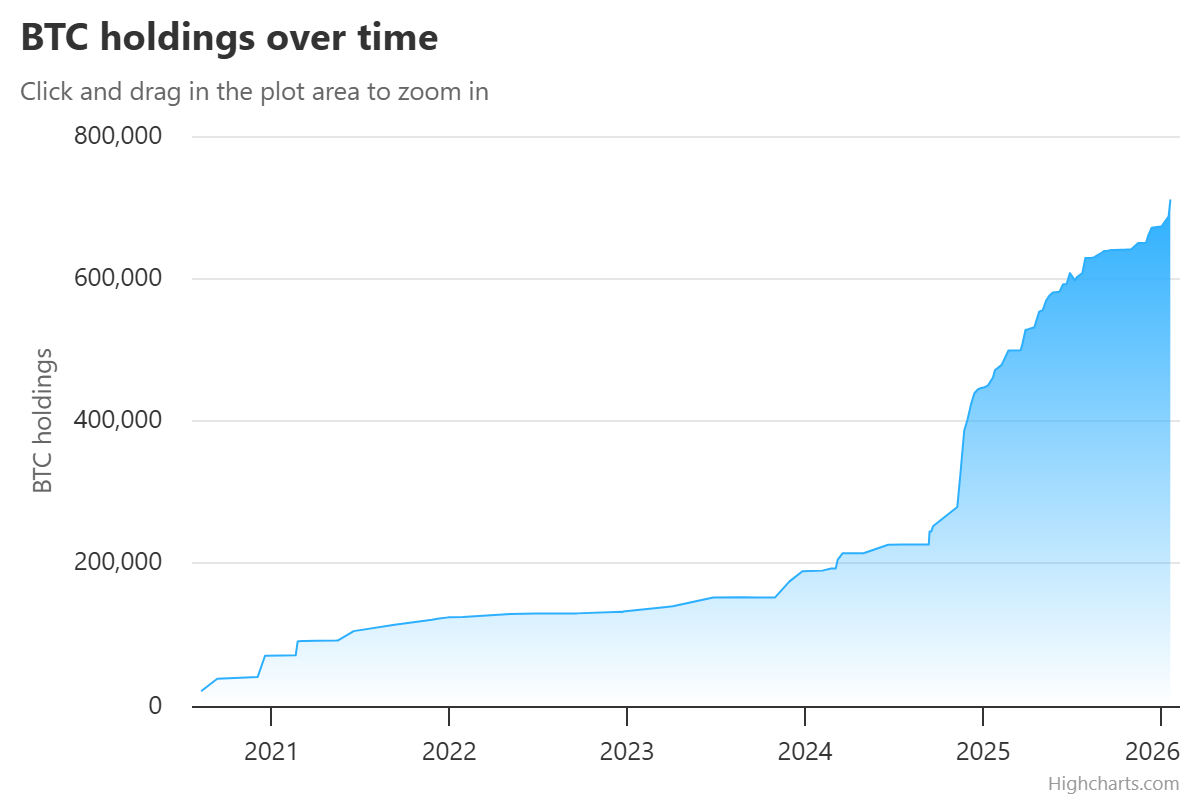

The company is Strategy, which may not come as a surprise. They added more than 22,000 Bitcoin during a market pullback, lifting total holdings to about 709,715 BTC.

The move shows continued institutional buying despite short-term price swings.

Over seven days in mid-January 2026, Strategy quietly made one of the largest Bitcoin purchases of the year so far.

The company bought 22,305 BTC for roughly $2.13 billion, paying an average price of $95,284 per coin.

The buys took place during a broader market dip, when prices and sentiment both weakened.

ALSO READ: 10 Giant Companies That Hold the Most Bitcoin

How Much Bitcoin Strategy Bought

Strategy completed the purchases between Jan 12 and Jan 19, 2026.

Regulatory filings show the company spent about $2.13B to acquire 22,305 BTC at an average price of $95,284.

Strategy CEO Michael Saylor shared the news on X.

After the transaction, Strategy’s total Bitcoin stash reached about 709,715 BTC, making it the largest public corporate holder by a wide margin.

To fund the buys, the company relied on at-the-market share sales and preferred stock issuances.

This approach allows Strategy to keep buying Bitcoin without waiting to build cash, but it also increases dilution risk for shareholders.

RECOMMENDED: Bitcoin Whale Wakes Up: $85M Moved After 13 Years

How Markets Reacted

The market response was mixed. Bitcoin prices slipped during the same week as the purchase, reflecting broader risk-off sentiment.

Strategy’s stock also dropped, falling roughly 5–7% shortly after the disclosure.

Investors focused on timing. Buying during a dip can pay off if prices rebound, but it can also amplify losses if the decline continues.

The size of the purchase kept attention high, even as short-term price action stayed weak.

What This Means Going Forward

This move confirms that Strategy remains committed to adding Bitcoin regardless of short-term volatility.

At the same time, the growing size of its holdings increases exposure to price swings and keeps funding methods under close watch.

Future buys, equity raises, and broader institutional flows will likely shape sentiment.

YOU MIGHT LIKE: Did The U.S Steal $15B Bitcoin From A Chinese Scam King? Here Is The Truth

Conclusion

Strategy’s $2.13B Bitcoin purchase signals strong conviction, but it also brings higher risk tied to timing, leverage, and market volatility.

Should you invest $1,000 in Bitcoin Now?

Before you invest in bitcoin, you’re going to want to read our latest premium members crypto alert which will be published in the next few days.

We will reveal some exciting crypto assets to consider for 2026 with explosive potential.