India now requires live face scans, location data, and bank checks before anyone can trade crypto.

The changes add security, but they also raise serious privacy questions.

In January 2026, India’s Financial Intelligence Unit rolled out one of the toughest crypto identity systems in the world.

Every user must now prove who they are using real-time face scans, location tracking, and bank verification before they can trade.

India has about 119 million crypto users, so this rule does not affect a small group.

It changes how a massive digital economy works.

YOU MIGHT LIKE: Bitcoin, Ethereum, XRP: The 3 Cryptos Dominating January 2026

What The New Rules Require

Before you can buy, sell or even hold crypto on an Indian exchange, you now need to pass several identity checks.

A live selfie must be taken during signup, using software that verifies eye-blink or head movement to ensure authenticity.

Exchanges also record your exact GPS coordinates, IP address, timestamp and date at the moment you open your account.

Additionally, users must complete a “penny-drop” test, where a tiny bank transfer confirms ownership of your linked bank account.

All of this comes alongside traditional IDs like a Permanent Account Number (PAN) and secondary government ID such as Aadhaar or passport.

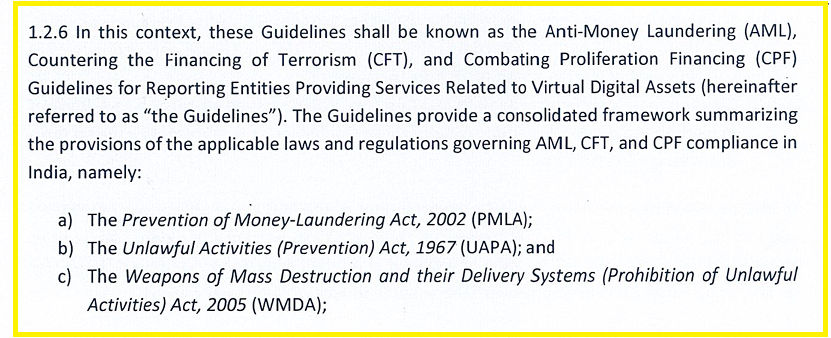

Why India Tightened the Rules

The FIU says crypto has become a major channel for money laundering and illegal transfers.

Fake accounts and stolen identities made it hard to trace who was really moving funds.

By linking crypto accounts to live biometrics, bank accounts, and physical locations, regulators want every trade tied to a real person.

This gives law enforcement much stronger tracking tools than before.

RECOMMENDED: 15 Cryptocurrency Predictions For 2026

How This Changes Crypto Trading in India

These rules will slow down signups and raise costs for exchanges, especially smaller platforms that must install biometric and location systems.

Some users may walk away rather than share such detailed personal data.

The biggest concern is data security.

Exchanges will now store faces, locations, and bank links for millions of people.

If that data leaks or gets misused, the damage could be permanent and devastating.

RECOMMENDED: Forget BTC & ETH – Here’s Why Experts Are Calling XRP The Hottest Crypto Of 2026

Conclusion

India’s new requirements make identity and location central to entering the crypto world.

While aimed at cutting down illegal activity, they place new privacy burdens on everyday users and redefine what it means to “open an account” in the digital asset space.

In our next Investing Haven Premium Crypto Alert we will outline key crypto assets to consider for 2026 with explosive potential