Sharding, EVM compatibility, and staking give NEAR practical long-term utility.Whether to buy or not depends on timing and risk management.

NEAR is a Layer-1 blockchain designed for speed and usability. It scales using sharding, supports Ethereum apps through Aurora, and offers staking rewards.

However, given the current crypto volatility, you might wonder if it’s too late to buy NEAR. Let’s help you decide.

ALSO CHECK: Top 3 AI Cryptos That are Exploding Right Now: Is the Web3 & Gen-AI Boom Here?

Is It Too Late To Buy NEAR?

It is not too late to buy NEAR. The network delivers fast transactions through Nightshade sharding, supports Ethereum apps via Aurora, and continues to attract active developers.

This means NEAR has room to grow over time. If you invest with patience and sensible position sizing, it still offers meaningful exposure to Layer-1 adoption.

RECOMMENDED: 5 Reasons To Buy NEAR Protocol in 2025

Why It’s Not Too Late to Invest in NEAR

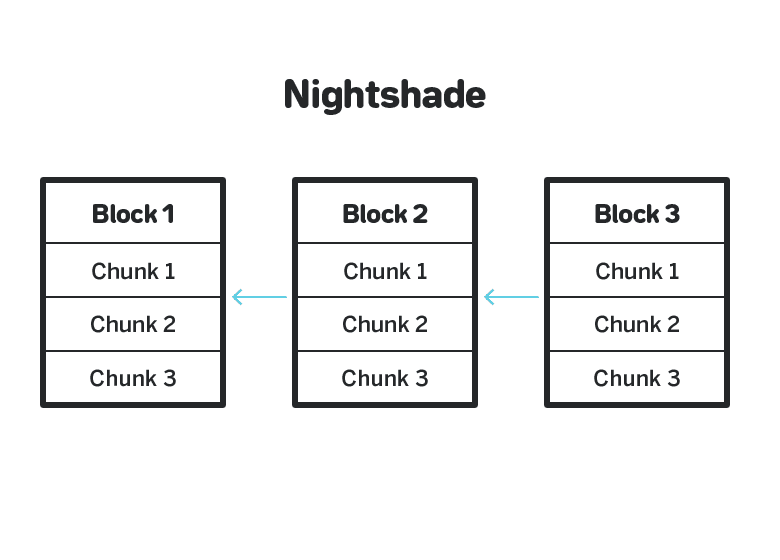

NEAR’s Nightshade sharding splits the network workload, increasing capacity and helping keep fees low. In testing, the protocol reached up to 1,000,000 transactions per second, showing long-term scalability.

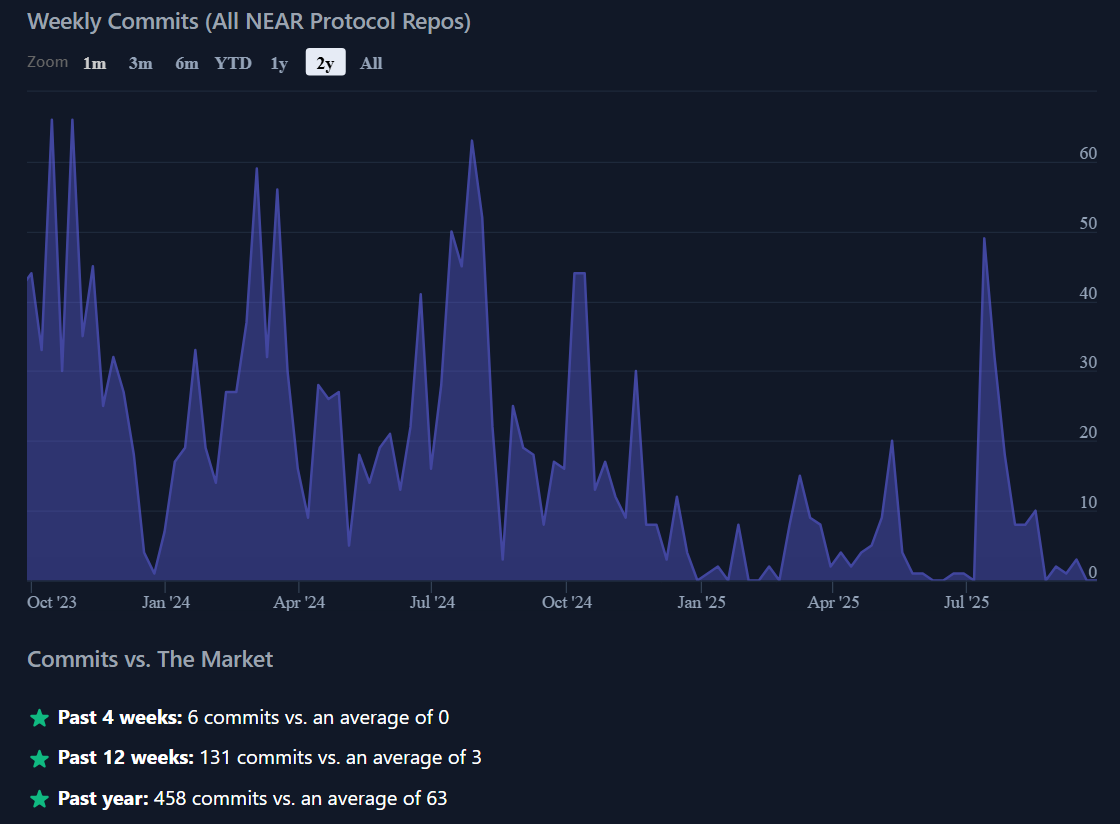

Aurora provides full EVM support, making it easier for developers to move Ethereum apps across without major changes. Developer activity has remained strong, with over 2,000 commits across core repositories, which signals ongoing improvements.

The current circulating supply is around 1.28 billion tokens, while staking returns typically range between 6% and 9%, supporting steady network participation. Block finality averages around one second, and transaction fees on Aurora usually cost just cents.

These metrics point to real application usage. However, technical risks such as bridge exploits remain, so ensure to monitor security updates and actual network usage.

RECOMMENDED: Top 3 High-Risk, High-Reward Cryptos For November

Tips For Buying NEAR

Use trusted exchanges or store tokens in a self-custody wallet. Many buyers prefer dollar-cost averaging and choose to stake part of their holding to earn rewards.

Keep your allocation modest and set clear exit rules.

That said, be aware of risks such as price swings, contract or bridge exploits, and reliance on large token holders.

Conclusion

It’s not too late to buy NEAR since it still offers credible long-term potential through scalable technology and staking benefits. Treat it as a calculated investment and size your position carefully.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

- Why This Bounce Matters (30 Crypto Charts) (Nov 23rd)

- What’s Going On With Bitcoin & Alts?(Nov 16th)

- This Is What We Want To See The Next 72 Hours(Nov 9th)

- The Next 2 To 3 Weeks …(Nov 2nd)

- A Successful Test of Bitcoin’s 200 dma? (Oct 26th)

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower