DOGE trades about $0.210, testing $0.22 resistance. Funding, open interest, and whale flows will likely shape the next move.

Dogecoin trades around $0.210 after intraday swings between $0.21 and $0.22. The 200-day exponential moving average sits at roughly $0.211 and acts as the main trend pivot. Traders will watch whether bulls can convert $0.225 into support or sellers push the price back to $0.20.

Let’s look at a quick Dogecoin price prediction to understand which way the price might move.

ALSO READ: Is It Worth Buying Dogecoin in 2025?

Price Snapshot And Key Levels

Dogecoin current price is around $0.210, with intraday highs around $0.22 and lows around $0.20 based on exchange price feeds. Immediate resistance lies in the $0.22 to $0.225 band. A decisive daily close above $0.225 with rising spot volume will open a technical path to $0.25 then $0.30.

The 200-day EMA, at about $0.210, defines the bull or bear pivot, and a firm close below that level increases the risk of a $0.205 to $0.20 retest. Traders should watch a clean daily close and expanding spot volume for conviction.

RECOMMENDED: Is Dogecoin A Good Investment And How to Buy DOGE?

Derivatives, Funding, Open Interest, and Liquidations

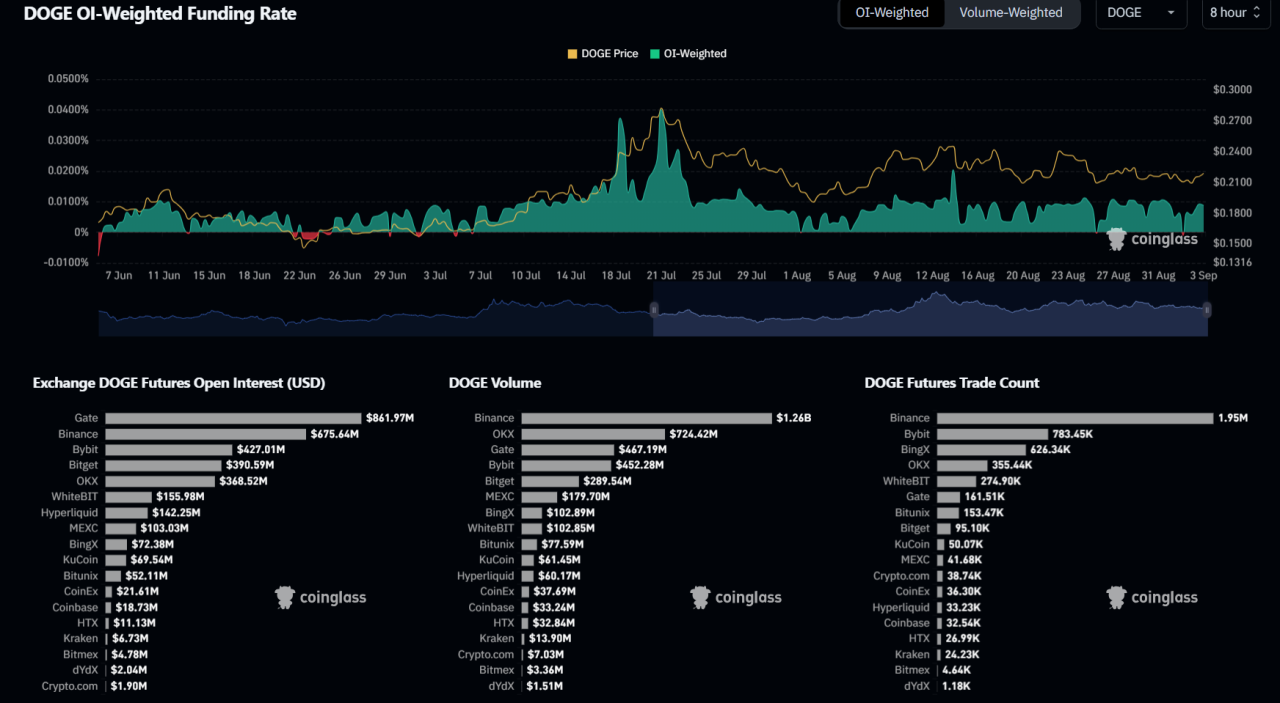

Derivatives show substantial open interest and mixed funding signals. Futures open interest stands around $3.35B, up modestly over 24 hours, which means material leverage sits on both sides of the market.

Funding rates have moved between slight positive and negative on different venues, which can flip the balance quickly. If OI stays elevated and funding turns positive while spot volume expands, leveraged shorts could face squeezes toward $0.25 to $0.30.

Conversely, negative funding into resistance tends to accelerate liquidations and drive price back toward the 200-day EMA. If you are looking for early signals, you should check exchanges’ long/short splits and liquidation heatmaps.

RECOMMENDED: What Could $1,000 in Dogecoin Be Worth in One Year?

On-Chain Activity And Whale Flows

On-chain metrics show active use and concentrated holders. The chain records about 135,000 transactions per day and an average fee of $0.087, indicating steady activity. Estimates put active addresses in the low hundreds of thousands.

A large whale moved roughly 900 million DOGE to Binance in late August, valued at about $200M, creating sell pressure while other large holders accumulated through the month.

We advise you to watch transfers and active address trends for confirmation.

RECOMMENDED: Is Dogecoin a Good Buy Now?

Conclusion

From our Dogecoin price analysis, a bull case needs a daily close above $0.225 with rising spot volume to reach $0.25 to $0.30. Failure at $0.22 and a break below the 200-day EMA near $0.211 targets $0.205 to $0.20. Keep tabs on funding, OI and whale flows for confirmation.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)