Hitting $1M with Bitcoin in a decade requires realistic return assumptions, strategic contributions, and disciplined execution of your investment plan.

Reaching $1M with Bitcoin in 10 years is possible, but it demands more than luck. You need a defined Bitcoin investment strategy, clear contribution targets, and an understanding of potential returns.

This article maps out scenarios, real-world examples, and tools to help you design an investment plan capable of hitting that milestone.

Continue reading to learn how to make $1 million with Bitcoin.

Can You Make $1M with Bitcoin?

Yes, but only if you combine significant contributions with exceptional returns. Turning a $10,000 lump sum into $1,000,000 in ten years requires about a 58.5% annual return.

For instance, Nasdaq’s recent model notes a $10,000 stake more plausibly becomes roughly $100,000 over ten years, not $1,000,000.

This means that you’ll need extraordinary price upside or large additional capital. Now, since you might not have a substantial lump sum amount to invest, we recommend using a strategy called dollar-cost averaging.

RECOMMENDED: Can You Create Wealth From Bitcoin?

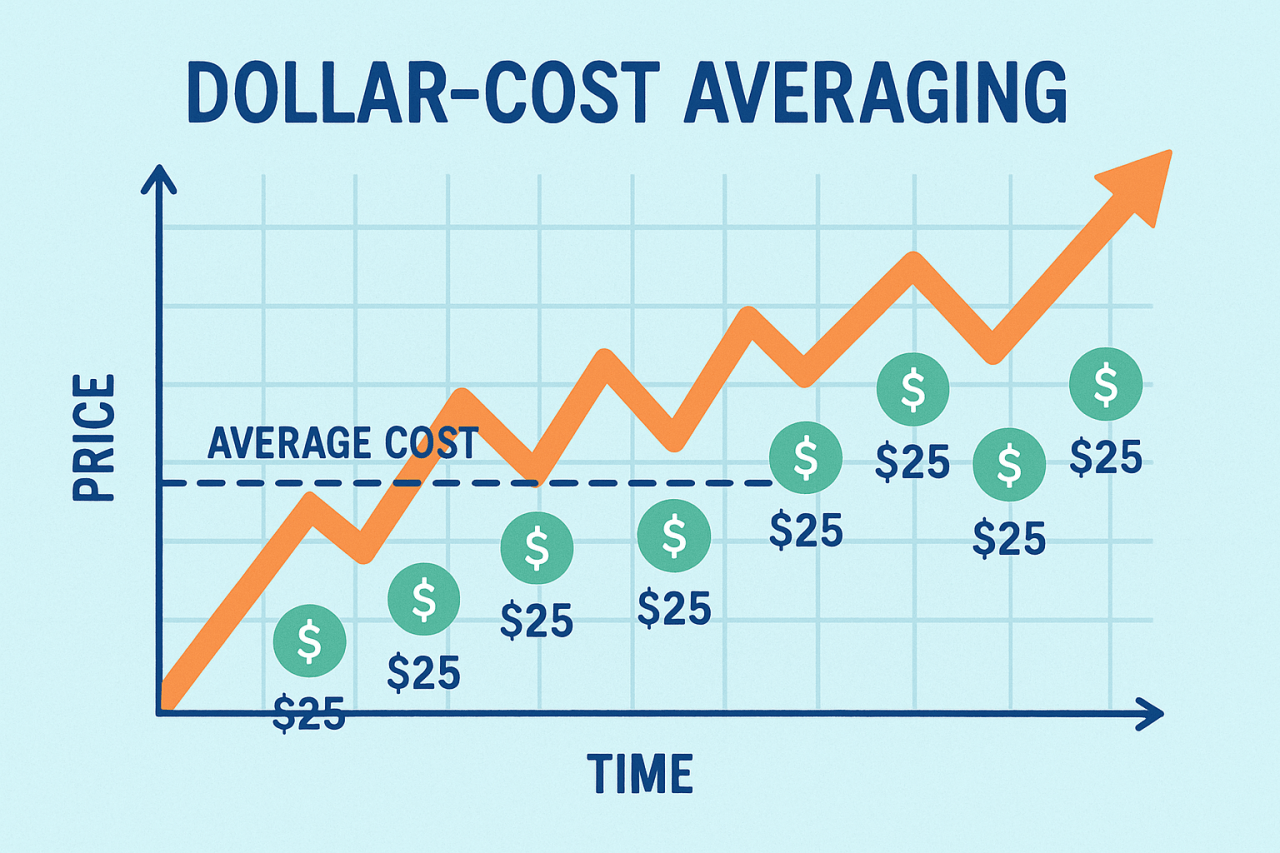

What Is Dollar-Cost Averaging?

Dollar cost averaging means investing a fixed dollar amount at regular intervals regardless of price. You buy more units when prices fall and fewer when prices rise, which lowers your average cost per unit over time.

Financial educators recommend DCA because it removes market timing and emotional trading from repeated purchases.

Advisors also warn that DCA can reduce upside versus a lump sum when markets trend steadily upward, and frequent small buys can incur cumulative fees, so factor fees into any DCA schedule.

Can DCA Help You Make $1M with Bitcoin?

Practical evidence shows disciplined DCA can accumulate meaningful Bitcoin positions. For instance, one investor going by “Rego”, bought roughly $30 of Bitcoin daily for seven years and ten months and amassed more than $1 million.

That steady habit produced larger gains than sporadic timing for the same capital. However, a practical DCA plan must include regular sizable deposits, realistic return assumptions, and planned partial exits.

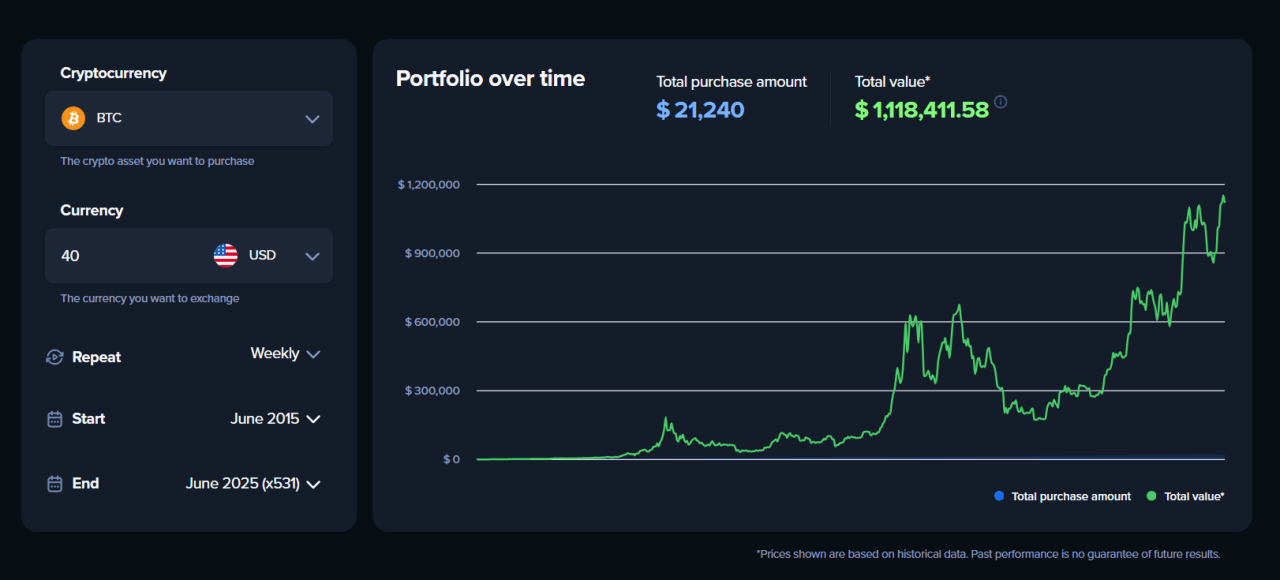

You can use public DCA calculators which let you simulate monthly or weekly buys, project outcomes under different growth rates, and estimate how much you must contribute to aim for $1M.

The DCA calculator below shows how much you’d have made if you invested $30 weekly between June 2015 and June 2025.

RECOMMENDED: Bitcoin Price Predictions 2025-2030

How Much to Invest via DCA to Hit $1M

Achieving $1M in ten years using dollar-cost averaging demands strong returns or significant capital – and ideally both.

Nasdaq analysts point out that investing $1,000 per month may become untenable unless Bitcoin’s price moves steeply upward, given constraints on many investors’ budgets.

A $10,000 lump-sum investment could approach $1M if Bitcoin delivers very high gains, but under more likely return rates, you will need to add more capital via disciplined, scheduled contributions.

Let’s look at an example:

| Contribution | Annual Return | Estimated 10-Year Value |

| $200/week ($10.4k/year) | 40% | ~$726k |

| $200/week | 50% | ~$1.18M |

The example above uses a standard formula for repeated investments with compound returns:

Future Value (FV) = Payment × \((1 + r)^n – 1\) ÷ r—where:

- Payment = $10,400/year

- r = 40% annual return (0.40)

- n = 10 years

Realistically, sustaining 40–50% annualized returns over a decade is rare, but occasionally observed performance in strong Bitcoin bull markets. So, to make $1M in a decade, you either have to increase your weekly allocations or hope for higher annual returns.

RECOMMENDED: Prediction: 12 Months From Now Bitcoin Will Be Worth?

Risks & Considerations

Bitcoin remains highly volatile and speculative. It responds sharply to regulatory changes, shifting macro sentiment, and evolving technology.

While DCA reduces the stress of timing the market, it does not eliminate the risk of losses or guarantee gains. So, always invest only what you can afford to lose.

Also, maintain diversification. Bitcoin should not represent your sole investment, even when pursuing ambitious goals such as $1M in ten years.

Conclusion

Dollar-cost averaging gives you a structured way to pursue a $1M Bitcoin target in ten years, provided you commit to consistent contributions and hope for strong returns. Set up automatic contributions, use modelling tools to monitor progress, and adjust your plan as market conditions evolve.

Don’t Miss the Next Big Move

Join the original blockchain-investing research service live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)