Coinbase CEO rejected parts of the Senate’s draft and lawmakers hit pause on the vote, creating fresh uncertainty in Washington.

Bitcoin slipped about 1% and traders reacted quickly as they weighed what new rules could mean for crypto products.

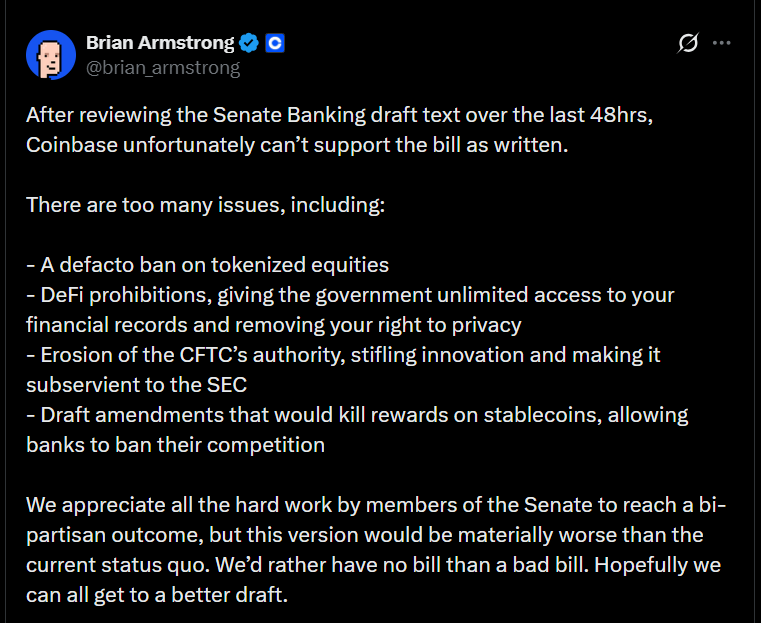

On Jan 15, Coinbase CEO Brian Armstrong said the exchange “cannot support” the Senate’s latest crypto bill in its current form, forcing the Senate Banking Committee to postpone its planned markup hours later.

Roughly 130 amendments now sit on the table, with the biggest fights focused on stablecoin rewards, tokenized stocks, and whether the SEC or CFTC should lead regulation.

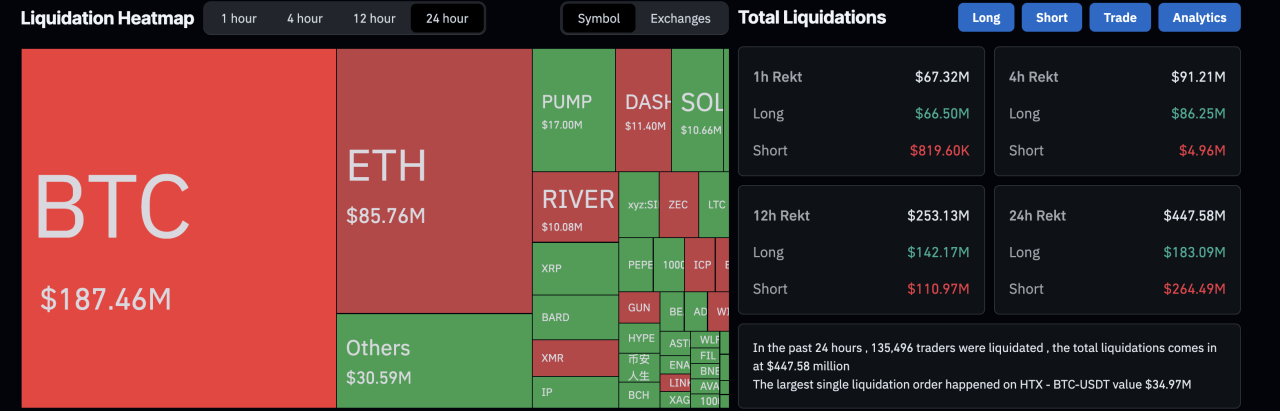

After the news, Bitcoin dropped about 1%, major altcoins fell around 2%, and about $66M in positions were liquidated during a short squeeze.

RELATED: Bitcoin Surpasses $95K After U.S. Senate Introduces Crypto Market Bill

Why Coinbase Objected

Armstrong focused on language that could restrict staking-like rewards and blur the legal status of tokenized equities.

Coinbase argues these products are central to how modern crypto markets work.

The company signaled it could support the bill if lawmakers soften or remove those sections.

What’s Happening In The Senate

With more than a hundred amendments in play, negotiations reopened between both parties.

Senate Banking leaders said the delay is meant to reach bipartisan agreement, but the volume and technical nature of the changes make a quick deal unlikely.

RECOMMENDED: Bitcoin Trading In A Danger Zone – Will Trump’s Credit Card Policy Help?

How The Market Reacted

Prices dipped across the crypto market reflected rising uncertainty: BTC fell about 1%, top altcoins dropped roughly 2%, and about $66M in leveraged trades were wiped out.

Institutions are watching closely because any change to custody or stablecoin rules could affect ETF inflows and how exchanges design products.

YOU MIGHT LIKE: Coinbase Enters S&P 500 – Is This Wall Street’s Crypto Turning Point?

Conclusion

Three things now matter most: updated bill language on stablecoin rewards, a new markup date from the committee, and how prices react to each update. These will decide whether this pause becomes a brief delay or a longer legislative stall.

Before you invest, In the next few days we will reveal our top crypto coins with explosive potential in 2026 to Investing Haven’s premium crypto alert members.