ETH continues to drop as staking removes a meaningful share of supply. Analyst targets point to $4,000 to $4,300 if momentum improves.

Ethereum is currently trading around 3080.11 USD.

Regardless of the drop, the market sits inside a familiar range, and most traders want clarity on where support will kick in and hold long enough to spark a move toward new highs.

Here is an Ethereum outlook for December to give you a glimpse of what might happen.

RECOMMENDED: Will Ethereum Hit $5,000 Sooner Than Expected?

Ethereum Outlook For December: Key Support, Resistance, And Momentum

For ETH to build strength, it needs a confident move above $3,400 and continuation above $3,400, which has acted as a ceiling for several weeks. If momentum carries through that level, $4,000 becomes the next clear target.

The recent break below $3,000 is a different story. This drop invited fast selling, since many traders use that level as a psychological reference point. When markets hesitate around major support, volume often reveals the truth.

Strong volume on a bounce tends to show genuine interest, while weak volume leaves price exposed to another test.

ALSO READ: Is It Too Late To Buy Ethereum (ETH) in 2025?

On-Chain And Network Signals That Influence Price

Staking continues to shape ETH’s supply profile. With about 35.7 million ETH staked, roughly 30% of total supply stays off the market, which reduces day-to-day selling pressure. This locked supply can make price reactions sharper when demand picks up.

Network activity remains steady, and average fees stay modest. Low fees help keep regular users active, which supports the ecosystem even if it does not create strong short-term excitement.

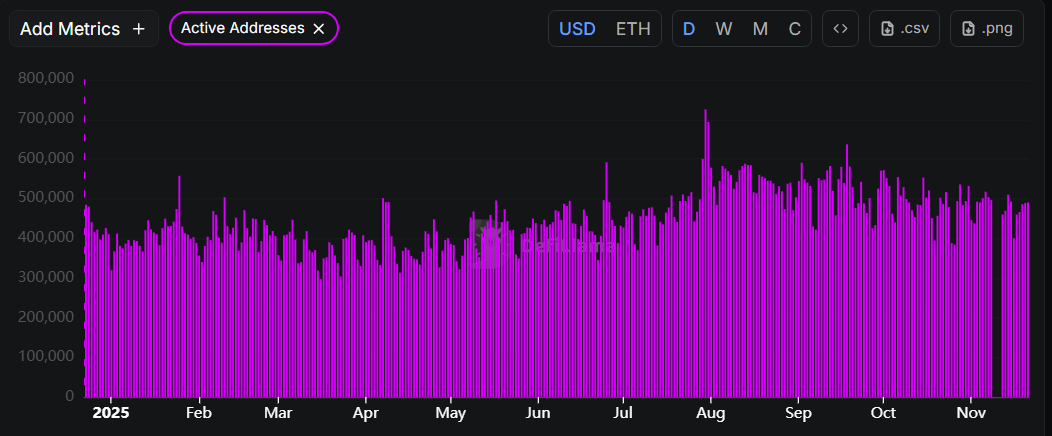

Pay attention to changes in staked supply and active addresses because these shifts often appear before larger price moves.

RECOMMENDED: What to consider before Investing In Ethereum (ETH)

Ethereum Price Forecasts And Flows

Ethereum price targets for December remain clustered between $4,000 and $4,300. And while price does not owe anyone a forecast, it helps frame the upper range.

You can check our ETH price prediction where we expect it to cross the $4,000 level again by year-end.

If ETH ETF inflows or broader market strength return, ETH can move through resistance faster than many expect. On the other hand, risk-off conditions or large exchange deposits usually cool momentum.

YOU MIGHT LIKE: How to Buy Ethereum (ETH) in 2025: A Step-by-Step Guide for Beginners

Conclusion

The base case for December is simple. If ETH Breaks above $3,400, it can work toward $4,000 and possibly beyond.

The most reliable signals remain volume at support, shifts in staked supply, and institutional flows, all of which tell a clearer story than headlines alone.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.