Bitcoin’s price hovers between $105K–$106K, with a breakout or breakdown likely to set its next major move. Traders should watch technical levels, ETF flows, and macro signals this week.

Bitcoin remains tightly boxed between $105K–$106K as it stabilizes after May’s surge to a record $111,970 on May 22. This week is pivotal: a clear breakout above the $106K–$107K zone would likely resume the uptrend, while a drop below $105K could signal a pullback toward the $100K region.

Technical Setup: Tight Range & Key Levels

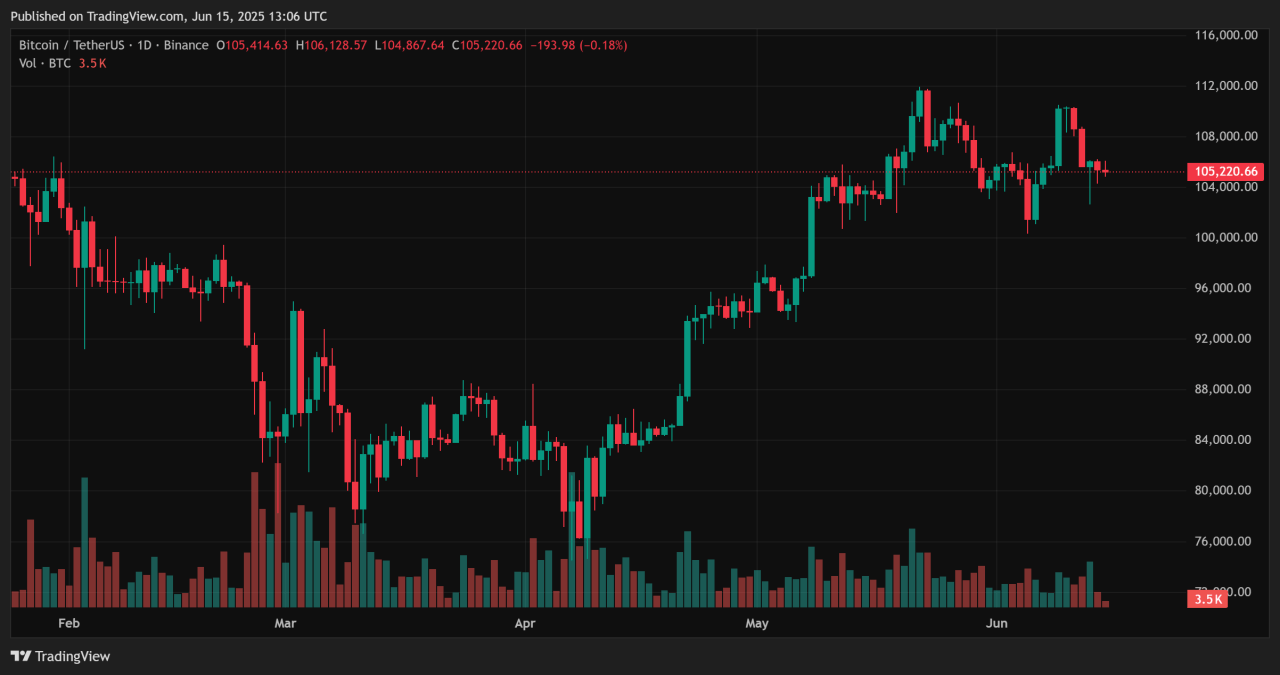

BTC has been trading in a narrow channel between ~$104.2K and $106.3K over the last week, repeatedly bouncing off the $105K mark.

Chart patterns show a symmetrical triangle/converging triangle forming at this level—classic consolidation that often precedes a breakout.

RSI sits midrange (~50–60), indicating neither overbought nor oversold conditions while the MACD shows mixed signals—bearish crossover on lower timeframes—but longer timeframe momentum remains intact.

A key technical trigger: $15 billion in short-side liquidations may ignite a squeeze above $105K. Support lies at $104.2K, with upside resistance at $106.5–$107K.

Fundamentals & Institutional Drivers

ETF flows remain a core driver: after a $267M outflow on June 2, inflows rebounded—cumulative ETF assets now exceed $132B .

Institutional interest is also growing: MicroStrategy continues buying, Bitwise highlights younger investors embracing “wholecoin” status, and on‑chain data points to whale accumulation .

Macro catalysts include softer U.S. inflation, a weakening dollar, and dovish Fed hopes—driving broader asset synergy as BTC, gold, and equities chase record highs .

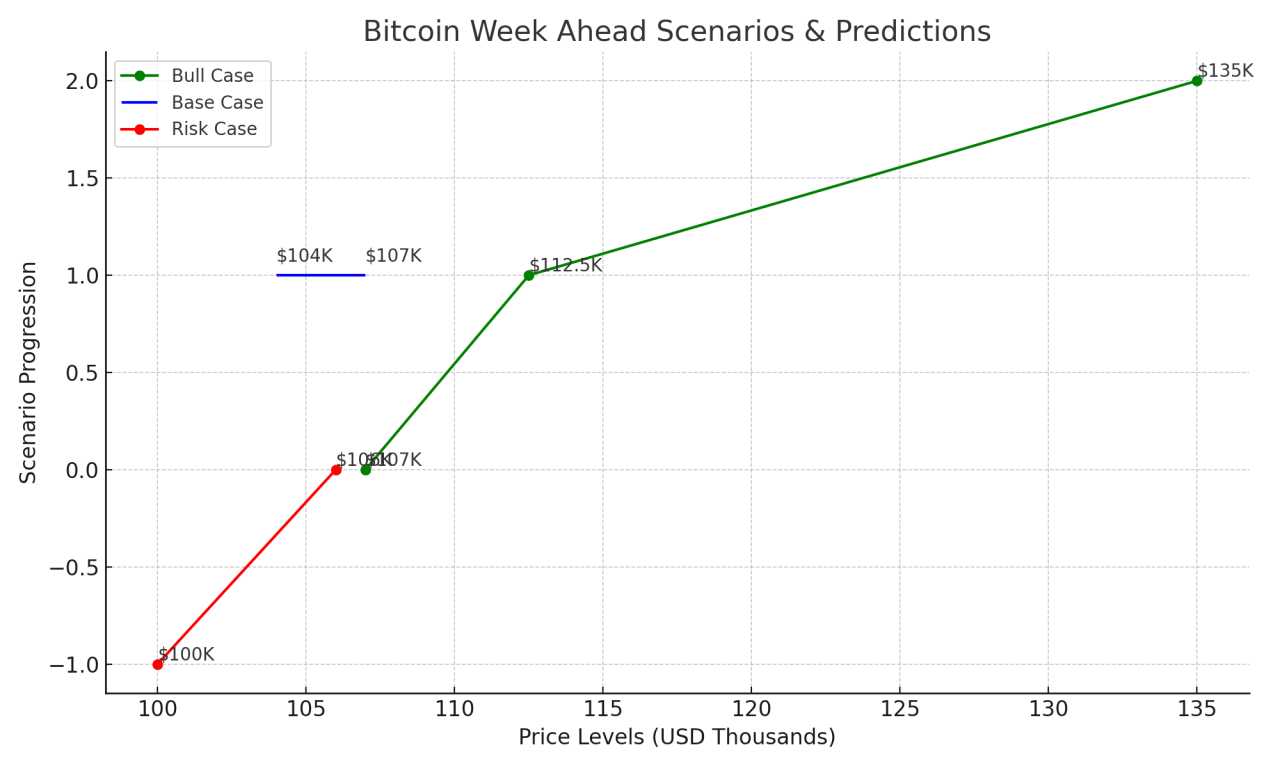

Scenarios & Predictions

- Bull case: Breakout above $106K–$107K ignites a surge toward $110K–$115K, possibly reaching up to $120K–$150K if ETF inflows and macro tailwinds persist .

- Base case: Sideways action in the $104K–$107K range continues as the market digests flows and macro data.

- Risk case: Rejection at $106K sees BTC fall back to $102K–$100K, testing psychological support and 100‑EMA confluence.

Conclusion

This week hinges on holding above $105K and clearing $106K–$107K. Traders should monitor volume on breakouts, track ETF flow updates, and watch macro signals like U.S. inflation and Fed commentary. A breakout could unlock fresh highs; a breakdown could open the door to deeper corrections.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)

- Is A Massive Breakout Coming? (May 17th)

- Top Altcoin Picks in the Strongest Emerging Narrative (May 9th)