Massive inflows into Bitcoin spot ETFs are changing how the market moves. Institutional money, fund mechanics, and global macro signals now play a bigger role in Bitcoin’s price action.

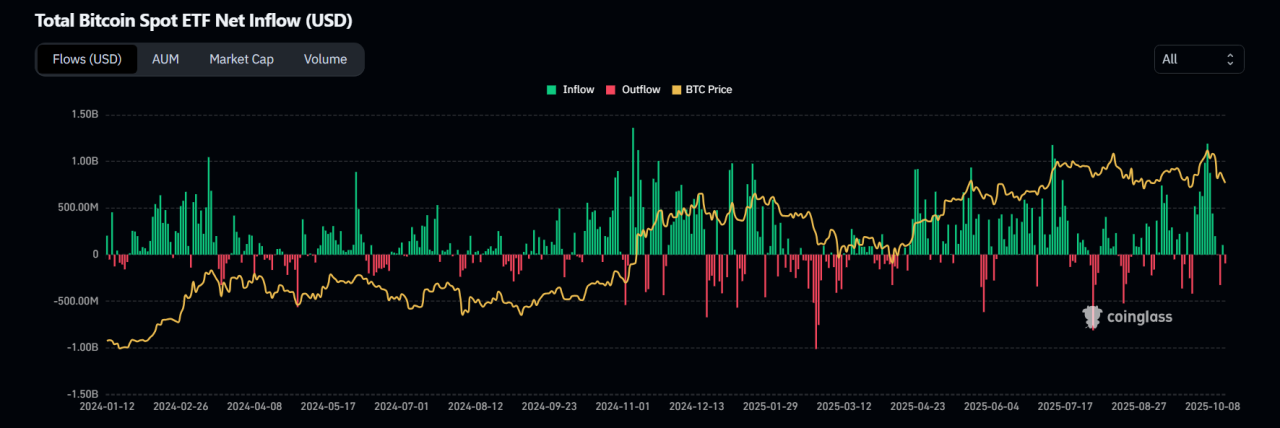

Since U.S. spot Bitcoin ETFs launched, investors have poured tens of billions of dollars into these funds. Some days have seen more than $100 million in net inflows. This steady stream of institutional money has shifted how Bitcoin behaves in the market.

Price discovery now often happens during U.S. trading hours when ETF activity is highest. As a result, Bitcoin’s short-term movements are increasingly influenced by fund flows and investor sentiment rather than only on-chain demand.

RECOMMENDED: Will Bitcoin Ever Hit $1 Million?

ETF Flows, Fund Mechanics, And Custody Concentration

Bitcoin spot ETFs work through a system where authorized participants create or redeem ETF shares based on investor demand. These transactions involve large amounts of Bitcoin held by custodians such as Coinbase and traded across multiple exchanges.

When inflows rise sharply, authorized participants must buy more Bitcoin, adding liquidity pressure to the market. Top ETFs, like those run by BlackRock and Fidelity, now hold billions in assets, giving them a major role in Bitcoin’s liquidity and short-term price stability.

In effect, ETF plumbing and custody control have become part of Bitcoin’s supply story.

RECOMMENDED: Top 3 Cryptos for ETF Gains: BTC, SOL, BNB

How ETFs Are Changing Bitcoin’s Market Behavior

ETF trading has brought Bitcoin closer to traditional markets. Weekly ETF inflows of over $5 billion have lined up with price rallies, showing that institutional money now moves prices faster and more visibly.

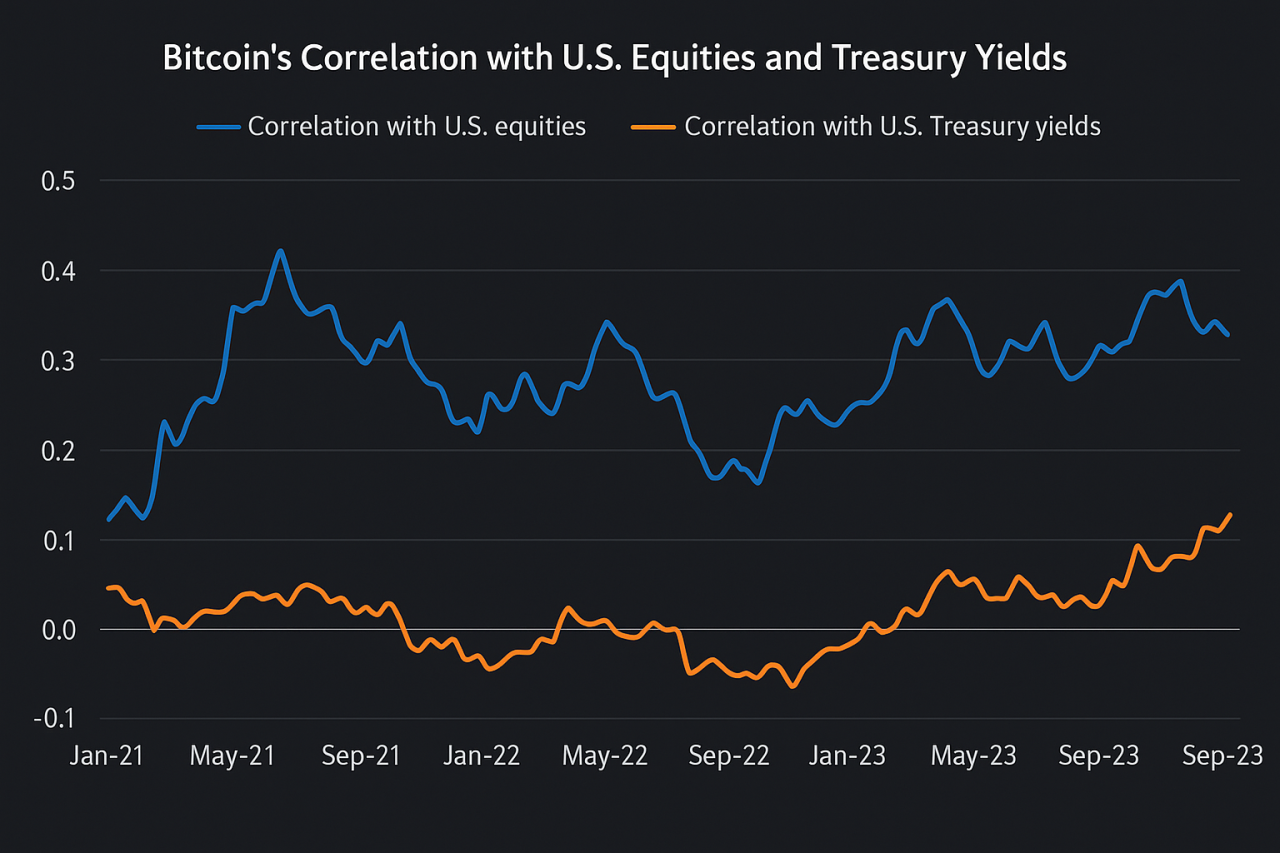

Bitcoin’s correlation with U.S. equities and Treasury yields has also grown, meaning it reacts more to changes in rates and risk appetite.

When ETF outflows occur, on-chain data shows lower exchange reserves and sharper price drops. This link between ETF flows and volatility marks a major change in how the Bitcoin market behaves day to day.

RECOMMENDED: Bitcoin (BTC) Fed-Cut Odds Collide with Spot-ETF Flows

Conclusion

Spot ETFs have turned Bitcoin into a market that reacts not only to blockchain activity but also to institutional fund flows and broader economic signals. Understanding ETF flows, fund activity, and macro trends is now essential for reading Bitcoin’s next move.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- From Failed Breakout to Consolidation: How to Think About Yesterday’s Flash Crash (Oct 12th)

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)