Stacks links Bitcoin with smart contracts and lets holders earn BTC rewards.

This mix of utility and yield gives STX long-term relevance.

Imagine earning Bitcoin simply by holding a token. With Stacks you can.

STX opens up Bitcoin’s deep security to smart‑contract apps while offering holders real BTC rewards through stacking.

It lets you combine the safety of Bitcoin with practical yield – a rare mix in crypto today.

So, is it too late to buy STX or can you still get in on the action?

RECOMMENDED: 5 Compelling Reasons to Buy Stacks (STX) in 2025

Is It Too Late To Buy STX?

It is not too late to buy STX. Stacks continues to fill a clear role by giving Bitcoin new features and offering BTC rewards through stacking.

The network keeps improving, developers stay active, and STX still has room to grow as long as buyers understand the risks that come with any crypto asset.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Why STX Could Still Be A Good Investment

STX gets its value from actual activity. Users pay fees for transactions and smart contract actions.

Holders can also lock their STX to earn BTC rewards, which creates steady demand.

The circulating supply sits around the low billions, so STX does not follow the fixed-cap model of coins like BTC.

This makes supply growth an important factor for buyers.

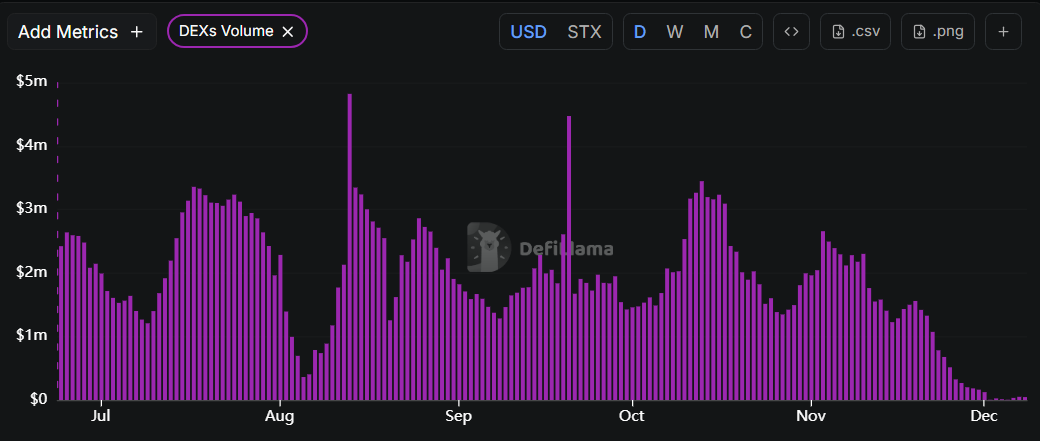

Liquidity on major exchanges is solid, but anyone buying large amounts should still check trading volume to avoid unexpected price jumps.

Adoption And Developer Momentum: Why Utility Matters

Stacks depends on real usage instead of hype or price movement.

Developers continue improving tools and preparing upgrades that make apps run faster and integrate more easily with Bitcoin.

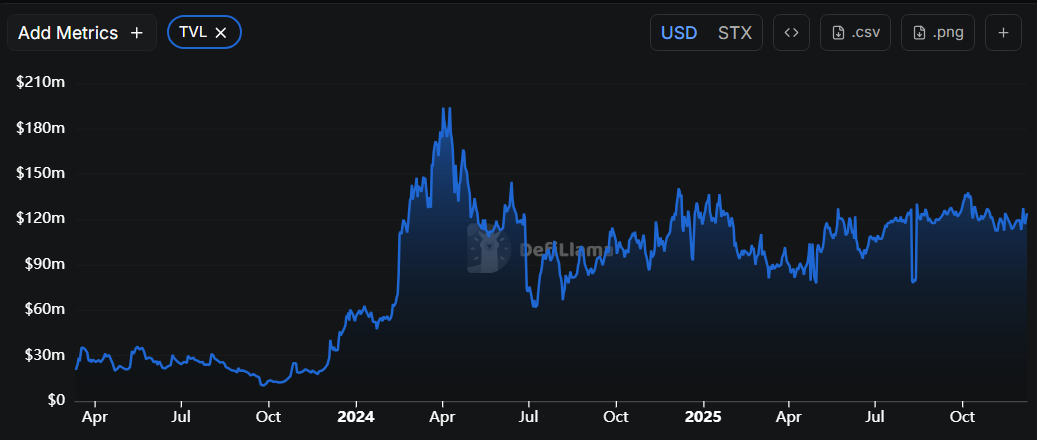

Growth in active users, app activity, and locked value shows that people are actually building and using the network.

When more apps launch and activity rises, STX sees more fees and stronger stacking participation.

These signals help buyers understand whether the network is moving forward or slowing down.

RECOMMENDED: Can Stacks (STX) Ever Rise To $66?

Risks & Practical Buying Steps

Every crypto asset carries risks, including market swings, lower adoption than expected, and supply changes.

Before you invest in STX, check exchange listings, confirm wallet support, and understand how stacking works.

Start with a small position, then add slowly through dollar cost averaging.

Treat STX as a speculative long-term bet, not guaranteed income.

Conclusion

If Bitcoin-based smart contracts keep expanding, STX remains a reasonable choice.

It offers rewards, growing utility, and clear adoption signals, as long as you manage risk carefully.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower