BitMine now holds 1.52 million ETH ($6.6 billion) and plans to raise $20 billion more, targeting over 5% of Ethereum’s total supply.

BitMine Immersion has concentrated over 1.52 million ETH, worth around $6.6 billion, on its balance sheet, positioning it as the largest corporate Ethereum treasury.

The firm added 373,000 ETH in one week alone and set its sights on acquiring up to 5 % of Ethereum’s circulating supply, an aggressive ambition that reshapes how institutions view ETH.

RECOMMENDED: Where will Ethereum (ETH) Be in 5 years?

BitMine’s Rapid Build-Up

BitMine Immersion added 373,000 ETH in a single week, raising its holdings to 1.52 million tokens valued at about $6.6 billion, making it the leading corporate ETH holder. That accumulation represented an increase from 1.15 million tokens just days earlier.

At current market prices, this holding equals roughly 1.3% of Ethereum’s total supply.

The company plans to raise up to $20 billion more through equity sales to purchase another 4.5 million ETH, potentially reaching ownership of over 5 % of the network. Corporate companies driving institutional investment in Ethereum include ARK Invest, Founders Fund and Pantera.

RECOMMENDED: Ethereum Price Prediction: Tom Lee Makes The Case For $30,000 ETH

Broader Corporate Steam and Supply Impact

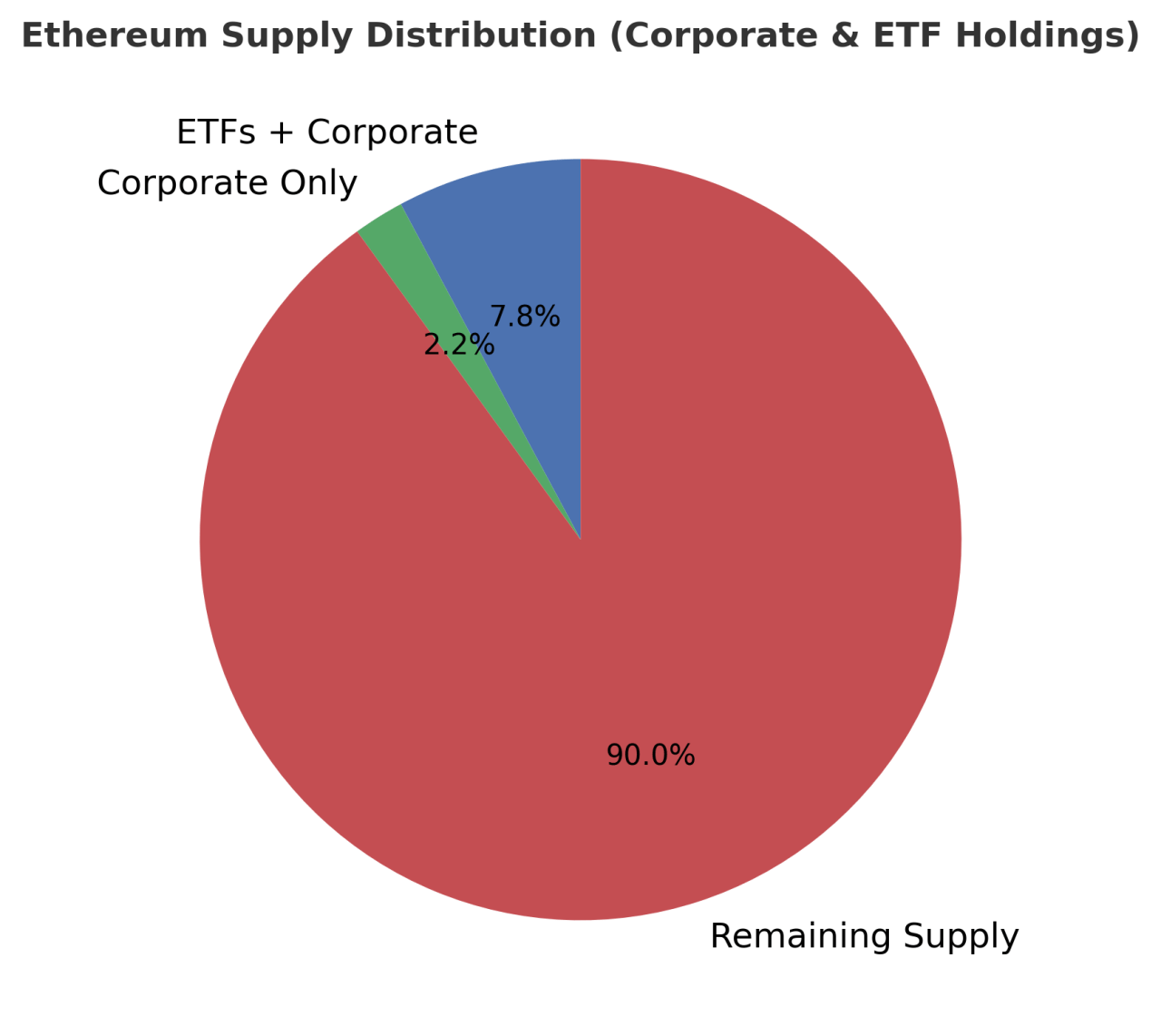

Corporate treasuries and ETFs now hold more than 10 million ETH, exceeding 8% of total Ethereum supply, and amounting to over $46 billion in aggregate value. Separate analysis shows Ethereum corporate accumulation accounts for roughly 2.2 % of supply.

BitMine alone represents a significant share of this concentration. That level of accumulation may constrain available supply, influence liquidity, and add new layers to ETH market dynamics.

Ethereum’s staking and token burn mechanisms already reduce circulating supply, and concentrated holdings by a single firm could add scarcity-driven pressure on pricing and trading behavior.

RECOMMENDED: Ethereum (ETH) Price Prediction 2025 2026 2027 – 2030

Conclusion

BitMine’s Ethereum accumulation – 1.52 million tokens in hand and ambitions to control 5% – signals a strategic shift in how institutions treat ETH.

As corporate entities and ETFs continue tightening supply, Ethereum may face increasing scarcity dynamics and emerge as a core strategic reserve asset.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)