A surge in crypto IPOs is renewing market confidence. Key players like Circle and Bullish are redefining public sentiment in 2025.

The current crypto summer IPO boom is more than a seasonal uptick. It’s a tangible shift, marked by real capital movement and market traction.

With major crypto firms going public, they’re reshaping how investors perceive value in the digital asset space. This resurgence signals that crypto is entering a more mature financial phase.

IPO Wave Fuels Market Momentum

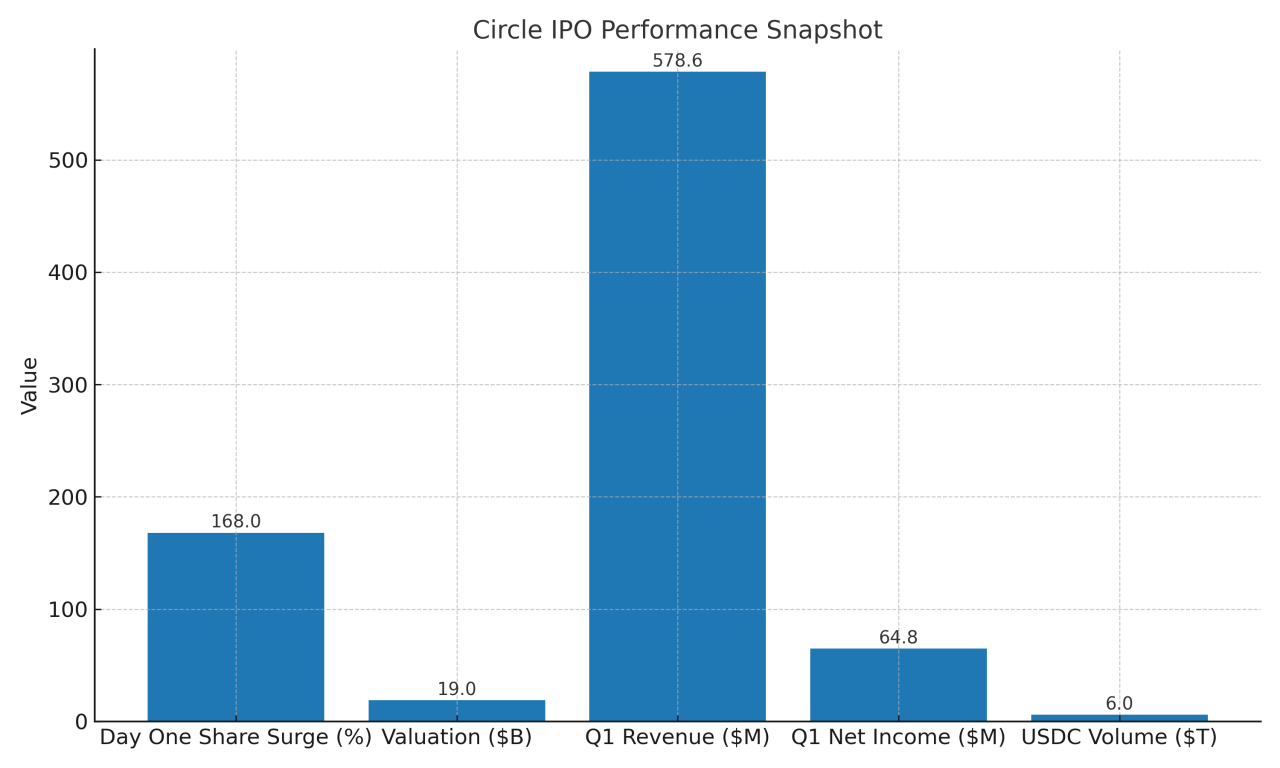

Circle’s IPO performance shocked Wall Street. Shares surged nearly 168 percent on day one, pushing the company’s valuation to almost 19 billion dollars. In Q1, Circle reported 578.6 million dollars in revenue and 64.8 million in net income.

Its stablecoin, USDC, processed over 6 trillion dollars in volume.

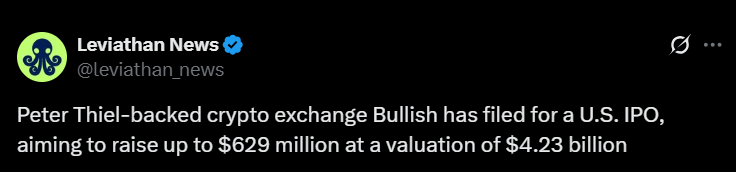

Meanwhile, Bullish crypto exchange IPO plans are drawing attention. The company aims to raise $629 million dollars at a $4.2 billion valuation.

Trading volume rose 78 percent in the first quarter. Backers include BlackRock, Ark Invest, JPMorgan, and Citi. Gemini, Grayscale, and BitGo have also filed to go public, widening the trend.

ALSO READ: Top 3 Altcoins Leading Asia-Pacific DeFi Growth in August 2025

Macro Forces and Institutional Appetite

The crypto market momentum in 2025 is tied to rising asset prices, public listings, and policy clarity. Bitcoin recently traded above 120,000 dollars while Ethereum follows with consistent inflows.

The GENIUS Act, passed earlier this year, provides clearer rules for digital assets. These changes attract institutional investors who now favor infrastructure-focused platforms.

Compliance-first companies with predictable revenue are getting attention. This shift supports the view that crypto firms can scale within mainstream capital markets.

Institutional investment in crypto is no longer experimental. It aligns with a broader move toward regulated, revenue-generating crypto businesses.

ALSO READ: Best Place to Buy Ripple (XRP) In Dubai

Conclusion

The regulatory support for crypto IPOs and sharp investor interest in firms like Circle and Bullish signal a meaningful market evolution.

What we’re seeing is not hype but a shift in how crypto competes for capital. Public markets are no longer a frontier. They’re becoming a proving ground for blockchain’s most credible companies.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)