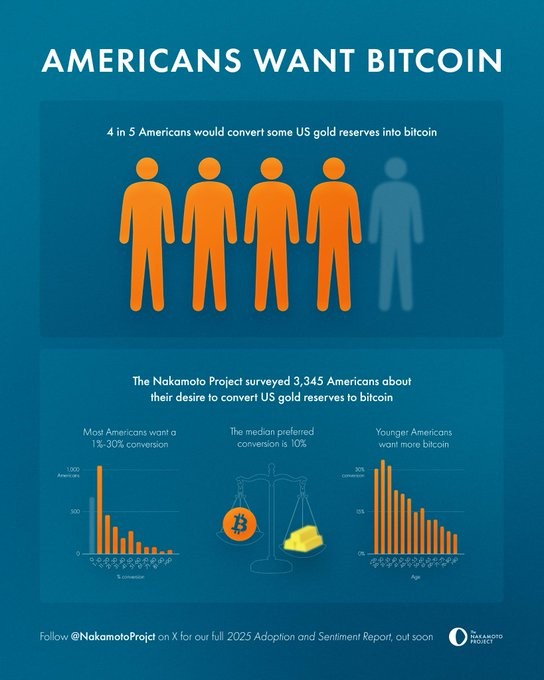

A survey by The Nakamoto Project reveals a significant shift in American sentiment towards digital assets, with 80% of the respondents favoring conversion of a portion of the US gold reserves into Bitcoin.

The public backing, which came out particularly strong among younger demographics, signals a growing appetite for digital assets in Americans.

Public Backing and Demographics

The online survey, conducted between February and mid-March 2025 with 3,345 participants matched to U.S. Census demographics, found a median recommendation of 10% for the gold-to-Bitcoin conversion, with suggestions ranging from 1% to 30%.

Support for converting part of the US gold reserve into Bitcoin was most pronounced among those aged 26 to 30, followed by individuals under 26 and those between 31 and 35.

This trend aligns with existing data showing an inverse correlation between age and Bitcoin ownership, indicating a clear generational shift in investment preferences.

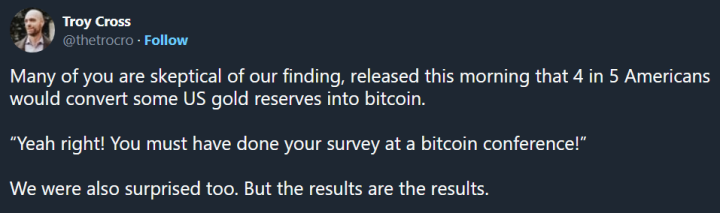

Despite initial skepticism from some social media critics who questioned if only crypto-enthusiasts were polled, Nakamoto Project co-founder Troy Cross affirmed the survey’s validity.

He noted that when presented with a choice, respondents were hesitant to select 0% Bitcoin, instead gravitating towards diversification.

Dennis Porter, co-founder of the Satoshi Action Fund, echoed this sentiment, highlighting a perceived growing indifference among Americans towards gold and a natural inclination towards diversified portfolios.

Washington Takes Notice: A Strategic Bitcoin Reserve?

The survey also reports that 66% of respondents expressed neutral to positive views on President Donald Trump’s push for a strategic Bitcoin reserve.

White House adviser Bo Hines has proposed a budget-neutral plan for the Treasury to acquire up to 1 million BTC over five years, leveraging profits from the country’s existing gold reserves.

This initiative builds on Senator Cynthia Lummis’ Bitcoin Act of 2025, which aims to declare Bitcoin a key strategic national resource. Additionally, Health Secretary Robert F. Kennedy Jr. previously suggested a one-to-one matching of Bitcoin reserves with gold holdings.

Currently, the United States holds the world’s largest gold reserve at 8,133 metric tons, officially valued at $11 billion but worth over $834 billion at today’s market rates.

In contrast, the U.S. Bitcoin holdings stand at approximately 207,189 BTC, valued around $22 billion—less than 3% of its gold holdings. This significant disparity highlights ample room for digital asset diversification.

Broader Adoption and Market Outlook

Beyond federal considerations, Bitcoin adoption is gaining traction at state and corporate levels. Several U.S. states are exploring or implementing policies to hold up to 5% of their reserves in Bitcoin and gold, with Arizona even developing a digital asset reserve without taxpayer funds.

Corporations like MicroStrategy and Japanese firm Metaplanet are also significantly increasing their Bitcoin holdings.

JPMorgan analysts further anticipate Bitcoin to outperform gold in the second half of 2025, citing new investors and key drivers. They note a recent trend of Bitcoin price appreciation coinciding with a decline in gold prices, and substantial inflows into Bitcoin ETFs compared to outflows from gold ETFs.

This comprehensive shift in public opinion, political interest, and market dynamics points towards a future where Bitcoin plays a more prominent role in national and global financial strategies.

Gain Instant Access to the World’s First Blockchain Investing Research Service — Actionable Crypto Alerts, Built on 15+ Years of Market Experience

Discover market-moving insights and exclusive crypto forecasts powered by InvestingHaven’s proprietary 15-indicator methodology. Join smart investors using our premium alerts to stay ahead of the curve—before the big moves happen.

This is how we are guiding our premium members (log in required):

- Is A Massive Breakout Coming? (May 18th)

- Top Altcoin Picks in the Strongest Emerging Narrative (May 9th)

- Bitcoin’s Must-Watch Chart Structure, What It Means For Top Altcoins (May 6th)

- Charts – XRP, Theta, Uniswap, and two RWA Token Tips (April 29th)

- Juicy Opportunities Are Starting To Show Up On The Charts (April 24th)