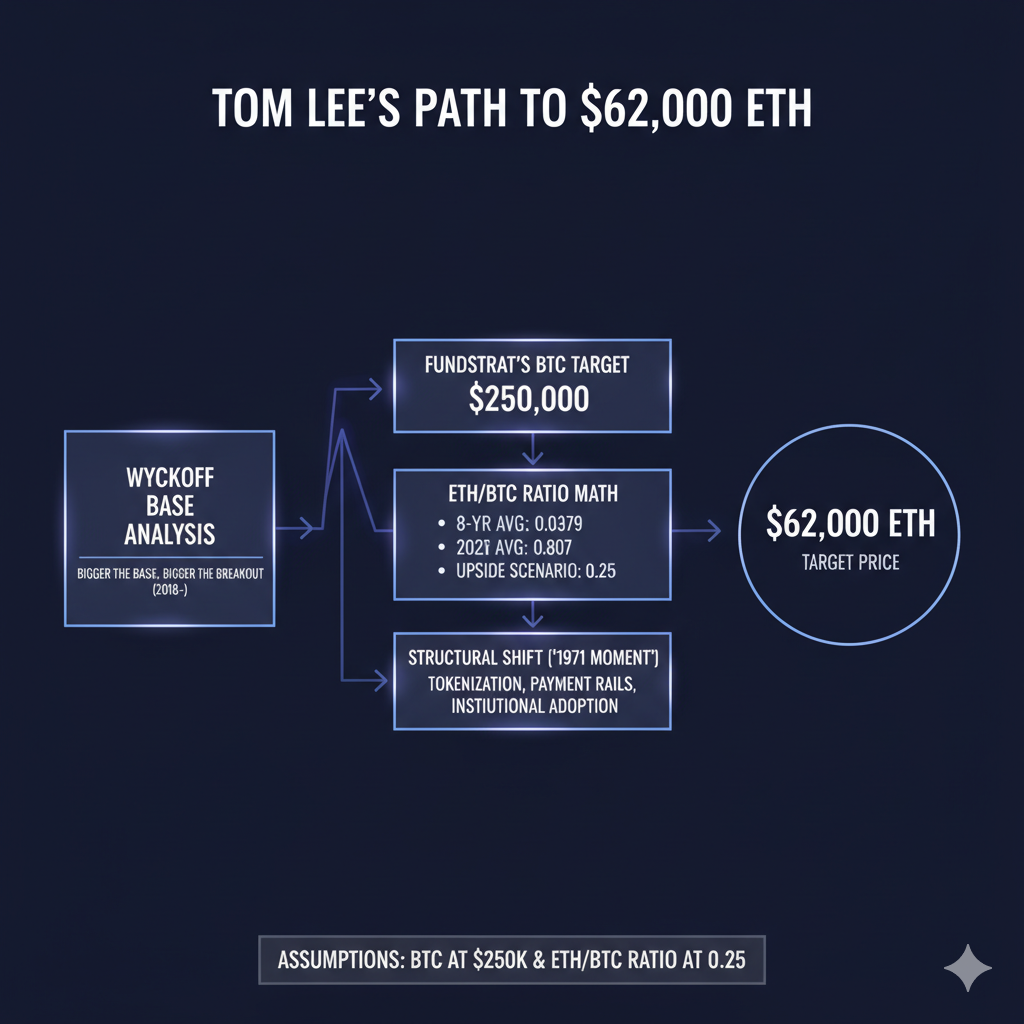

Tom Lee used ETH/BTC ratio math and Wyckoff base analysis. He said ETH could reach $62,000 under Fundstrat’s assumptions.

Tom Lee, Fundstrat’s head of research, presented a scenario that could put Ethereum at $62,000 using Wyckoff base analysis and ETH/BTC ratio calculations. He cited ratio levels, Fundstrat’s Bitcoin targets and valuation tied to payment rails and tokenization.

RELATED: Ethereum Price Prediction: Tom Lee Makes The Case For $30,000 ETH

Technical Case: Wyckoff Base And ETH/BTC Ratio Math

Lee opened with the Wyckoff framework, saying markets that form larger bases often set up larger breakouts. He said, “the bigger the base, the bigger the breakout,” and pointed to Ethereum’s multi-year consolidation since 2018.

He then applied ETH/BTC ratio math, noting the current ratio at 0.03707, an eight-year average of 0.0479, and the 2021 peak of 0.0807. Using Fundstrat’s Bitcoin assumptions, including a $250,000 target, Lee showed simple ratio arithmetic that maps BTC prices to explicit ETH ranges.

Under ratio reversion to the long-term average, he estimated ETH might trade in a $12,000 to $22,000 band, presented as a baseline case rather than the full upside scenario. He said these were model outputs for investors now.

RECOMMENDED: What a $500 Crypto Investment Could Look Like in Bitcoin Vs. Ethereum This Week

The Big Upside Scenario: 0.25 Ratio And The “1971 Moment”

Lee then moved to his full upside scenario. He said that if ETH/BTC rose to about 0.25, and if Fundstrat’s Bitcoin projections held, simple multiplication produces an Ethereum price prediction around $62,000.

Lee described this as a broader structural shift, calling it a “1971 moment” for finance, where tokenization and stablecoins change how money and payments work. He linked that outcome to institutional adoption, public crypto treasuries and on-chain settlement for financial services.

Lee framed the $62,000 outcome as an implied valuation based on those structural changes and his ratio math, not as a short-term forecast.

ALSO READ: What to consider before Investing In Ethereum (ETH)

Near-Term And Intermediate ETH Price Forecasts

Lee also gave intermediate bands and shorter targets. He cited possible moves to $5,500 to $9,000, and said ratio reversion tied to a $250,000 Bitcoin case implies an ETH range around $12,000 to $22,000.

Conclusion

Tom Lee’s Ethereum price prediction rests on testable math. If ETH/BTC rises toward 0.25 and Bitcoin meets Fundstrat’s high targets, then by his model Ethereum could trade at about $62,000 per coin.

The analysis depends on ratios, measured assumptions about Bitcoin, and structural shifts in how finance works.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Which Crypto Should You Invest In Right Now?

For alerts on the key crypto assets that are primed for investment right now you should consider Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)