Chainlink shows bullish signs near $13, supported by real-world adoption and partnerships, offering a strong setup for long-term investors.

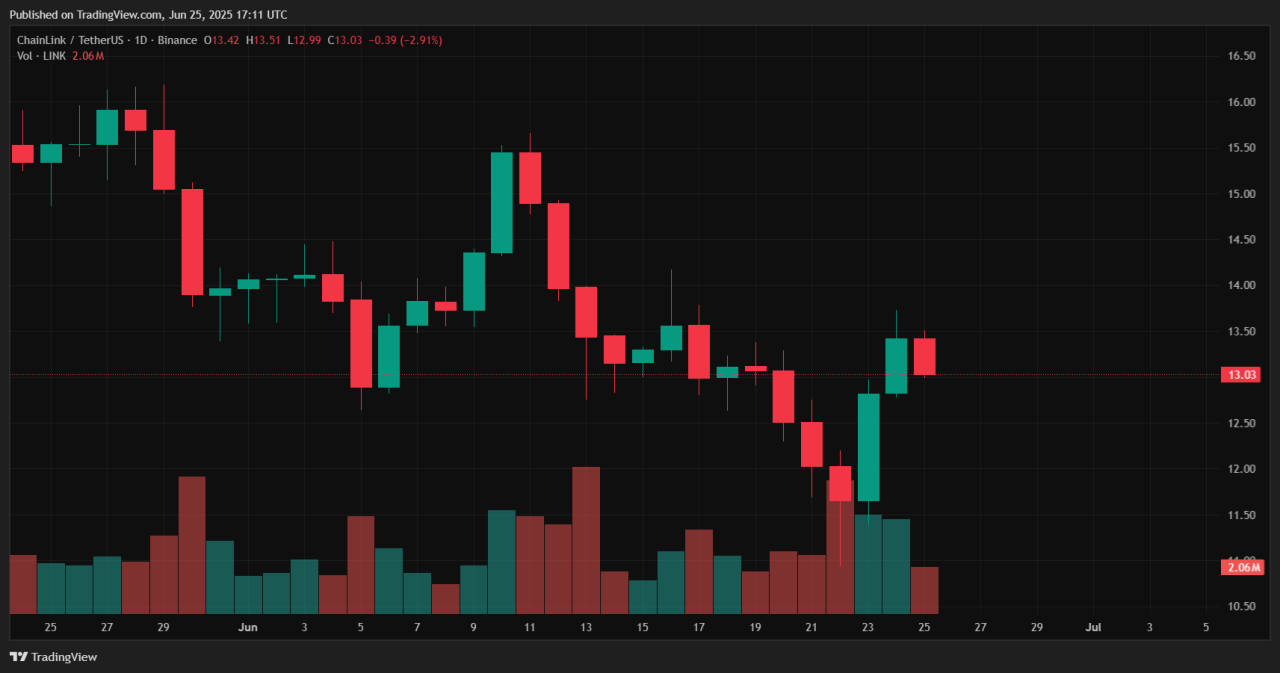

Chainlink (LINK) currently trades near $13.05, holding steady following a recent correction that ranged between $12.80–$13.70. This article assesses whether current conditions offer a compelling entry point based on market structure, intrinsic utilities, and forward-looking scenarios.

Building Price Momentum & Market Structure

After breaking above resistance at $12.50, LINK established an uptrend with higher highs and lows, supported by strong volume—bullish momentum confirmed by on‑chain data.

Technical indicators present mixed signals: daily charts lean ‘neutral to buy’ with RSI near 52 and MACD flatlining, while shorter-term metrics show overbought Stoch‑RSI—suggesting momentum may pause before another move higher.

Key levels to watch include support at $12.85–13.00 and resistance around $13.30–13.35, where profit-taking may emerge.

Chainlink Real‑World Utility & Ecosystem Developments

Fundamentals remain solid. LINK powers decentralised oracles critical to DeFi platforms like Aave or Synthetix, and integrations through CCIP now span Solana and other non‑EVM chains—unlocking over $18 billion in cross-chain capital.

A major catalyst is the Mastercard partnership enabling 3 billion cardholders to buy crypto directly on‑chain, prompting an 11–13% price surge on the news. Expansion into tokenized assets—via collaborations with JPMorgan, SWIFT, UBS and ANZ—positions LINK as a foundational blockchain infrastructure asset.

Outlook & Risk Scenarios For Chainlink

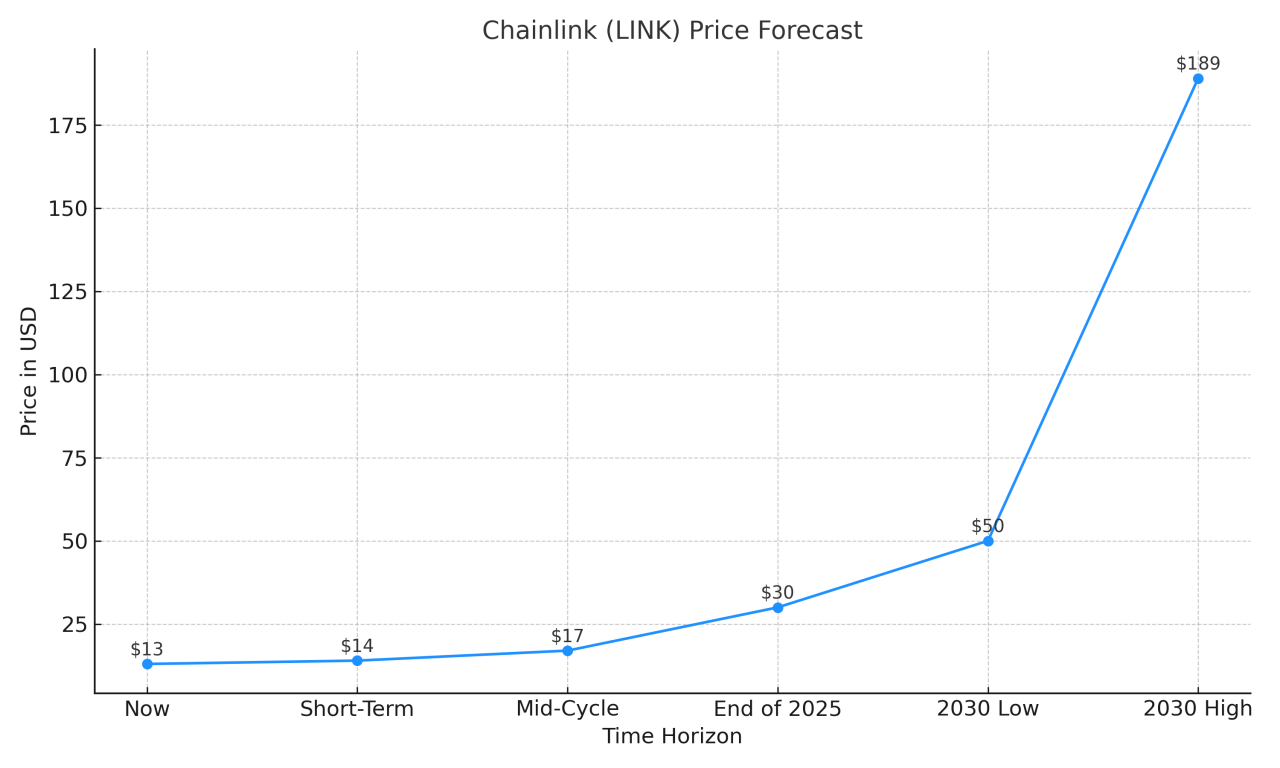

Analyst projections diverge: conservative short-term forecasts peg LINK in a tight $12.80–14 zone, while mid-cycle models see a move to $17 on strong on-chain activity.

Longer-term, upside targets range from $25–30 by the end of 2025 to $50–189 by 2030.

Risks include macro crypto sentiment, Fed policy shifts, possible whale selling around $15.77 resistance, and broader market volatility.

Conclusion

Chainlink’s recent momentum, supported by real-world utility and institutional partnerships, suggests the current ~$13 range is a strategically attractive entry for medium‑ and long‑term investors.

However, short‑term traders should monitor support at $12.85–13.00 and wait for a confirmed breakout above $13.30–13.35. In summary: promising buying opportunity for patient holders; cautious optimism for traders seeking entry confirmation.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)

- Is A Massive Breakout Coming? (May 17th)

- Top Altcoin Picks in the Strongest Emerging Narrative (May 9th)