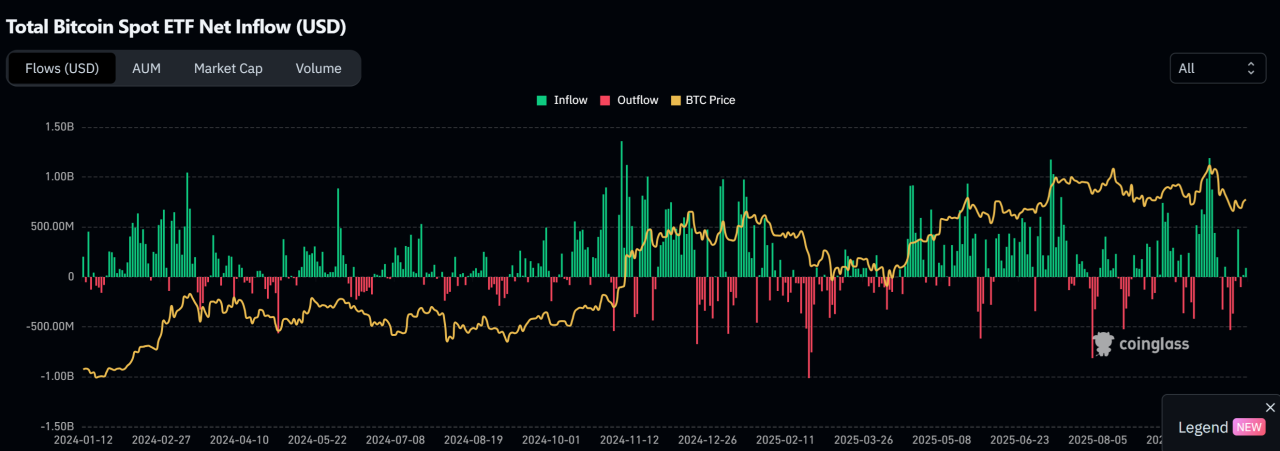

Bitcoin’s daily chart shows short-term strength with $446.6M in ETF inflows last week. The next few days will show whether this momentum can continue or fade under macro pressure.

Bitcoin starts the week at an important turning point. Technical charts show improving momentum, and institutional investors added $446.6M through spot ETFs last week. At the same time, on-chain activity looks stable but not explosive.

This mix leaves Bitcoin balanced between a possible breakout and a short-term pullback, depending on how trading volume and macro trends evolve in the coming days.

RECOMMENDED: Why Bitcoin Will Close 2025 Under $125K According To Crypto Investment CEO

MACD, BTC Moving Averages, And Volume

The daily MACD has turned positive, signaling a possible short-term rally, while the weekly chart is still waiting for full confirmation. Bitcoin is trading just above key moving averages, which have acted as strong support in recent weeks.

If price holds above $113,000 and the MACD continues to strengthen, momentum could extend higher.

However, if trading volume stays weak and the price slips under $100,000, it may trigger a deeper correction. RSI remains neutral, suggesting the next strong move will depend on whether volume rises or fades.

RECOMMENDED: 10 Giant Companies That Hold the Most Bitcoin You’ll Be Surprised Who’s on Top

Institutional Flows And On-Chain Trends

ETF data shows steady institutional interest. Last week’s $446.6M inflow marks another week of positive sentiment, led by large funds such as BlackRock’s IBIT.

On-chain activity, including active addresses and transfer volumes, remains consistent but not yet signaling a major wave of new demand.

If Bitcoin ETF inflows continue at this pace, the coin could regain upside momentum. But if flows slow or turn negative, short-term selling pressure could increase.

RECOMMENDED: The ETFization Of Bitcoin: How Flows Reshape Macro Sensitivity

Fed Policy, Real Yields, And The Dollar

The macro backdrop remains critical. Any hawkish comments from the Federal Reserve or stronger U.S. dollar could weigh on Bitcoin. Conversely, signs of easing policy or softer inflation data could lift market sentiment.

If you are trading, watch Fed speeches and inflation figures closely this week.

Conclusion

Bitcoin’s next move depends on three key factors: the weekly MACD close, the direction of ETF flows, and upcoming Fed and dollar signals.

A confirmed MACD uptrend with steady inflows could push prices above $114,000, while weaker momentum and falling flows may send it back toward $100,000.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- The Ongoing Test Of Bitcoin’s 200 dma Will Be Decisive For The Outcome In Crypto Markets (Oct 20th)

- From Failed Breakout to Consolidation: How to Think About Yesterday’s Flash Crash (Oct 12th)

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)