DOJ emails link Jeffrey Epstein to a $3M Coinbase investment in 2014, arranged through crypto insiders, raising concerns about early investor screening.

Newly released Department of Justice emails connect Jeffrey Epstein to a $3 million investment in Coinbase in December 2014.

The documents appear in a large public release of Epstein-related records and show how the funds moved through well-known crypto figures during a period when Coinbase was still building its early investor base.

RECOMMENDED: Coinbase Cost-Of-Living Crisis Ads Banned In UK

How The $3M Coinbase Investment Was Arranged

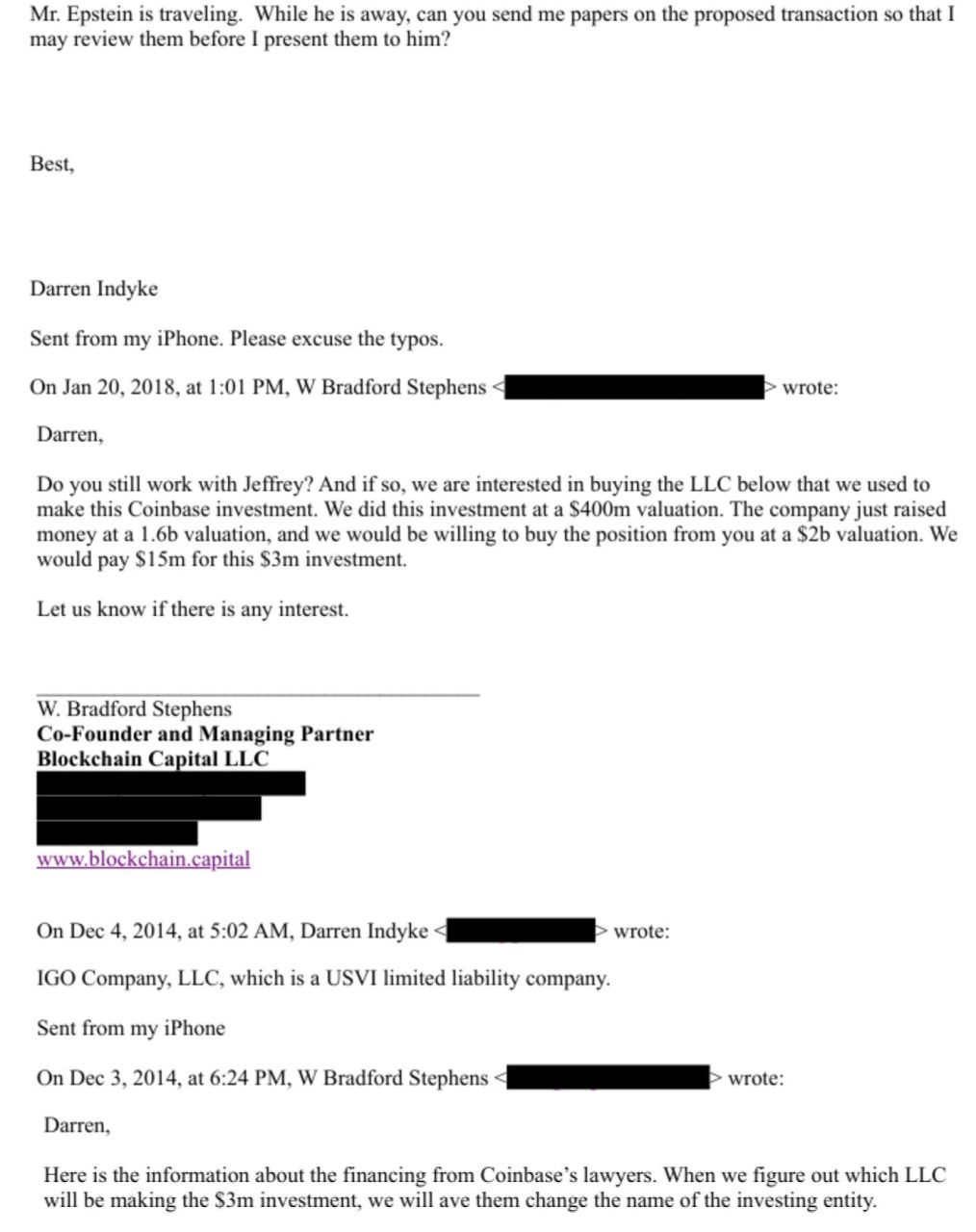

Emails in the DOJ release describe discussions and introductions linked to a $3 million Coinbase share purchase in December 2014. Journalists reviewing the files say the messages match the timing of one of Coinbase’s early funding rounds.

At the time, Coinbase had a private valuation of about $400 million and was attracting venture capital and high-net-worth investors.

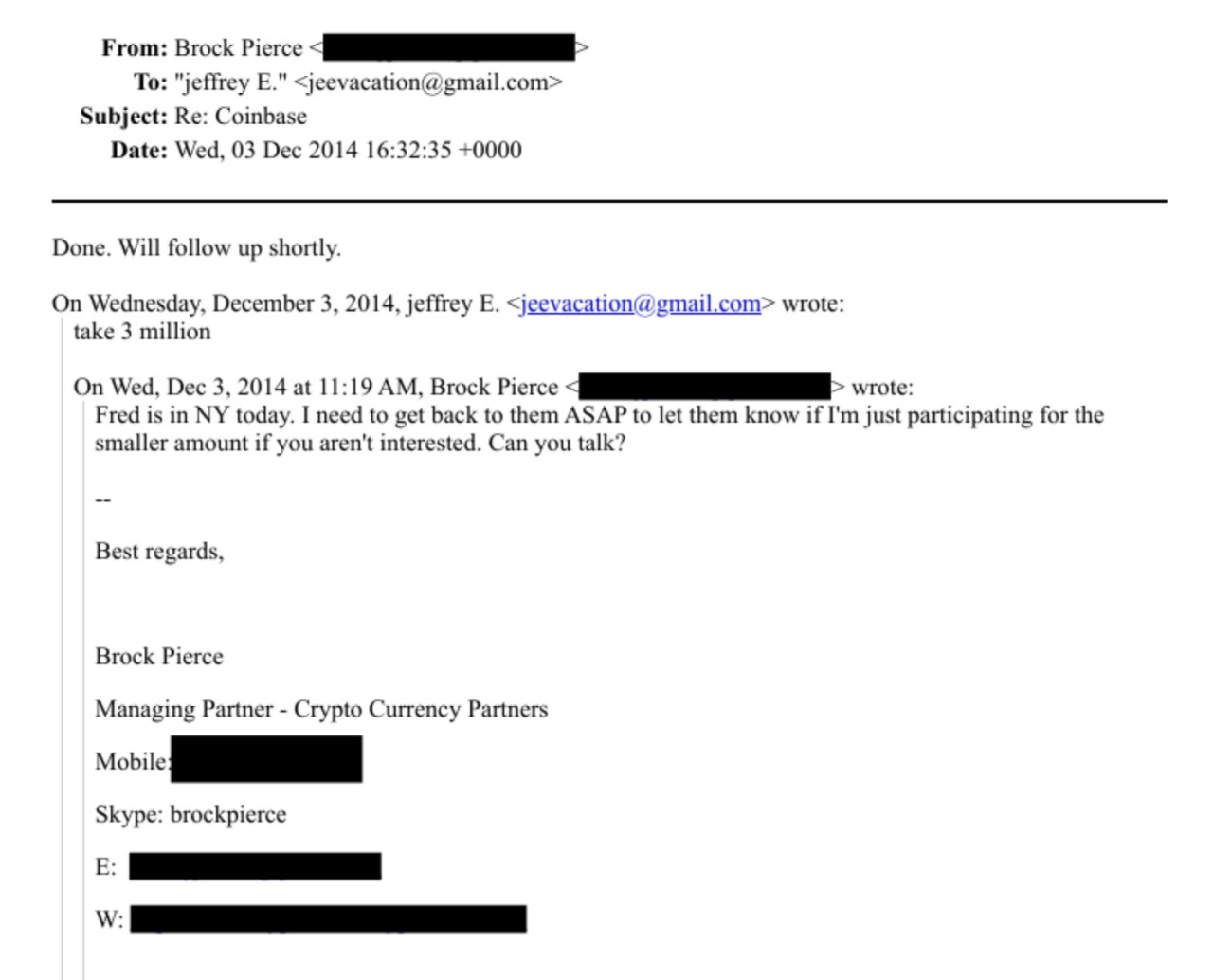

Reports indicate that Brock Pierce and Blockchain Capital helped place Epstein’s funds into the company.

The emails include references to meetings, contacts, and follow-ups that supported the transaction.

Several outlets note that the structure of the deal fits an early investor position, not a later resale.

This suggests Epstein entered Coinbase when access was limited and required personal connections.

ALSO READ: Secret White House Meeting Could Unlock $500B in Stablecoin Yields

Who Was Aware And What The Emails Reveal

The records show that Coinbase co-founder Fred Ehrsam requested a meeting connected to the investment, pointing to internal awareness.

Other messages show ongoing contact between Epstein and figures in the crypto sector over several years.

Some reporting says Epstein later sold around half of his Coinbase stake. Estimates suggest he made several million dollars from the sale, though exact figures differ by source.

The emails also document personal outreach, introductions, and status updates that helped keep the investment moving.

These records show that the deal involved multiple intermediaries and clear communication across the network.

RECOMMENDED: SEC Drops Gemini Earn Lawsuit, Ending A Long Legal Fight

Conclusion

The DOJ emails provide concrete evidence that Jeffrey Epstein invested $3M in Coinbase in 2014 through crypto insiders.

The case shows how early fundraising practices can create long-term credibility risks, especially when background checks and transparency fall short.