Ethereum trades around 3111.45 USD with fast swings. Staking locks supply, ETFs reshape access, and long term trends matter more than short term noise.

Ethereum Trades around 3111.45 USD today, and recent moves show sharp jumps followed by sudden pullbacks.

Many investors are trying to understand if this price level presents a fresh entry or if risk outweighs the reward.

So, is it too late to buy Ethereum? Look at ETF flows, staking levels, and supply patterns to help you decide.

RELATED: Thinking About Investing in Ethereum? Here’s Why It’s Not Too Late!

Should You Buy Ethereum Today: Current Price, ETFs And Macro Context

Ethereum holds the $3,000 zone, and daily swings remain strong. Spot Ethereum ETFs changed how institutions enter the market, and their flow data adds real weight to short term price action.

Some sessions recorded heavy outflows and others brought solid inflows, which made price reaction immediate when large funds reshuffled positions.

Major ETFs now hold billions in combined assets, a scale that did not exist in previous cycles.

Ethereum price predictions remain divided, with some forecasting a possible push toward the $4,300 to $7,500 range by year end, while others point to rate uncertainty and liquidity risks that could cap rallies.

These mixed signals likely show that Ethereum still reacts more to funding flows and macro data than many expect.

RECOMMENDED: How to Buy Ethereum (ETH) in 2025: A Step-by-Step Guide for Beginners

Long Term Structural Drivers: Staking, Supply Mechanics And Upgrades

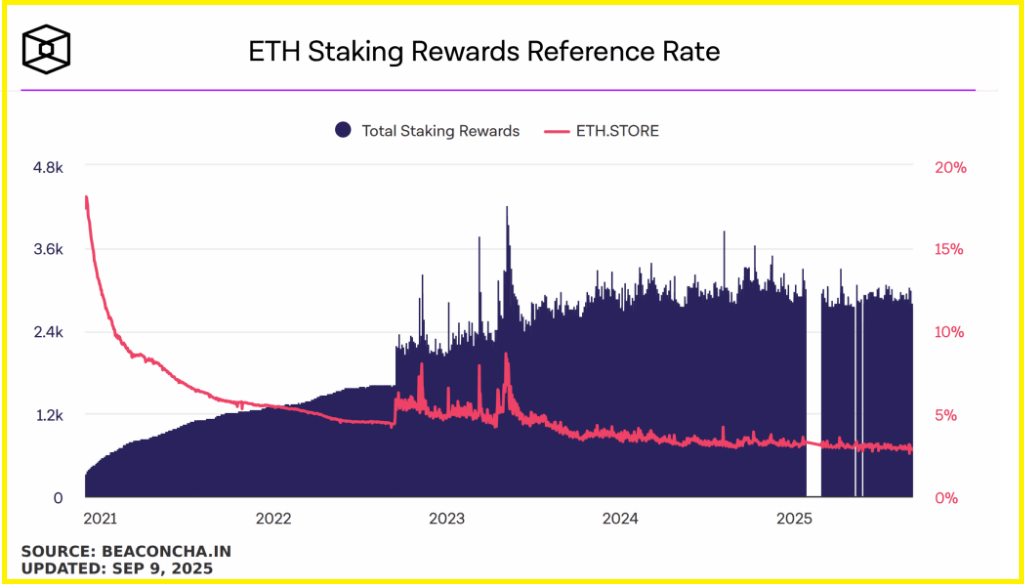

The long term picture looks different from the daily noise. Staking totals about 35 million ETH, around 29% of supply, and this locked balance reduces liquid tokens on the market.

Stakers earn yield, and this has created a steady base of holders who care more about multi year growth than short term pivots.

EIP-1559 still burns fees, although lower activity recently made burn fall below issuance, which led to slight net inflation.

Layer 2 growth lowered mainnet fees, which helps users but reduces burn.

These trends are slow moving signals that matter most for patient holders rather than traders watching hourly charts.

ALSO READ: Will Ethereum Hit $5,000 Sooner Than Expected?

How To Decide If It’s Still Worth Buying Ethereum

To invest in ETH, start with your time frame. A multi year plan makes volatility easier to handle, and staking or dollar cost averaging can help smooth entry timing.

Otherwise, keep position sizes small, usually 1-3% of your portfolio.

Finally, compare spot and ETF exposure, check tax rules, and set clear exit rules to reduce avoidable losses.

RECOMMENDED: Is Ethereum (ETH) A Good Investment? 7 Factors You Should Know

Conclusion

Is it too late to buy Ethereum? It is not automatically too late to buy Ethereum. Price sits below earlier peaks, staking removes supply from markets, and ETFs expand access.

Your choice should match your horizon, comfort with swings, and preference for staking or simple spot exposure.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):