions of dollars in recent sessions.

It would seem the convergence of federal policy reform, mainstream fund flows, and favorable macro signals pushed Bitcoin into new record territory and tilted investor sentiment toward risk assets.

Conclusion

U.S. retirement-account inclusion marked a historic shift that broadened crypto’s investor base.

Bitcoin’s record near $124,500 reflects tangible effects from that policy, institutional liquidity, and rate-cut optimism. Still, national retirement plans considering Bitcoin 401k investment must weigh volatility, liquidity constraints, and fiduciary responsibility in designing these offerings.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service, live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)