Learn how to buy Cow Protocol (COW) in 2025 using exchanges or CoW Swap, while minimizing fees and slippage. Understand wallets, risks, and governance to make informed COW purchases.

With growing demand for decentralized finance solutions that protect users from MEV and offer fairer pricing, Cow Protocol is a powerful player in the DEX ecosystem.

For this reason, understanding how to buy Cow Protocol in 2025 is essential. Thanks to expanded listings on top exchanges and the rise of intent-based trading via CoW Swap, gaining exposure to COW token has never been easier – or more relevant.

What Is COW & Why Buy in 2025?

COW is the native governance token powering CoW Protocol, a meta‑DEX that uses batch auctions to match trade “intents” in rounds.

This design facilitates peer‑to‑peer “Coincidence of Wants” (CoWs) combined with solver arbitrage across DEXes and aggregators, reducing slippage and shielding traders from MEV attacks like frontrunning and sandwiching.

Inflation is capped at about 3% annually, controlled via CoW DAO voting, so token issuance is predictable. Rising on‑chain activity and broader exchange listings (e.g. Binance, Coinbase) make COW attractive both for governance voting and speculative entry.

Where to Buy COW in 2025

COW token is listed on major centralized exchanges, with COW/USDT pairs available on Binance (spot listing from November 6, 2024 with zero-fee promotion and “seed” tag), as well as Coinbase, Kraken, MEXC and Gate.

Alternatively, users can access COW permissionlessly on CoW Swap across Ethereum, Arbitrum and Gnosis Chain by submitting trade intents into periodic settlement batches – no KYC required.

CoW Swap recently added support for native ETH input (“eth-flow”) to simplify direct ETH→COW swaps. Cross-chain bridges like Hop or Connext facilitate moving COW to additional chains.

Step‑by‑Step Guide to Buying CoW Protocol (COW)

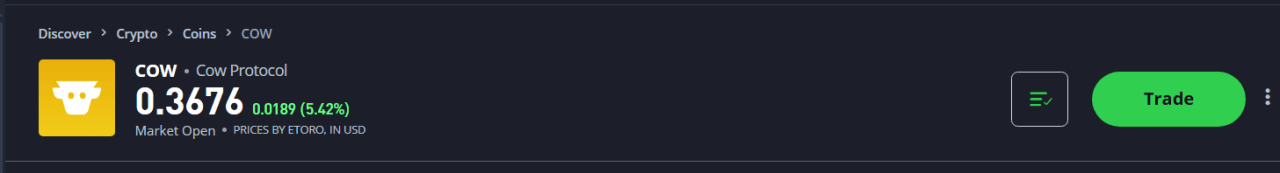

Buying COW With eToro

- Sign up for an eToro account here and complete the required identity verification (KYC).

- Deposit funds—either fiat (e.g., USD, EUR) or supported cryptocurrencies—into your eToro wallet.

- Search for CoW Protocol (COW) on the platform, view the current price chart, and access trading tools.

- Select the amount of COW you wish to buy. You can execute a market order for immediate purchase or set a limit order to target a specific price.

- Execute the trade. Once completed, your COW tokens are held securely within eToro’s platform.

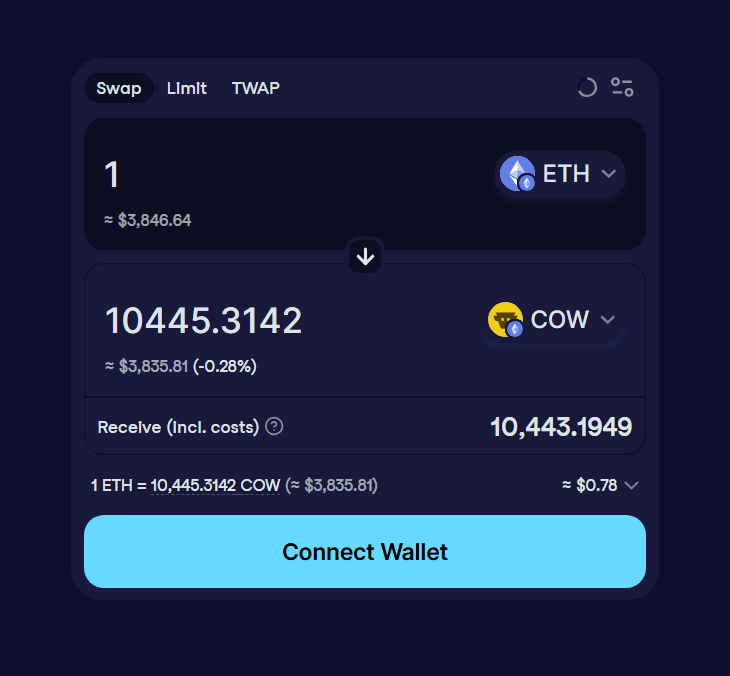

Optional: Decentralized Alternative via CoW Swap

If you prefer no account or KYC requirements, you can still use CoW Swap:

- Connect via MetaMask, WalletConnect, or Gnosis Safe on Ethereum, Arbitrum, or Gnosis.

- Fund your wallet with ETH or stablecoins.

- Select what to sell and buy (i.e., sell ETH → buy COW).

- Set slippage tolerance.

- Submit your trade.

Trades settle via batch auctions, and tokens arrive directly in your wallet.

How to Minimize Fees & Slippage When Buying Cow

The batch auction model at CoW Swap aggregates opposing trade intents to enable direct internal matches and external liquidity routing, which typically keeps fees and slippage lower than on AMMs like Uniswap or Sushiswap.

On CEX platforms, avoid high slippage by trading during peak USDT order‑book liquidity, and use limit orders when possible. Within CoW Swap, grouping multiple intents (e.g. swapping USDT → ETH then ETH → COW) in one batch reduces gas overhead.

You should also set a tight price limit (±0.5–1%) across either method to guard against MEV risk such as sandwich attacks.

Wallet Storage & Security Tips

After buying, you need to find the best wallet for storing COW token.

Always confirm that the wallet address supports ERC‑20 tokens on Ethereum, Arbitrum or Gnosis and that the COW contract is 0xdef1ca1fb7fbcdc777520aa7f396b4e015f497ab (on Ethereum mainnet) before manually adding it.

Here are some security tips to help you stay safe:

- For long‑term storage, use hardware wallets like Ledger or Trezor, optionally with MetaMask or multisig Safe for added security.

- Be cautious of phishing.

- Always ensure you are on genuine domains (cow.fi, CoW Swap) and avoid copying unknown smart contracts into your wallet.

Compliance, Risk & Disclosures

Access to COW on eToro, Binance and Coinbase can be subject to regional restrictions depending on your country of residence – be sure to verify availability in your jurisdiction before depositing.

Remember, CoW Protocol is a small‑cap token (#336 on CoinGecko, market cap under $200M), and COW price can swing rapidly.

The DAO‑managed inflation schedule (3%/yr maximum) has the potential to dilute holdings if you’re not voting or updating your tokens.

When trading via CoW Swap or CEX, stay aware of your local tax regulations for cryptocurrency gains, and never invest more than you’re willing to lose.

Conclusion

Once you’ve acquired COW, track your portfolio via Etherscan or CoW Protocol analytics. Engage with CoW DAO’s governance proposals on Snapshot or Discord if you wish to influence direction.

Also, be mindful of on‑chain gas spikes and consider timing trades during off‑peak hours. That said, volatility remains and you should be cautious when trading or investing in the long-term.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)