Ethereum’s price remains soft in 2026, but BlackRock continues to expand exposure.

Yield, supply trends, and tokenization shape its long-term view.

Ethereum enters 2026 trading well below its record highs, with price action that has frustrated many investors.

ETF inflows have slowed, and broader markets still favor cash and bonds.

Yet behind the muted charts, institutional activity around Ethereum continues to grow at a steady pace.

RECOMMENDED: Bitcoin, Ethereum, XRP: The 3 Cryptos Dominating January 2026

BlackRock’s Ethereum Strategy Focuses On Yield

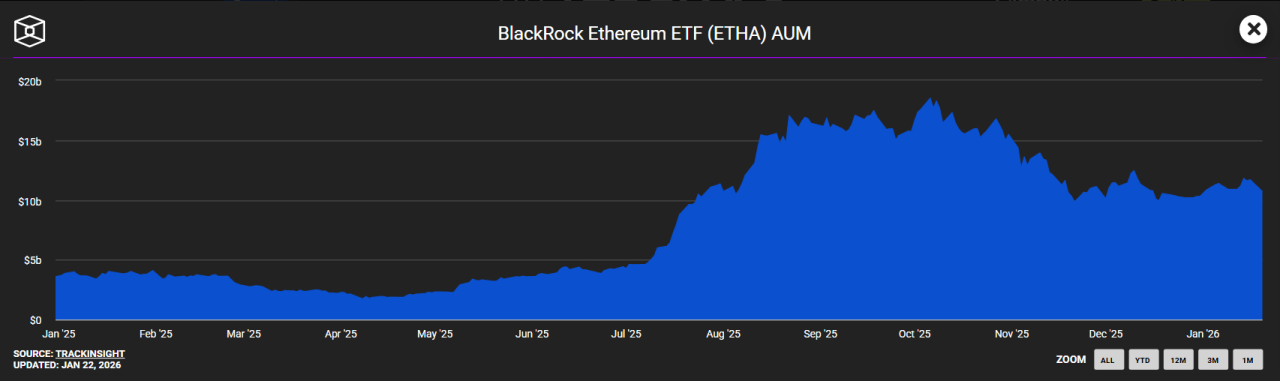

BlackRock’s spot Ethereum ETF gathered over $1.5B in assets even while ETH traded about 40% below its peak.

This shows steady demand from allocators who look past short-term price movement.

More important is BlackRock’s push toward staking.

Filings indicate plans to add staking exposure, which would allow investors to earn ETH rewards that average between 3% and 4% annually.

For institutions, this changes how Ethereum fits into portfolios.

ETH becomes a yield asset, not just a speculative token, and staking reduces the amount of ETH available on the market.

RECOMMENDED: Ethereum Shatters $120B Staking Record – Can ETH Hit $4,000?

Ethereum Still Leads Tokenization And Network Use

Ethereum remains the primary blockchain for tokenized real-world assets.

Over 65% of tokenized treasuries and private credit products operate on Ethereum and its layer-2 networks.

This concentration shows liquidity, security, and a mature developer base.

Supply trends also support long-term value. Since Ethereum shifted to proof-of-stake, issuance has dropped sharply.

During periods of high activity, fee burning has outpaced new issuance.

More than 27% of all ETH is now locked in staking contracts, which limits sell-side pressure.

YOU MIGHT LIKE: Ethereum (ETH) is Going To Space

Why Ethereum’s Price Remains Flat In 2026

The price stall ties closely to macro conditions.

Higher real interest rates pull capital toward bonds and money market funds. Spot ETH ETFs also experience uneven weekly flows, which caps short-term momentum.

Network usage has not declined. Liquidity preferences have changed.

RECOMMENDED: Morgan Stanley Files Ethereum ETF – Impacts for ETH in 2026

Conclusion

BlackRock’s stance on Ethereum is shaped by long-term mechanics rather than near-term price action.

Staking rewards, reduced liquid supply, and Ethereum’s central role in tokenized assets give the network structural support that does not always show up on price charts.

While macro conditions continue to weigh on ETH in 2026, institutional interest suggests confidence in Ethereum’s underlying role in the financial system is still quietly growing.

Should You Invest $1,000 IN Ethereum Today?

Before you invest in Ethereum, You’ll want to hear this.

In the next few days we will publish our latest premium crypto alert where we will reveal the crypto assets you may want to consider for 2026 with explosive potential.