Bitcoin trades at a low $107k as ETF outflows and labor data shape the week. Watch weekly closes around 110K and 114K.

Bitcoin is now trading in the low $107,000 to $109,000 range after a pullback from mid-August highs, setting a tight band for the week ahead. ETF flow dynamics and Friday’s U.S. nonfarm payrolls will likely decide whether this range resolves higher or lower.

RELATED: Why Bitcoin Is Down And Whether It’s A Smart Buy

ETF Flows And Rotation

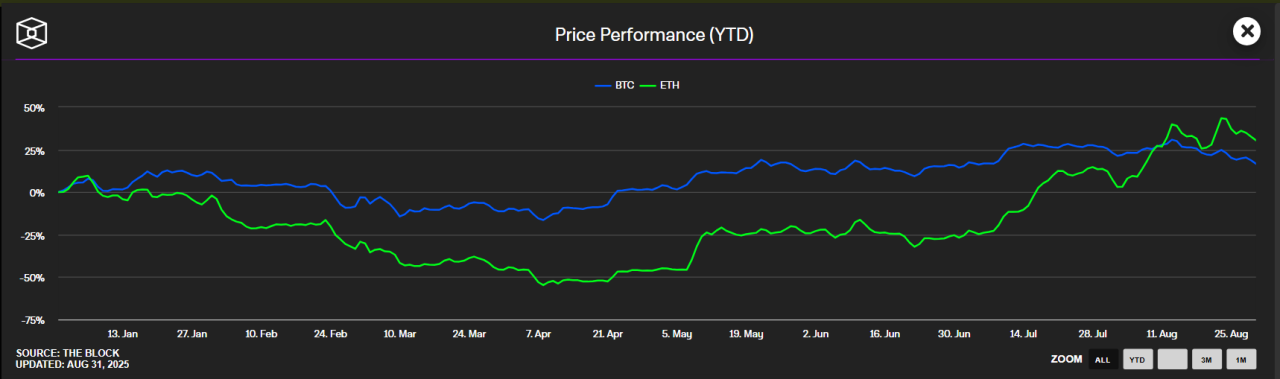

August saw a notable shift in institutional flows, with Bitcoin spot funds recording large net outflows while Ethereum funds drew material inflows.

One data provider tallied roughly $600M plus in Bitcoin ETF outflows for the month, while Ethereum ETFs were on track for several billion in inflows, and ETH has outperformed BTC over the last 30 days.

If outflows persist, the mechanical effect reduces bid support at current levels and increases the chance of a deeper test of key supports.

YOU MAY LIKE: Bitcoin $200K in 2025? Scaramucci Reaffirms Bold Price Forecast

Technical Map: The $107K–$110K Pivot

Price action compresses between roughly $107,000 and $110,000, a zone multiple technicians call decisive for the next leg.

A sustained weekly close above $110,000 would lower immediate downside risk, while a clear break below $107,000 would expose targets near $100K-$103K on several watched models.

Watch volume on any breakout, and treat weekly closes as higher conviction signals.

RECOMMENDED: Want to Make $1M with Bitcoin? Here’s How in 10 Years

Macro Catalyst: Friday NFP Scenarios

The August nonfarm payrolls release occurs Friday, Sep 5, 2025 at 08:30 ET, with consensus around roughly 74K jobs. A hotter print would likely lift the dollar and U.S. yields and increase selling pressure on risk assets, including BTC.

A softer print would push markets toward easier rate expectations and could spark a relief rally that tests the $114,000 area.

Conclusion

This week is about flows, the 107K–110K technical fulcrum, and the NFP print, not new on-chain fundamentals. Monitor weekly ETF net flows, where weekly closes fall relative to 110K and 114K, Bitcoin price predictions, and the NFP headline and wage detail on Friday.

Don’t Miss the Next Big Move

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)