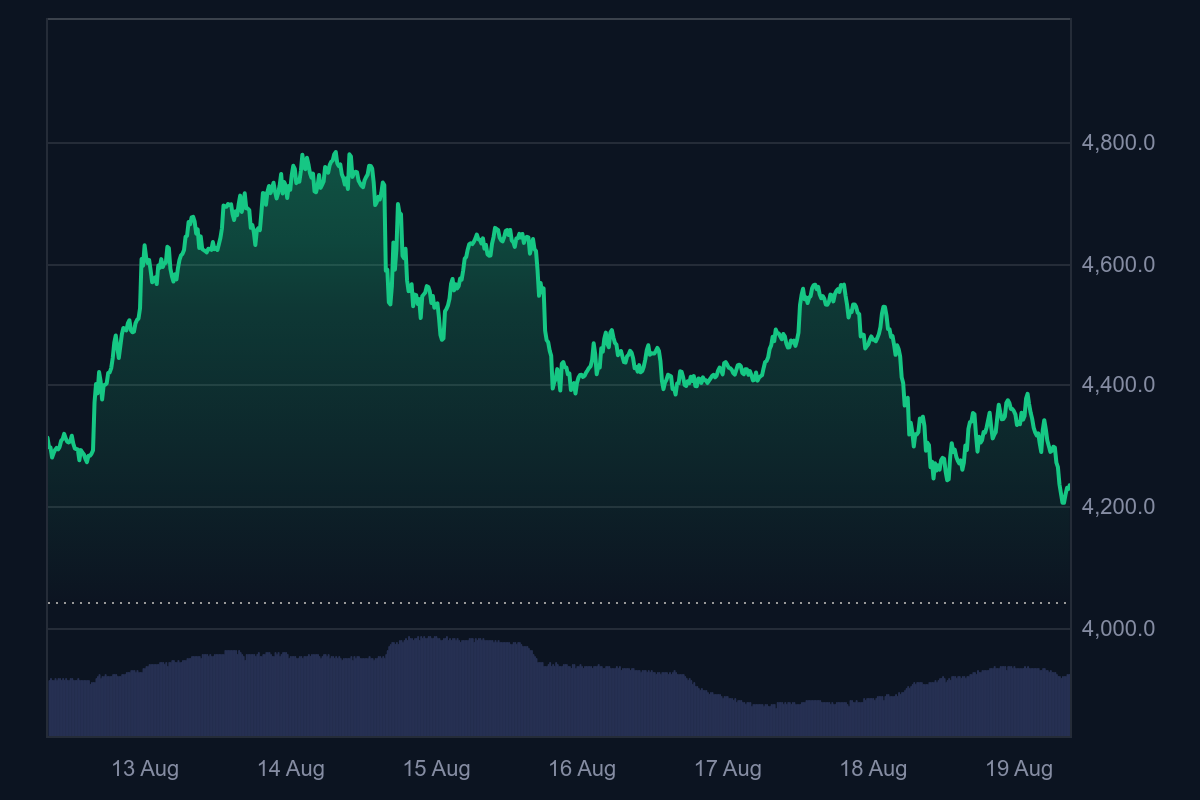

Imagine turning $5,000 into $12,500 – or watching it shrink to $3,300. That’s the reality facing Ethereum investors today. As of August 19, 2025, Ethereum trades at $4,237, just 11% below its all-time high of $4,891.

Over the past year, ETH surged 63%, fueled by institutional demand and critical network upgrades . But volatility remains extreme. In this guide, we forecast three realistic paths for a $5,000 ETH investment over the next 12 months: Bullish, Base Case, and Bearish.

RELATED: Where will Ethereum (ETH) Be in 5 years?

Where ETH Stands Today

Ethereum’s current price of $4,237 positions it at a pivotal technical and psychological threshold. The past six months saw ETH rebound from $2,100 in early August 2024, majorly due to two catalysts:

- Spot ETF Inflows: BlackRock’s iShares Ethereum ETF alone attracted $319 million in net inflows on August 12, part of a $524 million single-day surge across all ETH ETFs.

- The Pectra Upgrade:Ethereum’s latest upgrade initially made ETH supply inflationary but was quickly adjusted. Doubling “Blobs” has since restored deflationary pressure, correlating with a 50% price jump .

These catalysts are happening against a fragile macro environment. Particularly, the Federal Reserve’s rate-cut trajectory and U.S. crypto regulations under the FIT21 Act bring a sense of uncertainty. For now, ETH balances on a knife-edge between breakout and correction.

RELATED: Ethereum Price Prediction: Tom Lee Makes The Case For $30,000 ETH

Factors Influencing ETH Price in 12 Months

Four core factors will likely shape Ethereum’s 12-month outlook:

- On-Chain Dynamics: Roughly 25 million ETH is staked, reducing circulating supply, and EIP-1559’s burn mechanism can make ETH deflationary on high-activity days.

- Ecosystem Expansion: Despite TVL pressure, Ethereum remains DeFi’s backbone. Layer-2s like Arbitrum and Optimism now carry the majority of activity, easing congestion and expanding use. Real-world asset tokenization could unlock new demand.

- Market Sentiment: Sentiment now feels neutral. Spot ETH ETF inflows, recently registering strong daily flows, reflect growing institutional participation.

- Macro & Regulatory Risk: With the SEC’s position on ETH uncertain and rate/inflation moves influencing broader risk appetite, volatility remains likely.

RELATED: Ethereum Price Prediction: Will ETH Smash Its $4,800 All-Time High This Year?

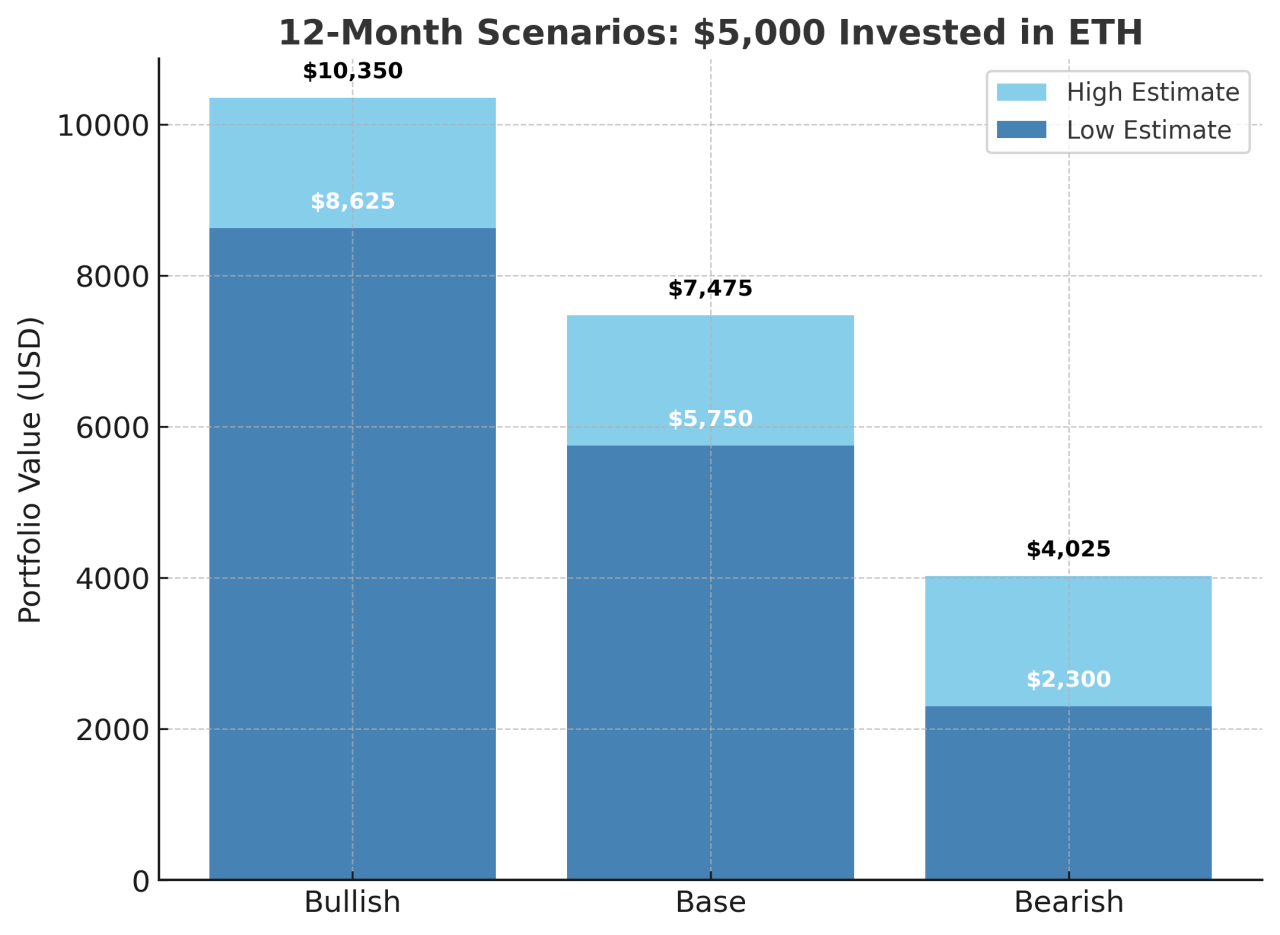

Three Scenarios for a $5,000 ETH Investment

Bullish Case ($7,500–$9,000 ETH)

Fuelled by record ETF inflows, institutional treasury demand, and stronger on-chain activity, Standard Chartered now sees ETH reaching $7,500 by end-2025, with $8,000–$9,000 viewed as upside potential.

Combined ETF and treasury buying has removed roughly 3.8% of circulating supply since June, triggering a “super-squeeze” scenario. If you hold 1.15 ETH, that’s $8,625–$10,350.

Base Case ($5,000–$6,500 ETH)

The base scenario leans on ETF growth, Layer-2 adoption, and Pectra upgrades boosting scalability. Token Metrics, for instance, flags the $5,000–$10,000 range as realistic if bullish momentum persists. At $5,750–$7,475, your position grows in line with a balanced outlook.

Bearish Case ($2,000–$3,500 ETH)

A macro downturn, regulatory setbacks, or stalling ETF flows could drag ETH down to 2023 lows. A breakdown below $2,500 would shake the market’s bull-case structure, opening the door for competitors to gain ground.

RECOMMENDED: Is It Still Worth Buying Ethereum In 2025?

Expert & Analyst Opinions

Michaël van de Poppe, a crypto analyst and swing trader, anticipates short-term consolidation in the $3,200–$3,500 range as Ethereum digests recent gains. However, he sees this as a healthy reset before macroeconomic forces propel recovery.

TokenMetrics Research echoes near-term caution, noting that regulatory uncertainty could cap upside momentum despite acknowledging Ethereum’s $10,000 potential if the Pectra upgrade successfully scales throughput.

In contrast, Standard Chartered’s Geoff Kendrick projects a more aggressively bullish $7,500 target by late 2025, arguing that Ethereum benefits from a self-reinforcing feedback loop where ETF inflows amplify on-chain activity, which in turn drives further price appreciation and institutional interest.

RECOMMENDED: How to Buy Ethereum (ETH) in 2025: A Step-by-Step Guide for Beginners

Risks to Consider

While Ethereum remains the dominant smart contract platform, it presents several critical challenges that could materially affect its price trajectory and the performance of any ETH investment:

- Scalability Challenges – Despite Layer-2 solutions, base-layer congestion and gas fee volatility remain persistent issues that could hinder adoption

- Competitive Pressure – Blockchains like Solana and Cardano continue to gain market share in DeFi and NFTs, threatening Ethereum’s dominance

- Market Cycles – Ethereum remains highly correlated with broader crypto market movements, exposing it to potential downturns

- Regulatory Risks – Ongoing uncertainty around securities classification and staking regulations could significantly impact Ethereum’s ecosystem

Final Takeaways & Next Steps

Ethereum presents compelling opportunities but carries significant risk. Here’s a clear summary of potential outcomes for a $5,000 investment:

| Scenario | ETH Price Range | Investment Value | Key Influencing Factors |

| Bullish | $7,500-$9,000 | $12,500-$15,000 | Strong ETF inflows, Fed rate cuts, successful upgrades |

| Base Case | $5,000-$6,500 | $8,300-$10,800 | Moderate growth, steady institutional adoption |

| Bearish | | $2,000-$3,500 | $3,300-$5,800 | Regulatory crackdowns, market downturn, tech setbacks |

Important Disclaimer: This analysis represents potential scenarios, not financial advice. Cryptocurrency investments carry substantial risk, including the potential loss of principal.

For those considering Ethereum exposure:

- Track key metrics like ETF flows, staking rates, and network activity

- Stay informed about regulatory developments and upgrade timelines

- Maintain a risk management strategy appropriate for crypto’s volatility

The coming year will likely see significant developments for Ethereum. By staying informed and managing positions carefully, you will be prepared for whatever market conditions emerge.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)