CoinGecko is considering a sale that could value the crypto data firm at $500M, showing strong demand for trusted market data.

CoinGecko has taken a serious step toward a possible sale after bringing in an investment adviser to explore buyer interest.

With millions of monthly users and widely used price-tracking tools, the platform sits at the center of how traders, investors, and companies follow the crypto market.

ALSO READ: Eric Adams’ NYC Token Crashes 80% Minutes After Launch – What Happened?

Sale Talks And Valuation Details

Reports indicate CoinGecko has begun a formal process to assess buyer interest, with a target valuation of $500M.

The company has not confirmed a final price or timeline, and no buyer has been named.

These early-stage talks often involve gauging demand rather than committing to a sale.

That flexibility allows CoinGecko to walk away if offers fall short of expectations.

RECOMMENDED: Monero Is The Top Privacy Coin After Surging 50% – Should You Buy Now?

Why Buyers Would Pay Up

Crypto data companies play a critical role in the market.

Exchanges, wallets, traders, and institutions rely on accurate pricing, volume data, and token metrics.

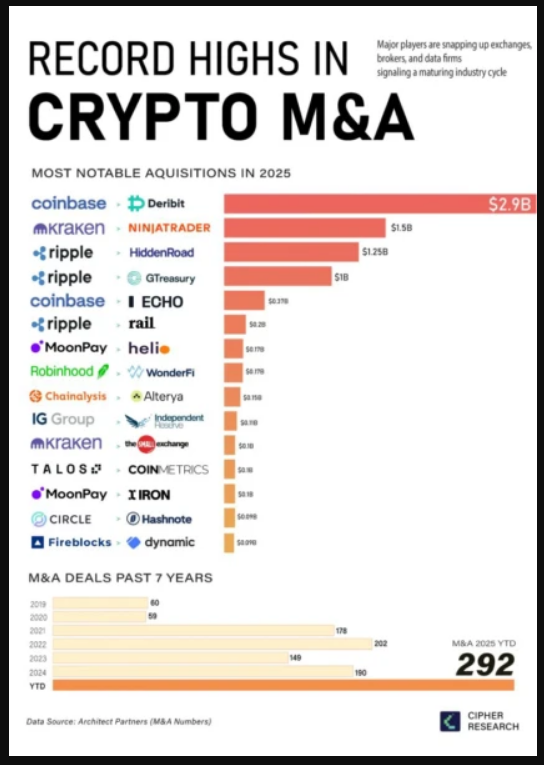

In 2025, crypto M&A activity totaled about $8.6B, a sign of strong interest in platforms that support trading and research.

A well-known example is CoinMarketCap, which was acquired for about $400M in 2020.

That deal set a clear benchmark for how much strategic buyers are willing to pay for traffic, brand trust, and reliable data feeds.

RECOMMENDED: Is India Turning Crypto Onboarding Into a Surveillance Game? What We Know

What Could Complicate The Deal

Several factors could still affect the outcome.

Valuation expectations may change, potential buyers could face regulatory limits, and competition from other data providers remains strong.

Because talks are ongoing, CoinGecko may also decide to stay independent if offers do not match its long-term goals.

Conclusion

If completed, a CoinGecko sale would stand out as one of the largest crypto data deals in years and could shift who controls key market information used across the industry.