Massive leveraged liquidations, weak liquidity, ETF outflows, and macro pressure combined to unleash a sharp crypto crash.

The crypto market recently plunged suddenly, wiping out tens to hundreds of billions in value in days. This flash crash was likely caused by a chain reaction of forces; whale trades, forced liquidations, weak market depth, ETF exits, and macro headwinds.

Let’s look at what caused the recent crypto market crash flash in more detail.

Whale Moves And Liquidations

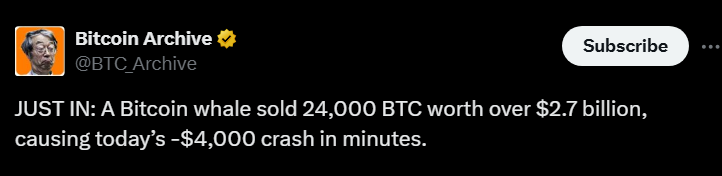

A large sale of about 24,000 BTC by a whale flooded thin liquidity zones, pushing prices sharply downward. That triggered automatic forced liquidations of leveraged long positions across exchanges.

In total, over $1.65 billion in bets got liquidated in hours.As each liquidation added pressure, prices fell deeper, triggering more margin calls.

Ethereum felt this too: in a 24-hour span, more than $400 million in positions were wiped out when ETH dropped below $4,000.

RECOMMENDED: Ethereum Alert: The Make-or-Break Levels Traders Can’t Ignore

Liquidity Dryness And ETF Outflows

At the same time, liquidity was weak. In calm markets, buy orders buffer drops, but this time order books were thin, especially for altcoins and midcaps. That made downward swings more extreme.

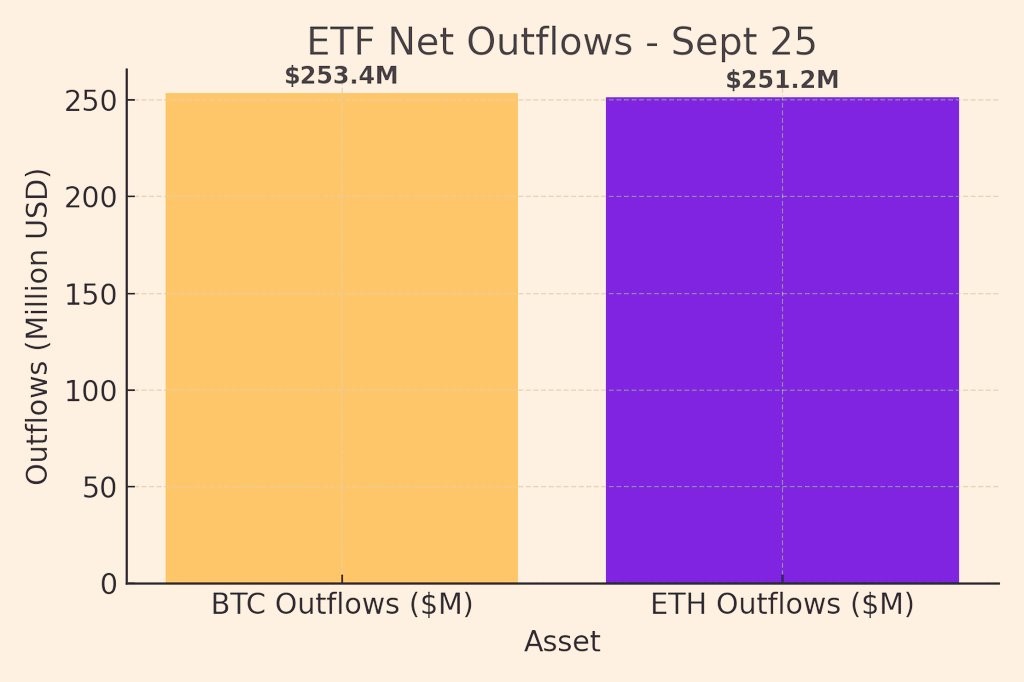

Institutional investors also pulled money from spot ETFs: Bitcoin ETFs saw $253.4 million outflows and Ethereum ETFs lost $251.2 million over one period.

These exits removed a stabilizing force, letting the sell-off intensify.

RECOMMENDED: Bitcoin’s Moment of Truth: Will These Key Levels Hold or Break?

Macro Pressure And Regulatory Anxiety

Beyond crypto factors, macroeconomic tension and policy uncertainty made the market fragile. A strong U.S. dollar, hawkish interest rate bets, and inflation worries pushed capital away from risky assets.

Regulatory fears also loomed large. Unclear rules in the U.S. and Europe made investors jittery. That sentiment turned a sharp drop into a panic. The result: what might have been a moderate correction morphed into a flash crash.

RECOMMENDED: Experts Explain What Crypto IPO Wave Means For Markets

Conclusion

The recent crypto flash crash was due to a mix of big whale trades, leveraged liquidations, thin liquidity, ETF exits, and macro/regulatory stress. To avoid future crashes, markets must build depth, manage leverage, and promote clear rules.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Which Crypto Should You Invest In Right Now?

For alerts on the key crypto assets that are primed for investment right now you should consider Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)