January’s big options expiry cleared risk but left tight price clusters behind.

This week will show whether those clusters pin Bitcoin or spark a fresh volatility burst.

Bitcoin is trading around 92981.4 and enters the week in a cleaner but more technical setup.

Roughly $2.2–$2.8B in options rolled off the books, yet traders quickly rebuilt positions.

Large strike levels still sit between $90,000 and $100,000, while estimates of “max pain” sit about $90,000–$92,000.

That map of strikes will shape how dealers trade, how much liquidity appears, and how sharp any move becomes.

ALSO READ: Bitcoin ETFs See $754M In One Day – Is BTC Bull Run Next?

Where Positions Sit Right Now

After expiry, options activity bounced back fast.

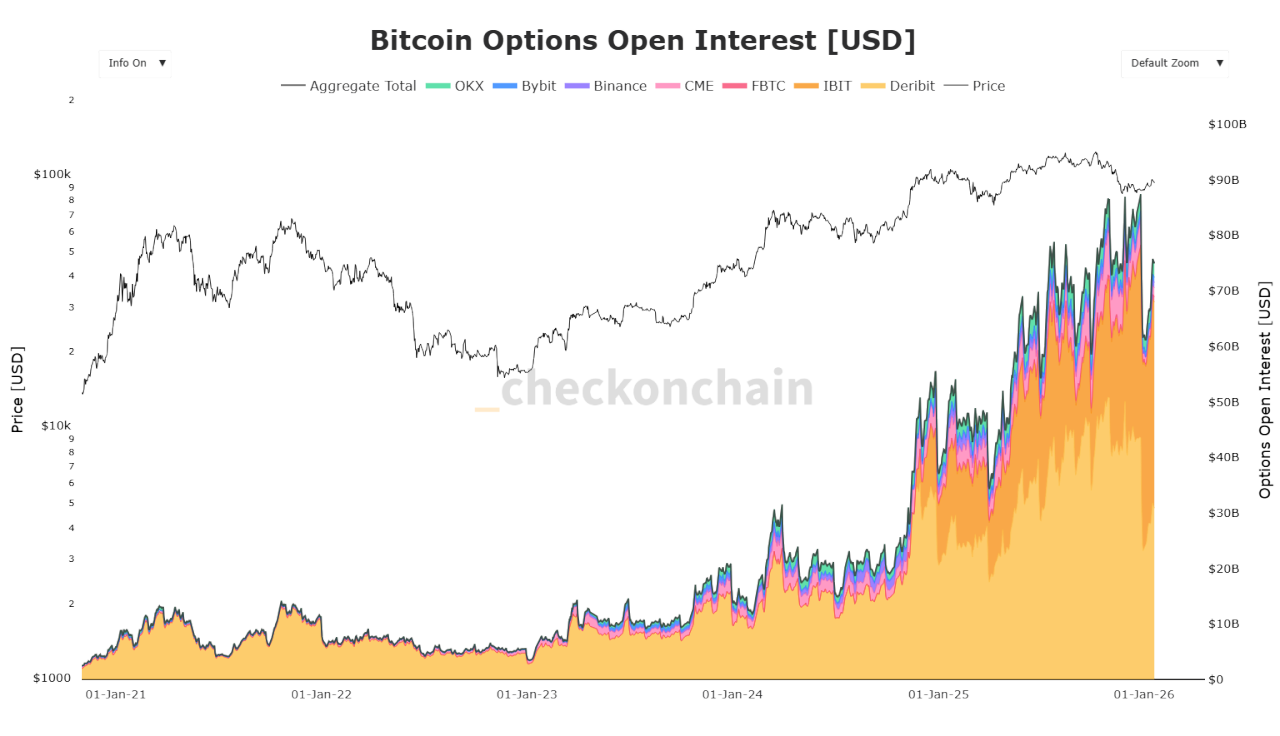

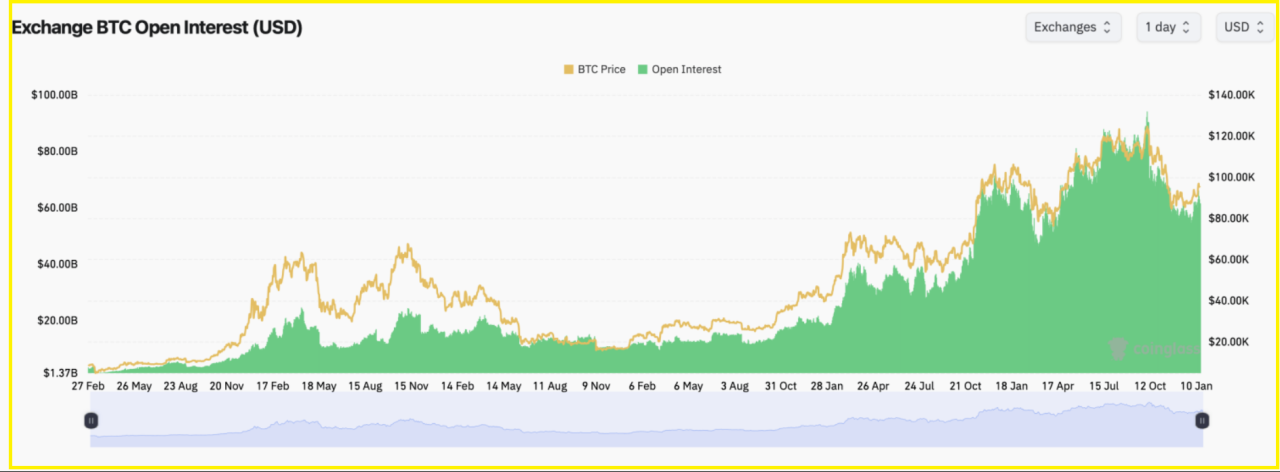

Across major exchanges, options open interest sits about $74B, compared with about $65B in futures.

That shift puts more influence in options markets.

A strike “heatmap” shows the heaviest bets clustered between $90k and $100k, which explains why price keeps testing but stalling in that zone.

Dealers who sold calls there must hedge by selling as price rises, which creates short-term resistance.

At the same time, large puts below the market offer a soft floor on dips.

The balance between puts and calls and where they expire will decide which side has more pull.

RECOMMENDED: Has Bitcoin Hit A Market Bottom? Analysts Weigh In After Recent Downturn

How Dealer Hedging Can Change The Game

Dealers hedge their risk by trading spot and futures.

When Bitcoin moves slowly inside the strike band, hedging flows usually cancel out and calm realized volatility.

But if price pushes quickly toward a crowded strike, dealers must adjust fast.

In thin trading hours, those adjustments can add fuel to the move.

Funding rates and the perpetual premium act like an early warning system: sudden spikes often come just before implied volatility jumps.

YOU MIGHT LIKE: Did The U.S Steal $15B Bitcoin From A Chinese Scam King? Here Is The Truth

What Matters Most This Week

The market will reveal its hand around three points: reactions at $90k and $100k, shifts in funding rates, and any big changes in open interest or exchange flows before the next Jan-30 tranche.

A clean break through the strike wall with rising funding would likely bring back sharp swings.

Staying inside the band with steady funding would keep things quieter.

Conclusion

This week is a tug-of-war between calm and chaos.

Strike clusters, funding, and flows will show whether Bitcoin stays pinned or breaks free.

Before you invest in Bitcoin, in the next few days we will publish our next members exclusive premium crypto alerts, we will reveal key crypto assets to consider for 2026 with explosive potential.