A $150M Bitcoin purchase could absorb over 1,600 BTC from the market and lift prices.

The outcome depends on execution speed, price levels, and market liquidity.

Strive announced a $150M preferred securities offering in late January 2026, with plans to buy Bitcoin and reduce outstanding debt.

At current prices, that amount represents a large, focused purchase that would expand Strive’s Bitcoin exposure and change its balance sheet profile.

Moves of this size tend to draw attention because they concentrate demand into a short time window.

RECOMMENDED:

Who Is Behind The $150M Bitcoin Plan?

Strive, associated with investor Vivek Ramaswamy, outlined the strategy in a regulatory filing.

The company said proceeds will fund Bitcoin purchases and repay convertible notes and other liabilities.

Strive currently reports holding about 12,798 BTC. Adding another 1,600–1,700 BTC would lift total holdings to roughly 13,400 BTC.

That jump places Strive among the more aggressive corporate Bitcoin buyers and increases the share of BTC on its balance sheet.

ALSO READ: This Company Spent $2.13B On Bitcoin Despite The Downturn

Why This Buy Could Ignite A BTC Rally

Bitcoin liquidity looks deep, but large single buyers can still move prices.

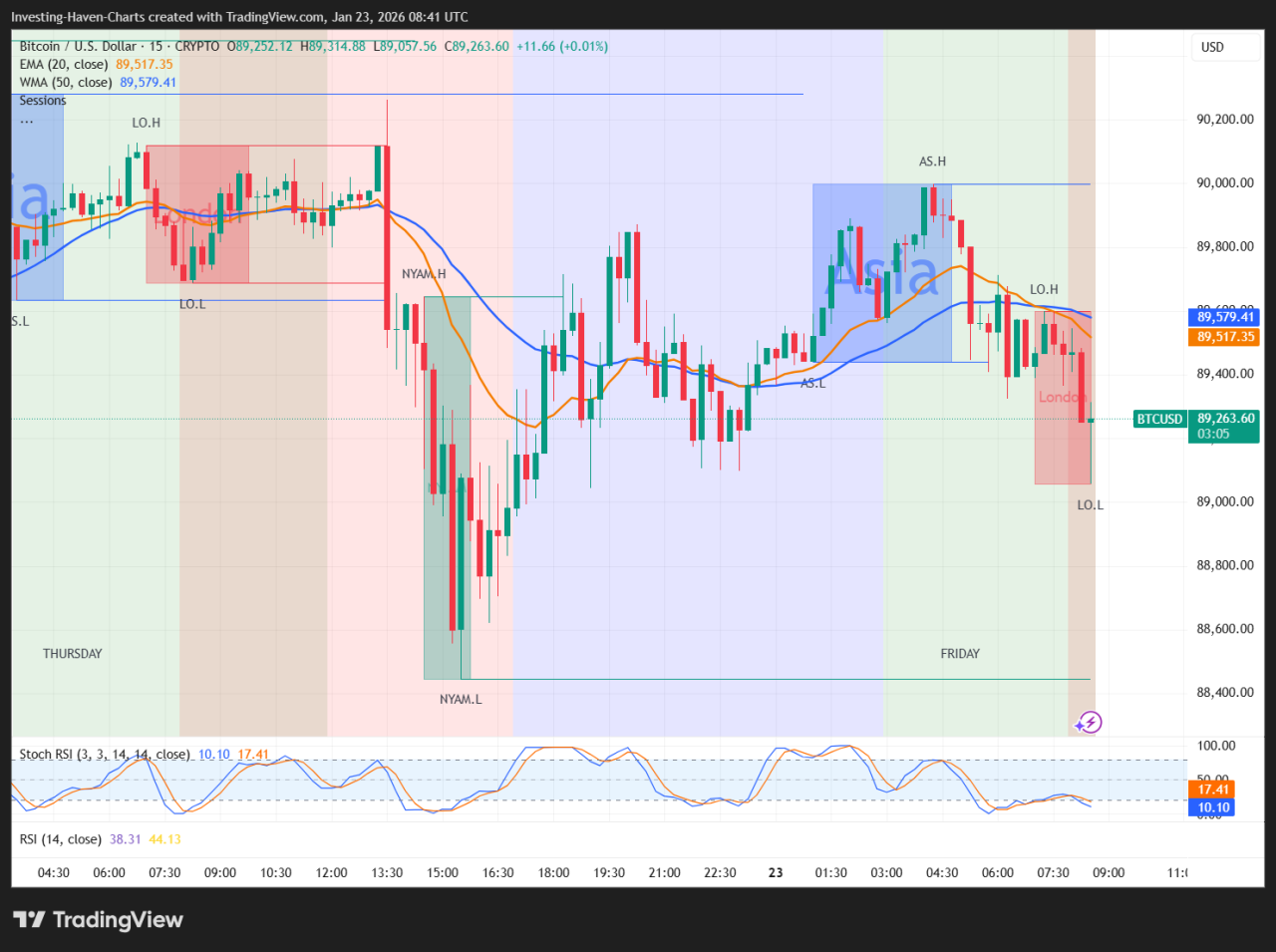

At the current BTC price of around $89,500, a $150M buy represents real demand that sellers must meet.

When buyers seek that volume quickly, prices often rise as offers move higher.

Even before coins change hands, the market often reacts to credible buying plans.

Traders adjust expectations, which can lift short-term pricing and momentum.

RECOMMENDED: Bitcoin Whale Wakes Up: $85M Moved After 13 Years

Should You Buy Now? What To Consider

Large corporate buys can support prices, but they do not remove risk.

Execution delays, price swings, or broader market weakness can offset the impact.

A fast rally can also pull prices ahead of fundamentals.

The question is less about one announcement and more about whether demand stays strong after the initial purchase.

Before you buy Bitcoin, you’ll want to read our latest premium crypto alert where we will reveal the crypto assets you may want to consider for 2026 with explosive potential.