Large holders are selling Pepe, adding pressure to the price. Still, some whales are quietly buying, hinting that the next move could surprise traders.

Pepe has come under selling pressure after a recent price drop, now trading around $0.000006 with a market cap near $2.9B.

Massive whale transfers and exchange inflows have made trading volatile. On-chain data shows both heavy selling and selective buying, leaving short-term direction uncertain.

RECOMMENDED: Pepe Price Prediction 2025 – 2030

What The Data Says Now: Price, Whales & Exchange Flows

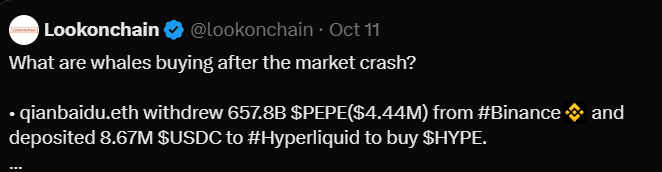

Pepe’s price fell about 4.6% in the last 24 hours, with daily trading volume above $590M. On-chain trackers reported one whale withdrawing 657.8B PEPE worth roughly $4.4M from an exchange, while others transferred over 1.5T tokens just before the latest dip.

These big moves suggest some whales are offloading holdings to secure profits. At the same time, a few addresses are buying on weakness, taking advantage of lower prices. Exchanges have seen more deposits than withdrawals during the downturn, signaling short-term selling pressure.

High leverage in futures markets has also triggered liquidations, amplifying the swings. Altogether, Pepe’s activity reflects a battle between profit-takers and opportunistic buyers.

RECOMMENDED: Little Pepe (LILPEPE) vs. Pepe Coin (PEPE): Layer‑2 Hype vs. Classic Meme Strength

Why Whales Are Dumping And Who Is Buying

Many whales are cashing out after strong meme coin rallies earlier this year. Some are rotating into new presales like Pepenode or safer tokens after recent volatility. The selling has added supply to exchanges, making it easier for traders to exit quickly.

But not everyone is leaving. On-chain data shows that new wallets are accumulating Pepe at lower levels, suggesting that smaller investors and a few long-term holders still believe in the token’s potential.

This constant back-and-forth between sellers and buyers has kept prices unstable, showing how sentiment in meme coins can shift in a matter of hours.

RECOMMENDED: 3 Reasons to Buy PEPE and One Reason Not To

Bull Signals To Watch Before A Rebound

A real recovery will depend on three key factors: consistent exchange withdrawals showing long-term holding, rising wallet PEPE accumulation by large holders, and a clean breakout above major resistance with growing volume.

If these align, bullish momentum could return quickly.

Conclusion

Whale selling continues to shape Pepe’s short-term moves, but steady accumulation by long-term holders and rising volume could give bulls the edge, setting the stage for a potential rebound.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- From Failed Breakout to Consolidation: How to Think About Yesterday’s Flash Crash (Oct 12th)

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)