Bitcoin can sometimes act like a safe-haven asset, but not always. Knowing when it does can help you make smarter portfolio moves.

We love referring to Bitcoin as “digital gold.” While it makes sense, sometimes this definition is more complicated. I’ve followed how Bitcoin moves through market cycles, and what I’ve seen is that its “safe-haven” status depends entirely on what’s happening in global markets.

Sometimes Bitcoin acts like gold when investors are running from the dollar, but other times, it behaves like a high-risk tech stock.

Understanding those shifts is key if you want to use it wisely.

ALSO READ: Why Do USD Moves Now Drive Both Gold And Crypto?

Bitcoin As A Digital Gold: Historical Patterns And What The Data Shows

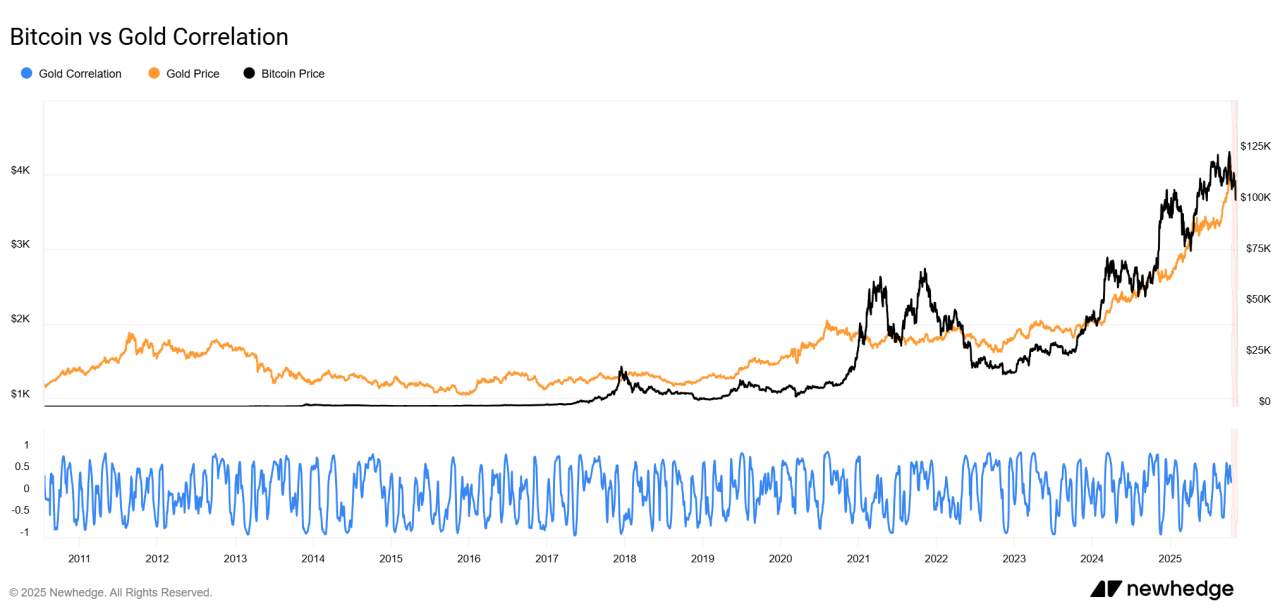

Let’s look at the data. Over the past three years, the rolling 60–90 day correlation between Bitcoin and gold has swung from -0.3 to +0.7. That means they sometimes move in opposite directions, and other times almost in sync.

For example, in late 2022, both climbed together as inflation fears spiked. But in 2025, Bitcoin broke away, rallying while gold stayed flat.

This means Bitcoin doesn’t have a fixed identity. It switches roles depending on what the market cares about most; liquidity, inflation, or speculation.

RECOMMENDED: Bitcoin’s New Place In The Global Financial System

When Bitcoin Acts Like Digital Gold

Bitcoin starts behaving like gold when confidence in fiat money drops or when big players look for alternatives to the dollar. A good example came in October 2025, when crypto ETFs saw strong inflows and Bitcoin rose along with gold.

That was a clear signal of investors hedging against potential currency debasement. Always watch for these clues: rising ETF inflows, exchange outflows (meaning investors are holding long term), and higher demand for downside protection. When these line up, Bitcoin tends to behave like a true store of value.

RECOMMENDED: The ETFization Of Bitcoin: How Flows Reshape Macro Sensitivity

When Bitcoin Fails As A Safe Haven

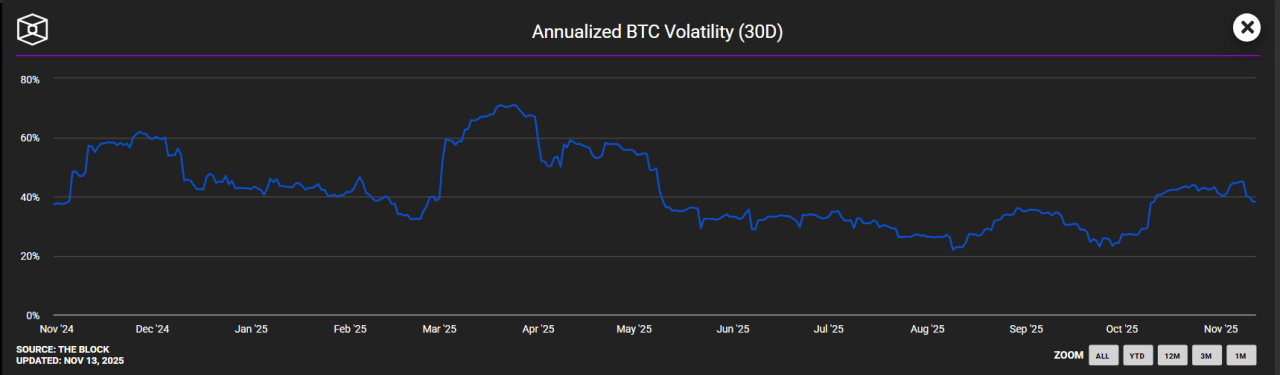

On the flip side, when markets panic and liquidity dries up, Bitcoin usually drops with stocks. During heavy selloffs, it’s often the first thing traders sell to raise cash. The data backs this up; recent realized volatility for Bitcoin sits around 45–50%, compared to gold’s steady 12–16%.

That difference explains why gold steadies nerves while Bitcoin tests them. Bitcoin is more of a high-beta hedge, not a full replacement for gold.

YOU MIGHT LIKE: 10 Giant Companies That Hold the Most Bitcoin

Conclusion

Bitcoin can act like digital gold, but only part of the time. The rest of the time, it’s still a volatile risk asset. If you want to treat it as a hedge, do it smartly: track its correlation with equities, watch ETF and on-chain flows, and size your position with care.

That’s how you use Bitcoin’s upside without letting its volatility control your portfolio.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.