Monero jumped 50% in just a week as volume surged and volatility widened.

The rally pushed XMR to fresh multi-year highs and back into focus.

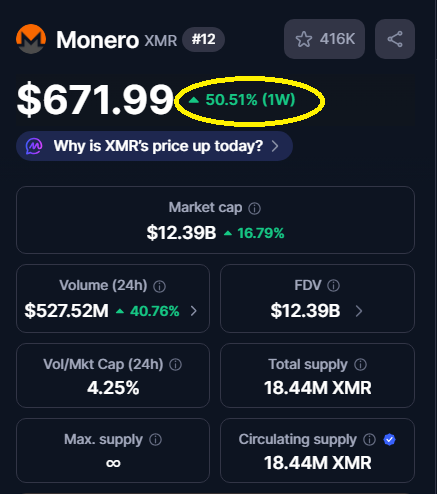

Monero climbed more than 50% in seven days and traded around $630–$680 on Jan 13, lifting its market value to roughly $11–12B.

Trading volume jumped across major exchanges, price swings widened, and liquidity thinned at key levels as buyers chased momentum.

How Big Was Monero’s Price Jump?

Monero’s move was fast and steep.

Price data shows XMR rising from roughly $430–$440 in early January to around $680 by Jan 13.

Intraday trading ranged widely, with sharp spikes and pullbacks within hours.

Market cap estimates expanded to about $11–12B, pushing Monero back into the top tier of crypto assets.

Volume also surged, confirming strong participation but also increasing short-term risk.

When prices rise this quickly, even small sell orders can trigger outsized moves.

Why Monero Is Rising Now

Several factors contributed to Monero’s surge.

Social data shows a surge in mentions and engagement, signaling strong retail interest.

At the same time, turmoil around Zcash redirected attention and capital toward Monero as traders looked for a functioning privacy coin.

Thin liquidity played a major role.

Many exchanges showed shallow order books, which allowed aggressive buying to push prices higher quickly.

On-chain trackers also flagged larger wallet activity, suggesting mixed participation from retail traders and larger players.

What Risks Investors Should Know

After a 50% jump, profit-taking becomes likely.

Early buyers may lock in gains, which can cause fast pullbacks.

Regulatory pressure on privacy coins remains a persistent threat and can appear without warning.

Liquidity gaps also increase downside risk, especially during volatile sessions. These factors make timing critical for any new position.

Conclusion

Monero’s rally reflects strong demand but also elevated risk.

Traders may prefer small positions with clear exit plans, while conservative investors often wait for consolidation.

Long-term holders must weigh Monero’s privacy value against regulatory uncertainty and sharp short-term swings.

Before you invest in Monero, In the next few days we will be sending our next Members Premium Crypto alert which will identify some key crypto assets with explosive potential in 2026.