Bitcoin’s institutional adoption, built-in scarcity, and evolving utility position it as a resilient, long-term investment asset with asymmetric upside.

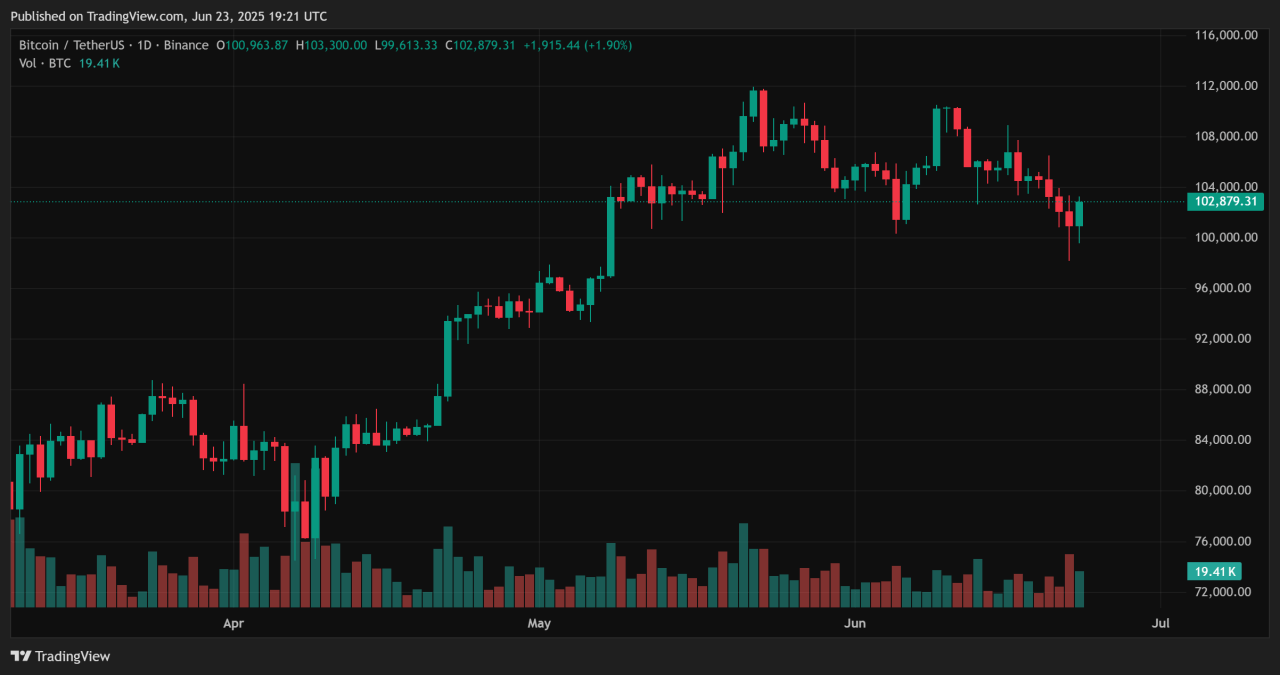

As of late June 2025, Bitcoin is trading near $112,000, with spot ETFs holding ~1.22 million BTC (~6.1% of total supply, valued around $121 billion).

Faced with this rapid institutional uptake, long-term investors are now wondering whether Bitcoin is just a speculative asset, or if it offers robust structural value that can sustain growth over years.

You may also like to read: Why Gold Makes Sense For Long Term Investors

1. Institutional & Sovereign Involvement

Spot ETFs now control over 6% of Bitcoin’s total supply, signaling major institutional commitment. Corporate treasuries hold ~746,000 BTC as of April 2025—up 167% YoY. Add the U.S. Strategic Bitcoin Reserve (200,000 BTC) and multiple sovereign holdings, and Bitcoin’s role shifts from fringe to strategic, anchored by large-scale, long-term holders.

2. Built-In Scarcity

Bitcoin’s 4-year halving cycle reduced supply issuance from ~900 to ~450 BTC/day in April 2024, cutting annual inflation to ~0.85%. Historically, these events have triggered massive 12–18 month rallies—averaging ~17× gains after prior halvings. Even in this mature cycle, Bitcoin has surged ~70% YoY post-2024. That built-in scarcity supports a long-term upward trajectory.

3. Macro Hedge & Diversification Appeal

Bitcoin is increasingly recognized as “digital gold”: post-halving inflation outpaces gold’s, and its macro role grows amid global uncertainty. Its changing correlation patterns—with rising but stabilizing links to equities—signal that Bitcoin has evolved into a portfolio-diversifying asset.

You may also like to read: $10,000 Invested in Bitcoin 10 Years Ago is Now Worth?

4. Network Strength & Ecosystem Evolution

With exchange-held BTC down below 11%, most coins are being HODLed offline, tightening available supply and intensifying scarcity-driven price gains. Meanwhile, infrastructure advancements—Lightning Network, tokenization, smart contracts—broaden Bitcoin’s practical use beyond store-of-value.

Conclusion

Bitcoin’s institutional and sovereign uptake, programmed scarcity, portfolio hedge benefits, and underlying ecosystem evolution together form a compelling, multi-decade investment thesis. For investors with a 5–10 year horizon, Bitcoin isn’t merely speculative—it’s an emergent strategic asset class built to last.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)