A capped PoW smart-contract chain with a long-standing focus on immutability, predictable issuance, and a steady community makes ETC a good buy today.

Ethereum Classic keeps the original Ethereum ledger intact and follows a strict immutability principle, which gives it a stable and predictable identity.

It runs on proof of work, supports smart contracts, and uses a fixed supply that limits long-term dilution. These features help ETC stand out in a market full of fast-changing networks.

Here are five reasons to buy Ethereum Classic today.

Top Reasons To Buy Ethereum Classic (ETC)

1. Immutability And Code Is Law

Ethereum Classic holds a unique position because it kept the original Ethereum chain after the 2016 split. That choice formed its core principle, often called “code is law,” meaning rules should stay final once written into the blockchain.

This appeals to users and investors who want a chain that avoids rollbacks and protects transaction history at all costs. It also creates a clear expectation of stability.

People who prefer predictable governance, such as long-term holders, custodians, and conservative funds, often see ETC as a network that is unlikely to shift direction suddenly. The chain’s identity is rooted in consistency, which helps build user trust over time.

2. Proof Of Work Security And Censorship Resistance

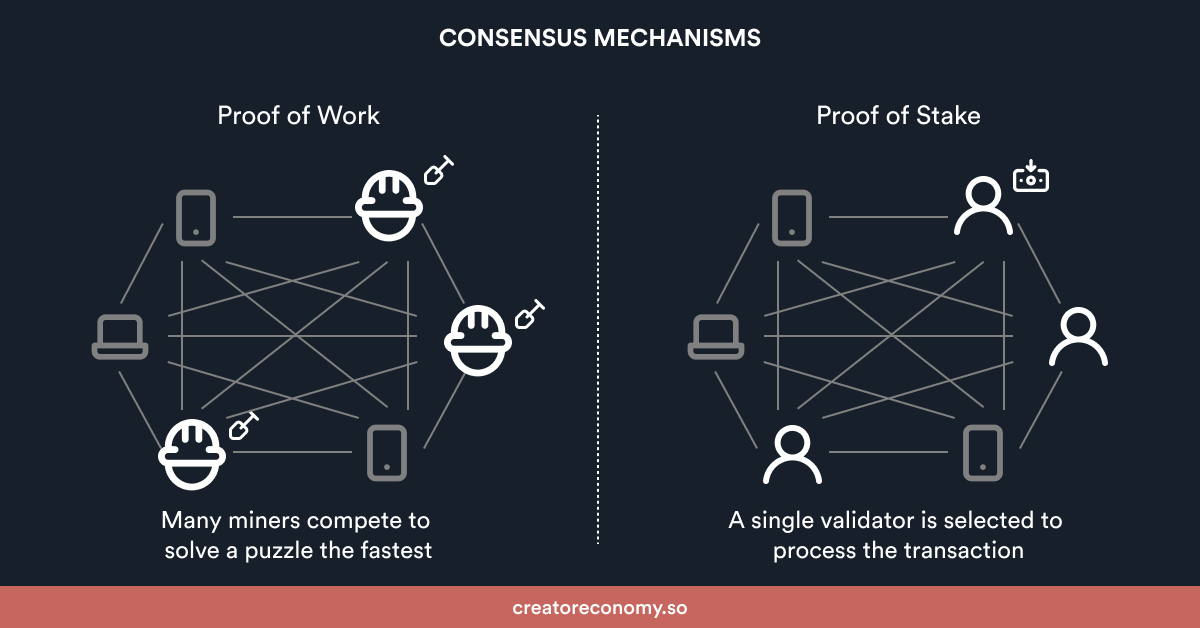

Ethereum Classic uses proof of work, a model that secures the chain through mining hardware rather than large token positions. This keeps control spread across many participants and makes it harder for small groups to influence rules.

ETC’s community has stayed committed to PoW and continues to publish guides, documentation, and educational material supporting this approach. While ETC has experienced 51% attacks in the past, the community responded with technical and legal measures and strengthened monitoring tools.

For investors, PoW offers a familiar security model used by Bitcoin. It does have trade offs, but it provides clear, transparent mechanics that users understand. ETC also adjusts parameters to help GPUs remain viable for miners, which keeps more participants securing the network.

3. Limited Supply And Predictable Issuance

One of ETC’s most appealing features is its fixed supply. With a maximum of 210.7 million ETC and about 154.5 million already in circulation, the remaining issuance is predictable. A capped supply is useful for holders because it makes long-term dilution easy to estimate.

This stands out in a market where many tokens increase supply without strict limits. ETC also sits in a liquid market bracket, which helps investors enter and exit positions without extreme volatility.

Supply clarity, combined with accessible liquidity, gives ETC a straightforward monetary structure that is easy to understand and model for long-term planning.

4. Smart Contract Compatibility And On-Chain Utility

Ethereum Classic supports the Ethereum Virtual Machine, so many smart contracts that run on Ethereum can run on ETC with small adjustments. This compatibility lowers the barrier for developers and encourages simple dApps, tools, and wallets to use the ecosystem.

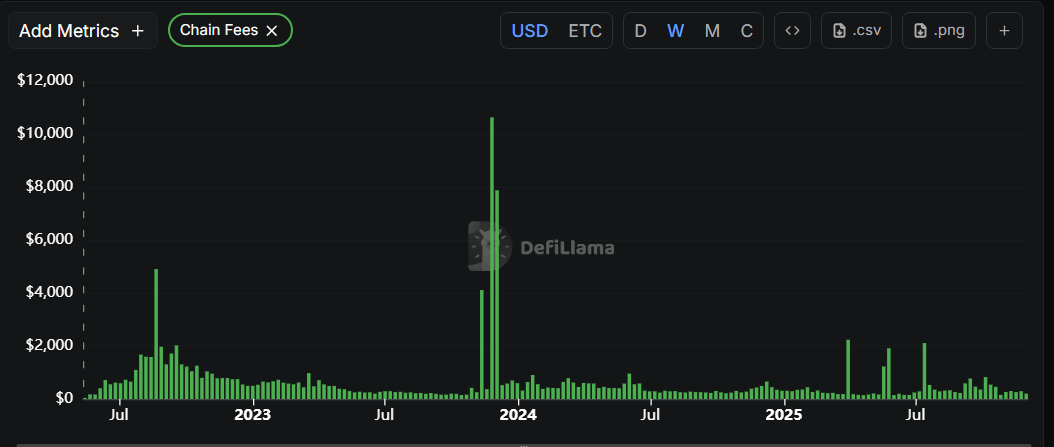

Fees on ETC often stay lower because daily activity is lighter, which helps users who want cheaper transactions for payments, basic DeFi, or NFTs. The ecosystem is smaller than Ethereum, but real projects, explorers, and infrastructure continue to operate.

For buyers, this means ETC offers meaningful utility without the congestion common on larger chains. Developers also keep improving tooling and compatibility to make it easier for new applications to launch on ETC.

5. Focused Community And Steady Stewardship

Ethereum Classic benefits from a stable community and organized groups that help maintain and grow the network. The ETC Cooperative and independent development teams contribute to upgrades, client maintenance, education, and funding for tools that keep the chain active.

They publish progress reports, developer resources, and plans for future improvements. A focused community does not guarantee rapid expansion, but it does improve reliability and reduces the chance of the chain becoming inactive.

For investors, this steady stewardship lowers protocol risk and provides confidence that ETC will continue evolving. Reports from these groups show ongoing work on testnets, grants, and client updates that support network health.

Conclusion

Invest in Ethereum Classic if you want a PoW smart-contract chain with strict immutability, a capped supply, and stable community support.

It offers clear rules and practical utility, though it also comes with risks like a smaller ecosystem. If it matches your goals, size your allocation carefully and keep a balanced portfolio.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

- Why This Bounce Matters (30 Crypto Charts) (Nov 23rd)

- What’s Going On With Bitcoin & Alts?(Nov 16th)

- This Is What We Want To See The Next 72 Hours(Nov 9th)

- The Next 2 To 3 Weeks …(Nov 2nd)

- A Successful Test of Bitcoin’s 200 dma? (Oct 26th)

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower