Federal Reserve Chair Jerome Powell has officially authorized U.S. banks to serve cryptocurrency firms under proper risk controls, boosting institutional crypto confidence.

On June 25, 2025, Federal Reserve Chair Jerome Powell delivered what many are calling a historic green light to the cryptocurrency industry.

During his semi‑annual testimony to Congress, Powell affirmed that U.S. banks are “perfectly able to serve crypto customers” as long as they effectively manage the risks—signalling a shift toward institutional engagement after years of regulatory caution.

Regulatory Clarity and Bank Engagement

Powell highlighted that crypto is maturing and becoming mainstream, prompting the Fed to reassess outdated policies such as the 2023 Section 9(13) stance on “novel activities”.

He welcomed recent crypto legislation, calling progress on stablecoin frameworks (like the GENIUS Act) “a great thing”.

He emphasized that the Fed will no longer consider “reputational risk” a barrier, signaling regulators’ retreat from aggressive “Operation Choke Point 2.0” tactics.

The message: banks now have clearer permission to work with digital‑asset firms without fear of informal discrimination.

Market Reaction and Institutional Flows

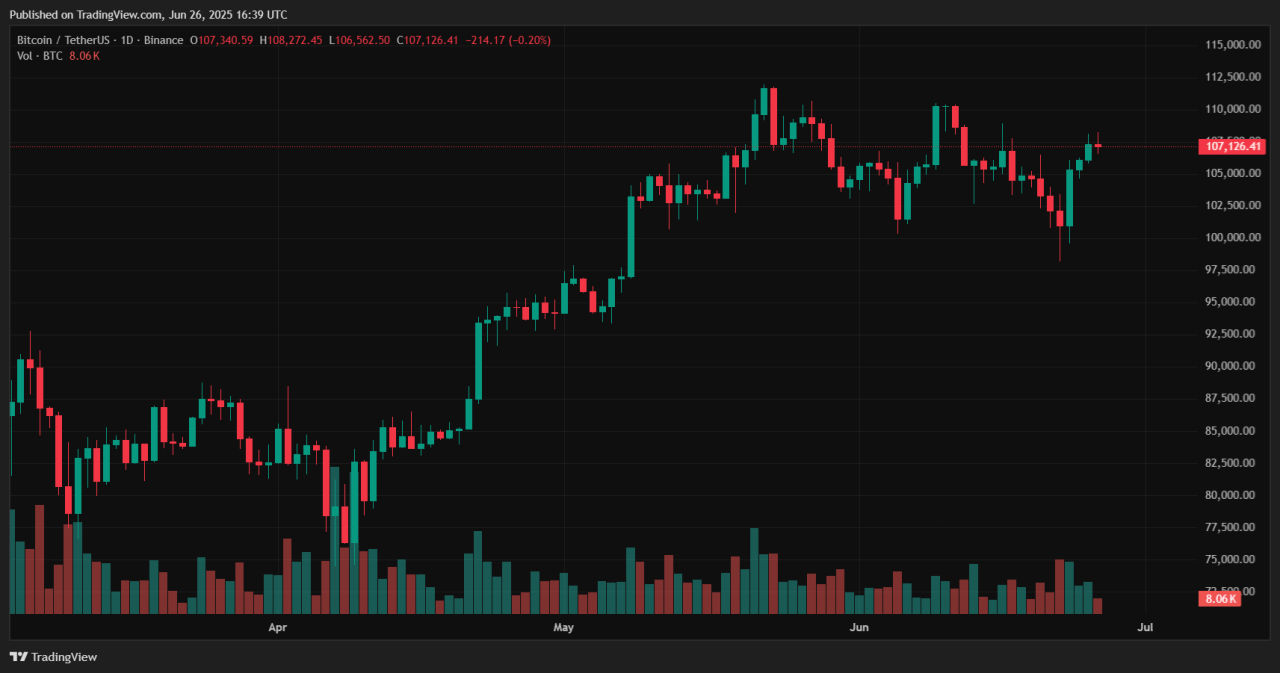

The market response was swift. Bitcoin jumped above $107,000—later rising to around $108,127—likely due to optimism over regulatory support, strong capital‑market events (e.g., Circle’s IPO), and the Senate’s movement on stablecoin regulation.

CME’s FedWatch tool now prices a ~22% chance of a July rate cut (up from 10%), although most expect cuts in September. Crypto stocks and ETFs also rebounded, reflecting renewed institutional investor interest.

Balancing Innovation with Caution

Powell was clear: openness to crypto doesn’t mean rushing rate cuts. He reiterated that inflation remains “sticky,” and that the Fed will move “patiently and data‑dependently”.

While encouraging bank innovation, he emphasized that financial stability cannot be compromised—and banks must continue strong risk‑management practices.

Conclusion

Powell’s balanced message—liberalizing bank engagement with crypto while maintaining macro‑prudence—marks a turning point.

With clearer policy, bullish markets, and institutions entering, the stage is set for a new chapter in U.S. crypto: one defined by regulated growth under prudent oversight.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)