KEY TAKEAWAYS

- Strategy controls more than 713,000 BTC, purchased for about $54.3 billion, making it the largest corporate bitcoin holder.

- A $12.4 billion Q4 loss shows how bitcoin volatility directly flows into earnings.

- Recent purchases, including 1,142 BTC for about $90 million, confirm the buying program remains active during downturns.

- Strategy stock now functions as amplified bitcoin exposure, with sharper upside and sharper drawdowns.

- Should you buy Bitcoin now?

Michael Saylor locked Strategy into permanent bitcoin accumulation, even after record losses. That commitment changes how markets value both the company and bitcoin.

Michael Saylor, executive chairman of Strategy (formerly MicroStrategy), has doubled down on an unprecedented corporate Bitcoin strategy.

This comes as the company posted a $12.4 billion quarterly loss tied directly to its Bitcoin holdings.

Saylor told CNBC that Strategy will not sell any Bitcoin and plans to buy Bitcoin every quarter indefinitely.

RELATED: This Company Spent $2.13B On Bitcoin Despite The Downturn

Bullish Commitment: Buy Bitcoin Every Quarter, Forever

In a February 10, 2026 interview on CNBC’s Squawk Box, Saylor revealed that Strategy won’t dispose of its Bitcoin, even if prices fall sharply.

He said the company is prepared to refinance debt if necessary rather than sell its holdings.

This emphasizes that corporate lenders continue to support a business whose treasury is dominated by Bitcoin.

Saylor’s pledge also codifies Strategy’s crypto policy; removing typical management discretion around selling or rotating out of Bitcoin during downturns.

If Bitcoin price falls 90% over several years, Saylor insists the company will simply “roll forward” debt to stay the course.

That rigidity transforms Strategy into what many analysts now describe as a leveraged Bitcoin vehicle trading on public markets, rather than a diversified corporate entity.

ALSO READ: Bitcoin’s Fall From Grace: 5 Secret Signals To Turn Panic Into Profit

Scale & Accumulation: Largest Corporate Bitcoin Hoard

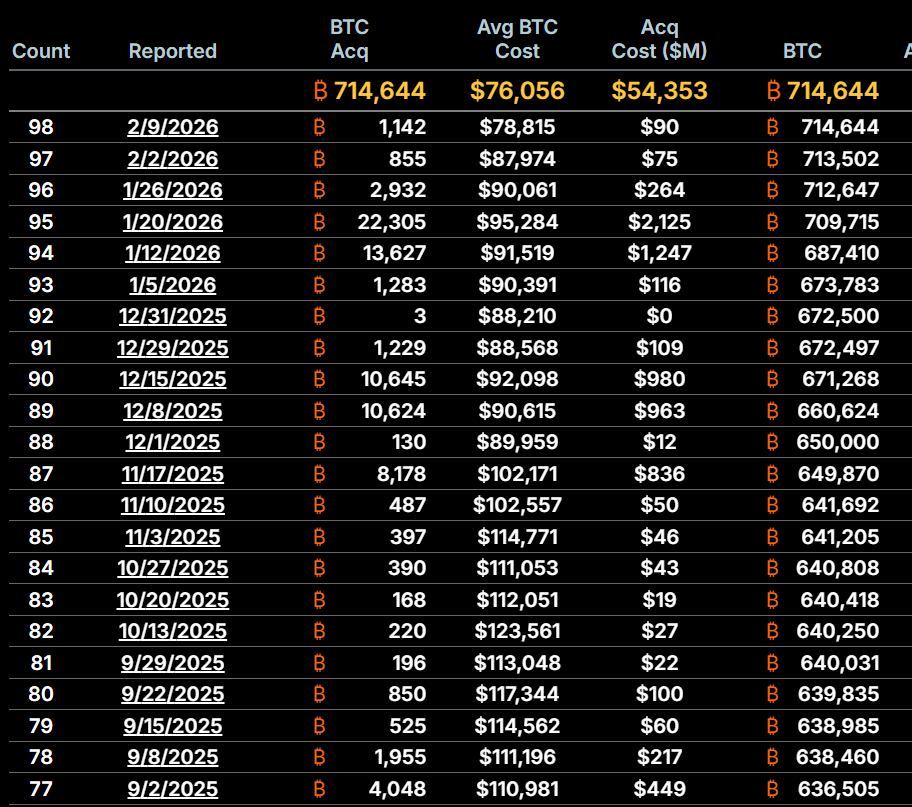

Strategy’s holdings sit between 713,500 and 714,600 BTC, depending on the timing of recent disclosures.

The total cost of those coins is roughly $54.3 billion. At an average price near $76,000, even small market moves translate into large balance sheet changes.

The company has been aggressively buying, even during market weakness. In January 2026 alone, Strategy added 40,144 BTC, and in early February it acquired an additional 1,997 BTC for about $165 million.

Today, Strategy controls roughly 3.4% of all Bitcoin in circulation, a scale that gives the company outsized psychological influence in markets relative to most institutional holders.

Strategy funds these buys through at-the-market share sales, convertible debt, and preferred share issuances; standard tools for a company using equity and capital markets to fuel asset accumulation at scale.

RECOMMENDED: Is Bitcoin Finished? Washington Rejects Bailout As Price Plummets

What Are The Risks Involved?

Saylor’s confidence in Bitcoin attracts several risks:

- Accounting: Bitcoin price declines turned into a $12.4 billion Q4 loss, even though the company did not sell any coins. These losses reflect valuation rules, but they still influence investor perception and stock behavior.

- Market Volatility: Bitcoin’s recent plunge from above $120,000 to around $63,000 significantly reduced the value of Strategy’s holdings, eroding investor confidence and weighing on the stock price.

- Capital and Dilution: To buy Bitcoin, Strategy must raise cash. That often comes from issuing shares or convertible debt, diluting existing investors when stock prices fall. Strategy’s share count has tripled over past years as a result.

- Strategic Identity Shift: With Bitcoin dominating its balance sheet, Strategy’s legacy software business has faded from investor focus. The company now trades more like a Bitcoin proxy than a diversified technology firm.

Despite these risks, Saylor argues that long-term Bitcoin appreciation outweighs short-term pain.

What This Means For Bitcoin And Investors

For bitcoin, Strategy represents a steady source of demand. A buyer of this size, operating on a fixed schedule, influences market psychology. Still, demand alone does not remove downside risk. Even committed buyers face limits when liquidity tightens or capital costs rise.

For investors, the decision is straightforward. Owning Strategy means owning bitcoin with leverage applied through corporate finance. Gains can exceed bitcoin during rallies. Losses can deepen quickly during declines.

So while Saylor’s public commitment may encourage institutional participation, it also raises questions about concentration risk in corporate treasuries.

YOU MIGHT LIKE: Why Did Bitcoin Crash? – The Secret Trigger Most Traders Missed

Conclusion

Michael Saylor has eliminated ambiguity about Strategy’s Bitcoin policy. The company will continue accumulating Bitcoin every quarter forever, regardless of price cycles or mark-to-market losses.

This means the company is no longer a traditional growth stock but a long-term, public Bitcoin investment vehicle.

Understanding that distinction is central to evaluating the company’s future performance.

Should You Invest In Bitcoin Now?

Before you invest, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Read our latest alert here: A Harmonic Setup in BTC Indicates a Bottoming Area Is Forming(Feb 8th)

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

Bitcoin Price Prediction

Visualize future value based on annual growth.