NYC Token jumped to a about $580M market cap, then fell about 80% after millions were pulled from liquidity pools.

The sudden move triggered rug-pull concerns and heavy losses.

NYC Token shot up fast after launch, briefly hitting a market cap of around $580M.

Within hours, it collapsed by roughly 80%, after on-chain data showed millions of dollars removed from its liquidity pool.

ALSO READ: Truebit TRU Crashes Nearly 100% After Hacker Wipes Out $26 Million – Is Truebit Dead?

What Happened After The Launch

NYC Token launched on Jan 12 and gained attention almost immediately.

Buying activity pushed its market cap into the $580M–$730M range within a short time. That rise did not last.

Heavy selling followed, and the token’s value dropped sharply in minutes.

Market trackers showed the market cap falling from hundreds of millions to well below $100M before most buyers could react.

This kind of move usually points to thin liquidity and short-term speculation.

When early holders sell into limited buy support, prices can fall fast.

The speed of this drop raised alarms across crypto-tracking platforms.

What Caused The Crush?

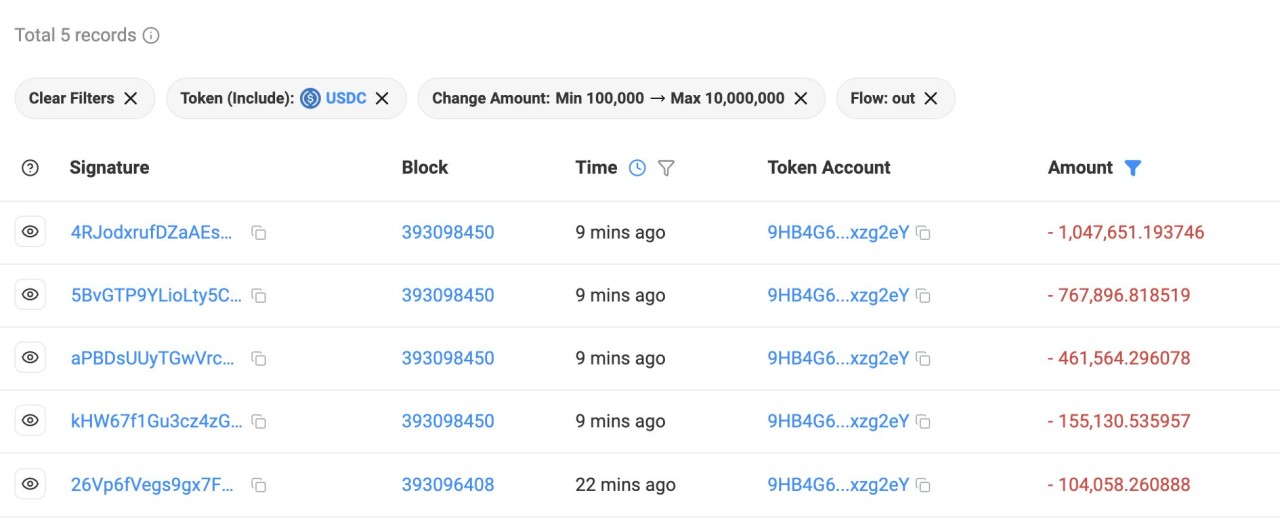

Blockchain analysts reviewing the token’s activity flagged large liquidity withdrawals shortly after launch.

Data from multiple trackers showed one or more wallets removing about $2.5–$3M from the liquidity pool.

Once that liquidity left, remaining holders faced steep losses since selling became harder without crashing the price further.

This pattern matches how many rug pulls work.

Liquidity gets added to attract buyers, then removed suddenly, leaving the token unable to support its price.

While wallet data can show where funds moved, it does not always confirm who controlled those wallets.

ALSO READ: $750M Left Bitcoin And Ether ETFs – Institutions Abandoning BTC?

Conclusion

The NYC Token collapse is a familiar crypto story, just at a much bigger scale.

A fast launch, thin liquidity, and sudden fund withdrawals turned early excitement into heavy losses.

For investors, the lesson is simple: slow down, check the basics, and never let hype replace caution.

In our next Premium Crypto Alert in the coming days, we will identifying the key Crypto assets to consider in 2026 with explosive potential.