Ethereum’s recent rally through $4,300 on record institutional inflows prompts a careful, data-driven take on whether it remains a solid investment now.

Ethereum now trades around $4,500 but in recent days up to $4,800, marking its highest level in over two years following $1 billion in single-day Ethereum ETF inflows led by BlackRock’s ETHA fund and Fidelity’s FETH.

That sharp surge raises the question: is Ethereum still worth buying in 2025 or is it priced for perfection?

Let’s find out.

RELATED: How to Buy Ethereum (ETH) in 2025: A Step-by-Step Guide for Beginners

Institutional Inflows and Market Strength

Institutional adoption of Ethereum has accelerated sharply. U.S. spot ETH ETFs pulled in more than $1.02 billion in net inflows in a single day, with BlackRock’s ETHA capturing around $640 million and Fidelity’s FETH about $277 million.

Ethereum is outperforming Bitcoin year-to-date, with a 29% gain compared to Bitcoin’s 28 %, and has surged above $4,800. Corporations now hold roughly 5% of circulating supply, signaling confident commitment from institutional treasuries.

RECOMMENDED: 5 Reasons to Buy Ethereum (ETH) Today

Ethereum Upgrades, Scalability, and Long-Term Potential

Ethereum’s technology roadmap remains compelling. The Dencun upgrade added cheaper Layer-2 data storage through Proto-Danksharding.

Upcoming mid-2025 Pectra will allow staking with up to 2,048 ETH per validator, improving institutional flexibility.

Separately, new research proposes fully parallel transaction execution, which could unlock greater scalability by reducing the sequential processing bottleneck.

These enhancements strengthen Ethereum’s case as a foundational smart-contract platform.

RECOMMENDED: Prediction: 12 Months From Now Ethereum Will Be Worth?

Risks and Outlook

Ethereum faces non-trivial risks. Leverage remains high and derivatives may amplify volatility despite inflows.

Regulatory clarity particularly regarding staking remains uncertain, though the U.S. appears more supportive, with retirement plans now allowed to allocate to crypto assets.

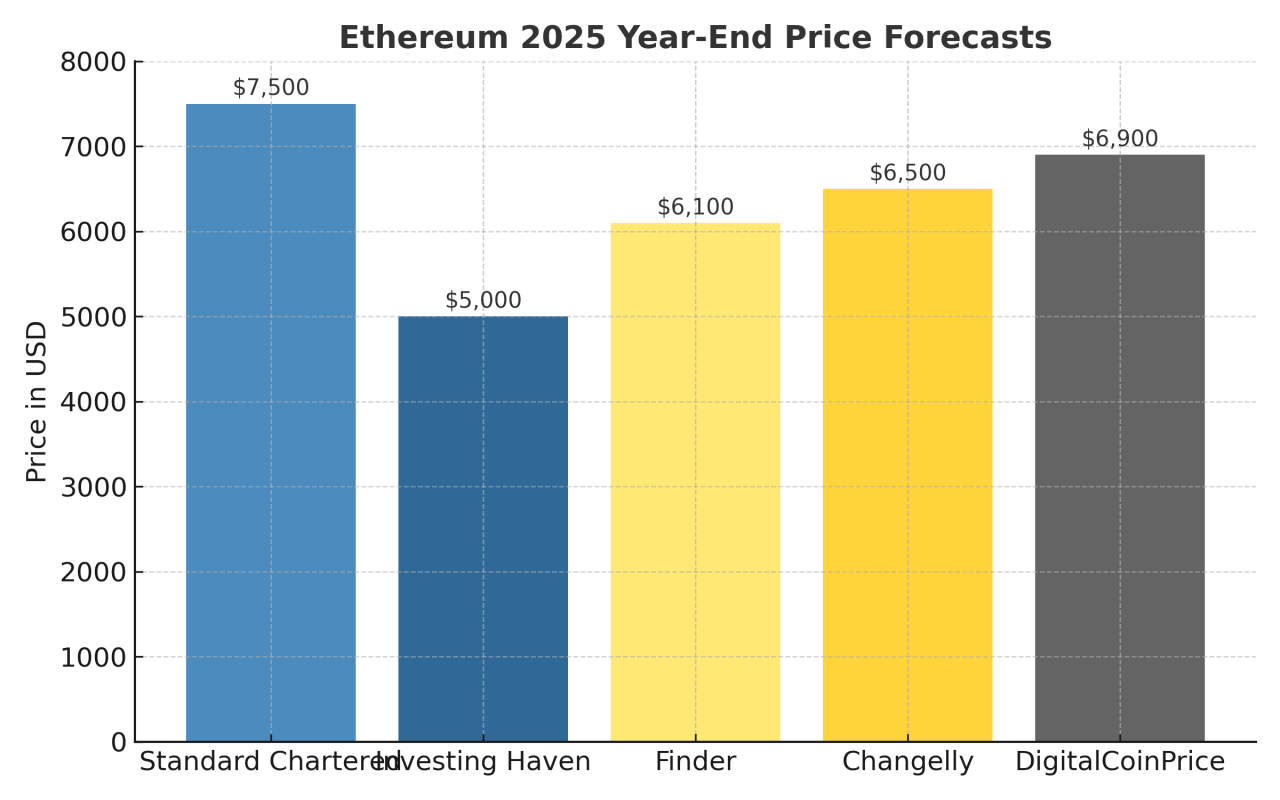

Ethereum price predictions vary widely, with some forecasts reaching $6,500, $7,000, and even up to $10,000 before year-end.

Conclusion

Ethereum’s surge, institutional accumulation, and roadmap for improvement make it a strong contender in 2025. However, only investors who understand its volatility and regulatory uncertainties will likely benefit from its further ascent.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service, live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)